Business

IASB Adjusts SME Standard While the UK and NZ Seal Audit Deal

In an era where financial transparency and accountability are paramount, the International Accounting Standards Board (IASB) has introduced pivotal amendments to the International Financial Reporting Standard (IFRS) for Small and Medium-sized Entities (SMEs).

These amendments, deeply intertwined with the changes to IAS 12, Income Taxes, issued in May, offer SMEs a temporary respite from accounting for deferred taxes, a move that comes in the wake of the implementation of the Organisation for Economic Co-operation and Development’s (OECD) Pillar Two model rules.

The amendments are twofold: firstly, they provide temporary relief from accounting for deferred taxes arising from the Pillar Two model rules, and secondly, they clarify the standard requirements for companies to disclose information that enables users of their financial statements to evaluate the nature and financial effect of income tax consequences of the Pillar Two legislation.

Companies can immediately benefit from the temporary exception, with the disclosure requirements being applicable for annual reporting periods starting on or after 1 January 2023.

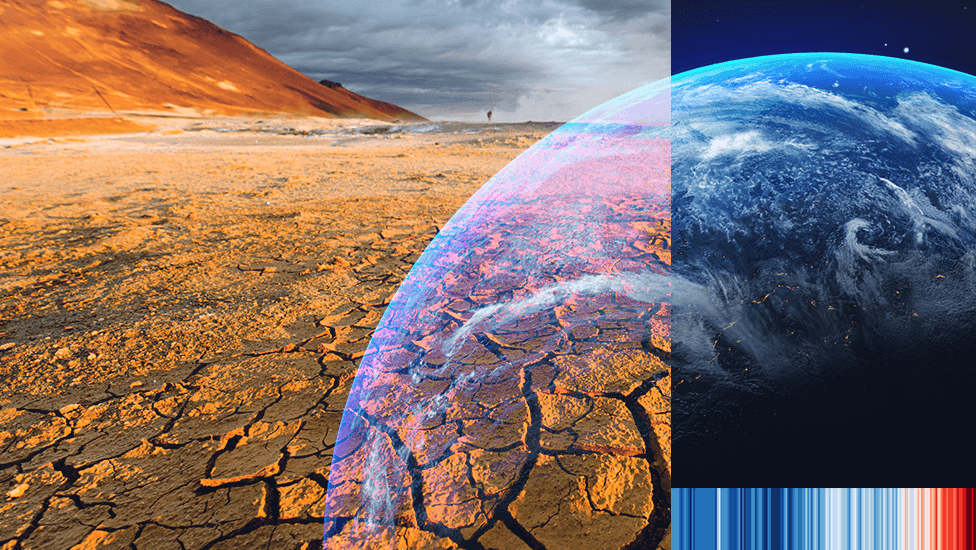

Climate-Related Matters

In the UK, the Endorsement Board (UKEB) has released two insightful reports, aimed at understanding UK companies’ existing reporting practices on climate-related matters and exploring the connectivity between sustainability reporting and financial reporting.

The first report, “Climate-Related Matters: Summary of Connectivity Research,” provides a comprehensive overview of recent third-party research into the connectivity challenges between Task Force on Climate-related Financial Disclosures (TCFD) disclosures and financial statements.

The second report, “A Study in Connectivity: Analysis of 2022 UK Company Annual Reports,” offers a detailed analysis from an investor’s perspective of potential connectivity challenges and includes stakeholder feedback on possible causes.

In a landmark agreement, the UK and New Zealand (NZ) have formalized a Memorandum of Understanding on Reciprocal Arrangements, a move that will facilitate auditors to work interchangeably between the two countries by recognizing audit qualifications in both nations.

IASB qualifications recognized in both nations

This agreement, signed by the UK’s Financial Reporting Council (FRC) and the NZ Financial Markets Authority, is anticipated to fortify the resilience of the audit market in both countries through increased competition and choice, and by enabling skilled professional accounting auditors to have their qualifications recognized in both nations.

Meanwhile, the FRC has introduced FRED 84, Draft amendments to FRS 102, which introduces new disclosure requirements about an entity’s use of supplier finance arrangements and their impact on the entity’s financial position and cash flows.

Lastly, the forthcoming IFRS 18, slated to be issued in the second quarter of 2024, aims to enhance the information companies provide about their financial performance, thereby facilitating investors in making informed decisions.

The new standard, which will supersede IAS 1, Presentation of Financial Statements, will introduce more rigor to the statement of profit or loss by requiring companies to present two new mandatory subtotals, including operating profit, and will allow companies to include management-defined performance measures, subject to certain presentation requirements to ensure transparency.

The evolving landscape of accounting standards and practices is a testament to the global shift towards enhanced financial transparency, accountability, and sustainability reporting.

The amendments and introductions of various standards and practices are not merely regulatory requirements but stepping stones towards a future where financial reporting is characterized by integrity, transparency, and above all, a commitment to fostering a sustainable and financially stable global economy.