News

Thailand’s Bitkub aims for ASEAN expansion with 2025 listing

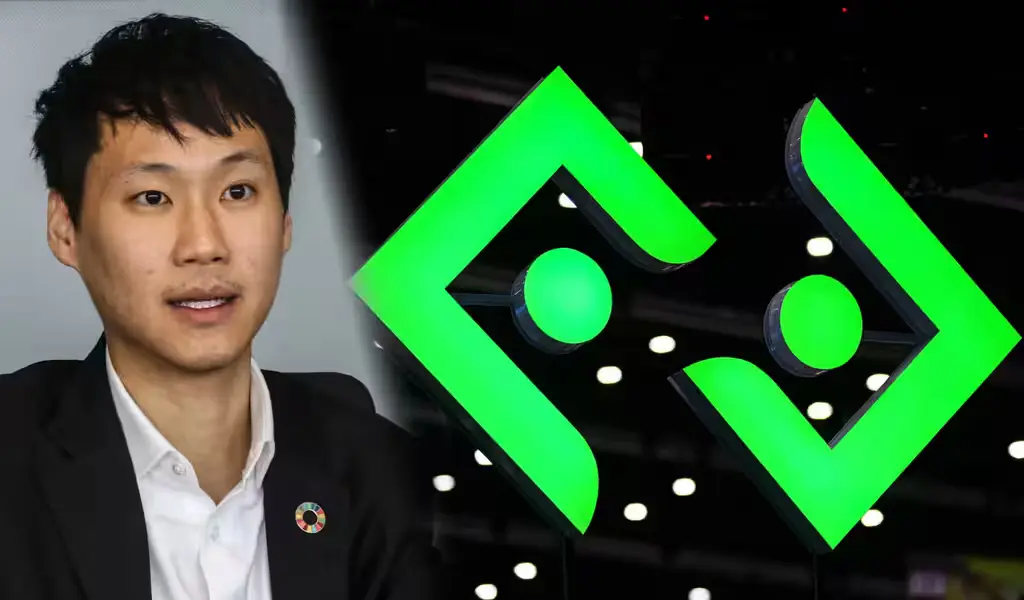

(CTN News) – The founder of Thailand’s top cryptocurrency exchange plans to expand into Southeast Asia’s developing nations and compete with Coinbase and Binance through an upcoming IPO.

Bitkub Capital Group plans to use the funds from its Bitkub Online exchange’s IPO, which is scheduled for the end of 2025, to make a claim in the region’s undeveloped markets, specifically Cambodia, Vietnam, and Laos, where regulators are still creating frameworks for digital assets.

“Indonesia and the Philippines would be bloodbaths because the winners are already known. Topp Jirayut Srupsrisopa, CEO of Bitkub Capital Group, stated that the company will expand into other countries and begin engaging with local regulators from the outset to be the most trusted platform.

Bitkub boasts a daily trading volume of $44.5 million, outperforming Indonesia’s Indodax and Tokocrypto and the Philippines’ Coins.ph. However, in frontier areas, the firm intends to expand beyond trade volume and build use cases for cryptocurrencies by dominating the market for remittances from migrant workers and digital nomads.

“We want to focus on developing nations so that we can leapfrog the West with the latest technology,” Topp told Nikkei Asia in an interview. “For developing nations who still use cash-based transactions, they don’t have any legacy systems, so they have a much lower opportunity cost to switch the system.”

Topp stated that listing in Thailand is a “priority” for Bitkub, however a dual listing in Hong Kong or the United States will be considered in the future.

“We have $3 billion in customer deposits.” He acknowledged that Bitkub’s IPO could pose a systemic danger to the Thai economy, highlighting the importance of legitimacy and capital. “We are becoming a public good, so everyone needs to own this infrastructure together.”

According to industry estimates, Bitkub’s market share in Thailand is expected to be 75% by mid-2023. Even when global leader Binance entered the market in November, Topp claimed Bitkub controlled 95% of “authentic volumes,” or real trades.

“Customers usually prefer cheaper, better, and faster items. Topp emphasized the importance of trust as a fourth aspect of finance. “We adopted the appropriate plan from the start. We’re not growing as quickly, but many who cut corners are no longer around.”

Bitkub Online shares, he claimed, will become a proxy stock for Thailand’s digital economy, distinct from the country’s staple agriculture and industrial businesses.

“Thailand is mired in the middle-income trap due to its reliance on physical trade. We are accountable for generating new sources of wealth for our country by representing digital services and green trade,” he stated.

Bitkub Capital Group’s venture capital arm will continue to invest in Thai businesses as the exchange’s international operations grow. “The successful ones must pay it forward by reinvesting in new startups to rebuild the startup ecosystem,” Topp said.

Thailand has only three unicorns (startups worth at least $1 billion), falling behind Singapore and Indonesia. During takeover talks with Thailand’s fourth-largest bank, Siam Commercial Bank, Bitkub was valued at 35 billion baht ($1 billion).

The agreement was canceled in 2022 because of a drop in cryptocurrency prices, highlighting liquidity and governance difficulties and prompting regulatory attention.

According to Topp, the transaction strengthened Bitkub’s position for regional expansion but had no impact on the company’s performance or IPO plans.

Bitkub last announced revenues of 2.8 billion baht in 2022, a 48% decrease from the previous year due to the “crypto winter.” However, the company made a profit of 342 million baht when the winter eliminated its nearest competitor, Zipmex, increasing Bitkub’s market dominance.

“For the past four years, we’ve managed the company on cash profit. “We’re not like other startups; we don’t want to run the business at a loss,” Topp added.

He also blasted the startup world’s “move fast, break things” ethos, which has landed global giants Binance and FTX in hot water with regulators.

“Right now there is regulatory arbitrage, which opens up opportunities for bad actors to exploit,” he told me. “All the regulators need to speak the same language and set a standard.”

Binance’s plea deal with US regulators resulted in the approval of bitcoin spot exchange-traded funds and institutional investment, improving the cryptocurrency market. The price of Bitcoin increased by 126% over the preceding year.

When asked if decentralized exchanges, which allow direct transactions between traders, pose a danger to centralized exchanges, Topp stated that decentralized exchanges are growing faster than centralized ones.

But on an absolute basis, we’re talking about a lot of money pouring from institutional investors into the industry.”

He said, “We’re talking about big money now, not just retail money.”