News

Hong Kong’s 3-Tier Banking System Could Be Reduced To 2-Tier As HKMA Proposes Scrapping Deposit-Taking Companies

In recent news, the Hong Kong Monetary Authority (HKMA) has proposed a significant change to the banking system in Hong Kong.

The proposal suggests the elimination of deposit-taking companies, potentially transforming the existing three-tier banking system into a two-tier system.

This proposed change has raised numerous questions and concerns within the financial industry.

In this article, we will delve into the details of the proposal, its potential implications, and the possible future of Hong Kong’s banking landscape.

The HKMA Proposal and Its Significance

The HKMA’s proposal aims to streamline the banking system in Hong Kong by removing the intermediate tier of deposit-taking companies.

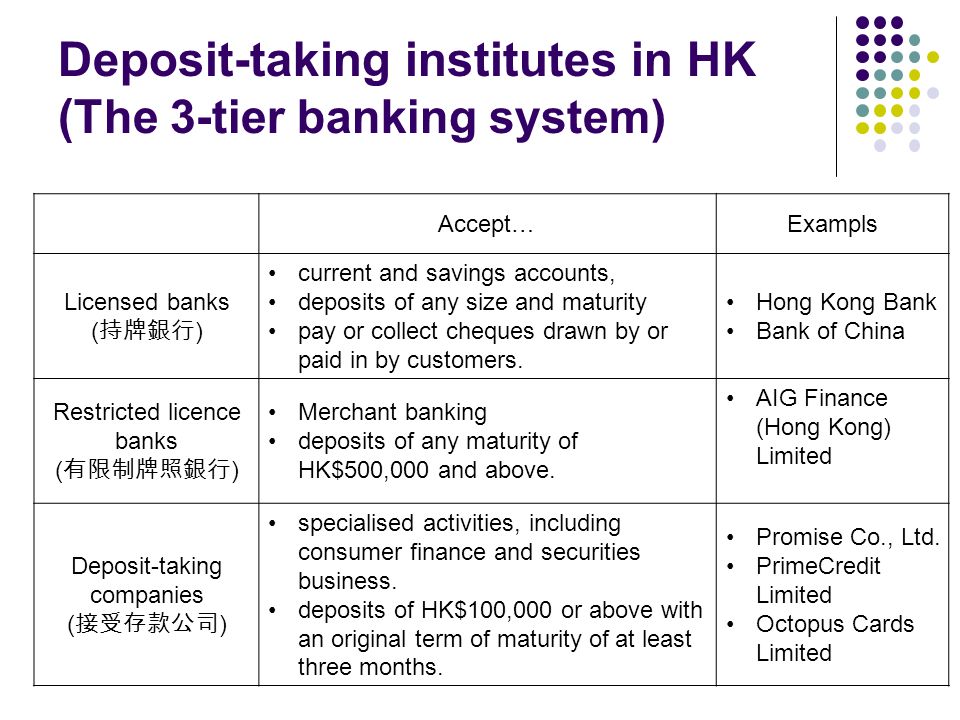

Currently, Hong Kong operates under a three-tier system consisting of licensed banks, restricted license banks, and deposit-taking companies.

The deposit-taking companies serve as intermediaries between the licensed banks and restricted license banks, offering a limited range of banking services.

The elimination of deposit-taking companies would simplify the structure of Hong Kong’s banking system, reducing regulatory complexity and enhancing operational efficiency.

It is anticipated that this change would align Hong Kong’s banking system more closely with international standards and practices.

Implications for Licensed Banks

Licensed banks in Hong Kong would be the primary beneficiaries of the proposed change.

With the removal of deposit-taking companies, licensed banks would have the opportunity to expand their business scope and offer a broader range of services.

This expansion could potentially lead to increased competitiveness among licensed banks, as they would have a larger customer base and more diverse revenue streams.

Furthermore, licensed banks may benefit from reduced regulatory burdens and compliance costs.

The elimination of an entire tier in the banking system would likely simplify regulatory oversight, allowing licensed banks to allocate more resources towards innovation and customer-centric initiatives.

Impact on Deposit-Taking Companies

The proposed elimination of deposit-taking companies would have a significant impact on these intermediaries.

As their role would no longer exist in the banking system, deposit-taking companies would need to reevaluate their business models and explore alternative avenues for sustaining their operations.

Some deposit-taking companies may choose to transform into licensed banks or seek partnerships with existing licensed banks.

By obtaining a full banking license, these companies can continue to provide banking services directly to customers.

However, this transformation process may come with various challenges, such as meeting the stringent regulatory requirements and adapting to a more comprehensive business framework.

Others may consider diversifying their operations or exploring new business opportunities outside the traditional banking sector.

These companies would need to carefully assess the market landscape and identify viable options to ensure their long-term viability and sustainability.

Potential Benefits for Customers

The proposed changes to Hong Kong’s banking system have the potential to bring several benefits to customers.

With licensed banks expanding their service offerings, customers would have access to a more comprehensive range of financial products and services.

This increased competition among banks may also lead to improved customer service, lower fees, and enhanced product innovation.

Moreover, the streamlining of the banking system could facilitate easier and more seamless banking experiences for customers.

With fewer intermediaries involved, transactions and account management processes may become more efficient, reducing administrative burdens and enhancing convenience.

Addressing Concerns and Challenges

While the proposed transformation of Hong Kong’s banking system holds potential benefits, it also raises valid concerns and challenges.

One primary concern revolves around the concentration of power among licensed banks.

With deposit-taking companies removed from the system, licensed banks would hold a more dominant position, potentially leading to reduced competition and limited choices for customers.

To address this concern, regulators would need to closely monitor the market and ensure effective competition safeguards.

Implementing measures to encourage new entrants and fostering a healthy competitive environment would be crucial in preventing any adverse effects on customers and the overall financial ecosystem.

Additionally, the transition process itself presents challenges.

The elimination of deposit-taking companies would require careful planning and coordination among various stakeholders, including regulatory authorities, licensed banks, and affected intermediaries.

Clear guidelines, support mechanisms, and transitional arrangements would be essential to mitigate disruptions and facilitate a smooth transition.

Conclusion

The HKMA’s proposal to transform Hong Kong’s three-tier banking system into a two-tier system carries significant implications for the financial industry and customers alike.

While the changes aim to streamline operations and align with international standards, careful consideration must be given to the potential challenges and concerns that may arise.

By striking a balance between competition, customer protection, and efficient regulation, Hong Kong can navigate this transformation and foster a resilient and progressive banking landscape.

RELATED CTN NEWS:

Prince William’s 5-Year Ambitious Plan To End Long-Term Homelessness In The UK

U.S. Supreme Court’s Most Significant Cases: List Of Some Cases For October’s Court To Decide

Ohio State University Faces Lawsuits Over Doctor’s Sexual Abuse After Supreme Court Rejects Appeal