News

Britain Launches Mortgage Relief as Interest Rates Soar

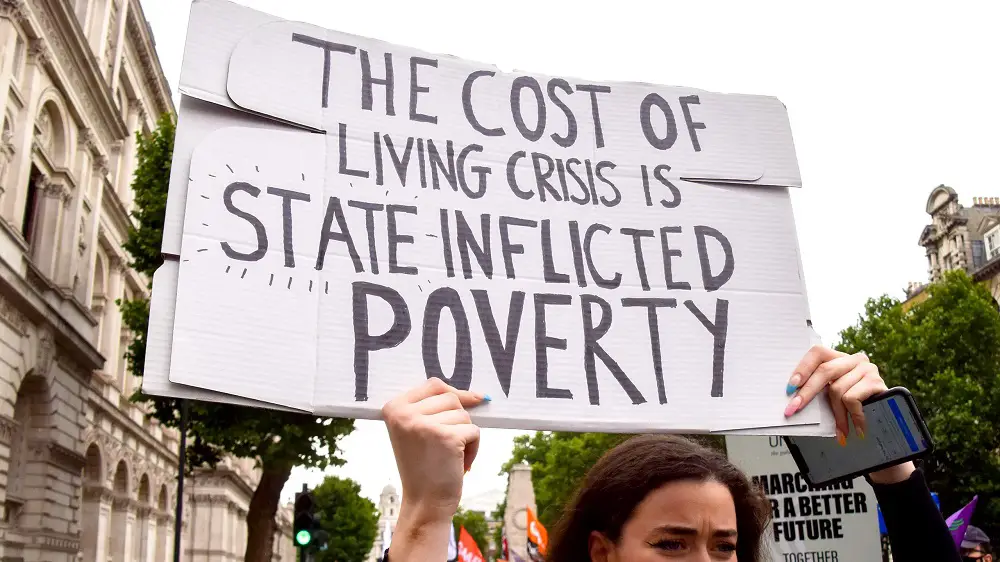

The Bank of England unexpectedly increased interest rates to a fresh 15-year high on Friday, prompting Britain to announce assistance for millions of cash-strapped homeowners struggling with skyrocketing mortgage expenses amid a cost-of-living crisis.

The UK’s leading lenders and finance minister Jeremy Hunt have agreed on a “mortgage charter” for clients in difficulty, including those who are in arrears. He did not, however, provide direct assistance, upsetting his political adversaries.

The Financial Conduct Authority (FCA) watchdog and bank executives met to discuss the measures, which include mortgage holiday periods to allow for flexible payment schedules and a 12-month minimum window before home repossessions.

Additionally, with no effect on their credit score, borrowers will be allowed to prolong the terms of their mortgages or move to an interest-only plan that does not temporarily repay capital before returning to their original loan contract within six months.

Mortgage anxiety

People who are “at real risk” of losing their houses because they fall behind on their mortgage payments, according to Hunt, are something that the Treasury is “particularly worried” about.

He continued, “Those whose outgoings will increase and who must change their mortgage because their fixed rate is ending are also causing concern.”

According to Hunt, these actions “should provide solace to those who are concerned about high interest rates and support for those who do get into difficulty.”

The Bank of England increased its benchmark interest rate by a half point to 5% on Thursday, marking the 13th consecutive increase. This put pressure on Britons who are already feeling the effects of rising food and fuel prices and increased the cost of home loans from commercial lenders.

The BoE is attempting to combat the persistently rising inflation, but in doing so has caused new mortgage woes, putting Britons at greater risk of default.

As Prime Minister Rishi Sunak’s Conservatives work to gain ground from the main opposition Labour party before the general election of next year, the mortgage issue has also increased the pressure on them.

The UK’s annual inflation rate was 8.7 percent in May, unchanged from April, according to official figures released this week, prompting the BoE to raise rates by more than anticipated. According to economists, rates could reach 6% this year, which would put the UK in a recession similar to that of the eurozone.

Britain still has one of the highest inflation rates in the G7, despite Sunak’s pledge to cut it in half by the end of the year.

The prime minister and I both rank combating excessive inflation as our top priorities, Hunt continued. “We have a strong commitment to helping the BoE take the necessary action. We are aware of the strain on families.

The restrictions were criticised as being a “weak response on a mortgage crisis they created” by Labour’s spokesman for finance, Rachel Reeves.

She added on Friday, “The Tories should be taking responsibility and acting now, not just shrugging their shoulders.

Martin Lewis, a campaigner for consumers who met with Hunt earlier this week and warned that mortgages were a “ticking time bomb” that was now “exploding,” expressed his satisfaction that it appeared the chancellor had taken note of his worries.

By year’s end, markets anticipate that the BoE’s benchmark interest rate, which is used to determine commercial mortgage rates, will have increased to 6%.

Most mortgages offered by UK banks have a fixed interest rate for a certain time—usually two to five years—after which it becomes variable or a new rate is set in accordance with market conditions.

A fifth or more of the disposable income of about 1.4 million mortgage holders whose contracts are about to expire will be lost to additional payments.

According to experts at the Resolution Foundation think tank, they are expected to increase by £3,681 ($2,900) for the typical household remortgaging in 2019.

According to industry group UK Finance, more than 80% of homeowners who have mortgages are on fixed-rate agreements.

However, 2.4 million of those contracts will expire prior to the end of 2024.

Britain May Offer Path to Citizenship for People of Hong Kong

Britain May Offer “Path to Citizenship” for People of Hong Kong