Business

China’s Property Crisis Casts A Shadow On Asian REITs Amidst Rising Global Challenges

(CTN NEWS) – China’s ongoing property crisis has created a ripple effect, causing concerns among investors in real estate investment trusts (REITs) across Asia.

The challenges faced by the Chinese property market have added to the existing pressures of rising interest rates and global inflation, further dimming the recovery prospects of regional REITs.

In this blog post, we will explore how the troubles in the Chinese real estate sector are impacting Asian REITs and the broader implications for the market.

A Challenging Environment for Asian REITs

REITs have traditionally attracted investors seeking a stable stream of dividend payouts. However, recent performance has been lackluster.

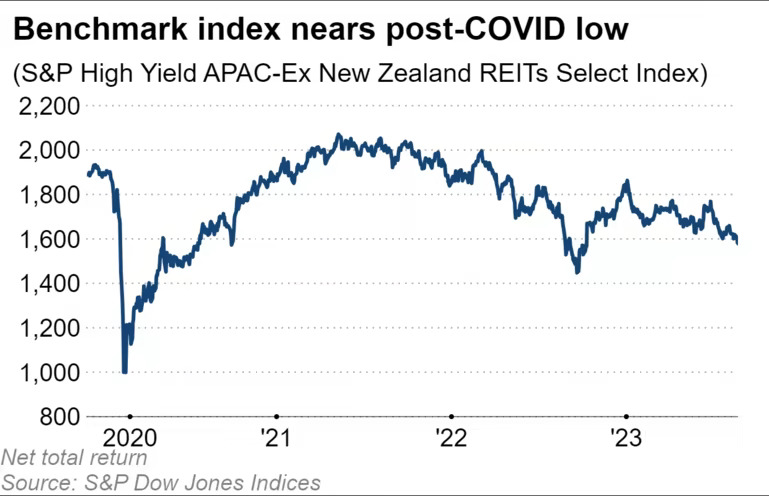

The S&P High Yield Asia Pacific-Ex New Zealand REITs Select Index, which tracks the 30 REITs with the highest dividend yields in the S&P regional stable, recorded a one-year net total return of minus 4.79% as of September 22.

Christine Li, head of research for the Asia-Pacific region at property consultancy Knight Frank, notes, “Driven partly by the latest turmoil emerging from the Chinese real estate market, confidence among investors in Asian REITs has waned as shares declined across the board.”

The slump in China’s housing sector has prompted investors to reevaluate their investment strategies, creating an atmosphere of caution in property equities throughout the region.

The Impact on Chinese-Exposed REITs

While not all Asian REITs have substantial exposure to the Chinese mainland, those that do have faced significant challenges. For example, CapitaLand China Trust, which holds a portfolio of malls in Beijing, Shanghai, and Chengdu, saw its shares decline by 20.54% year-to-date as of September 22.

Similarly, SGX-listed REIT Sasseur, with a retail portfolio in Chinese cities like Chongqing,

Hefei, and Kunming, was down 11.92% year-to-date. Hopes that China’s economic reopening post-COVID-19 would boost commercial properties have dwindled amid concerning economic data.

Louise Loo, lead economist at Oxford Economics, highlights the gravity of the situation: “Ongoing stress in the property and shadow banking sectors is adding to market nerves around China’s economic outlook, as property-related debt accounts for at least 43% of Gross Domestic Product.”

Recent blows to the real estate sector, such as Evergrande’s bankruptcy protection filing and Country Garden Holdings’ cash crunch, have only worsened the crisis.

Chinese REIT Market Developments

Interestingly, even as the crisis unfolds, the REIT market in China has shown signs of development. According to a report by Cushman & Wakefield, 17 new products were introduced into the public REIT market in China from the end of March 2022 to the end of June 2023.

These new entrants covered various categories of underlying assets, including industrial parks, warehousing and logistics facilities, and clean energy.

However, the report also points out that the total market value of the 28 public REITs listed on the mainland stood at 87 billion yuan ($11.9 billion) as of the end of June, approximately 10% below their initial issuance value.

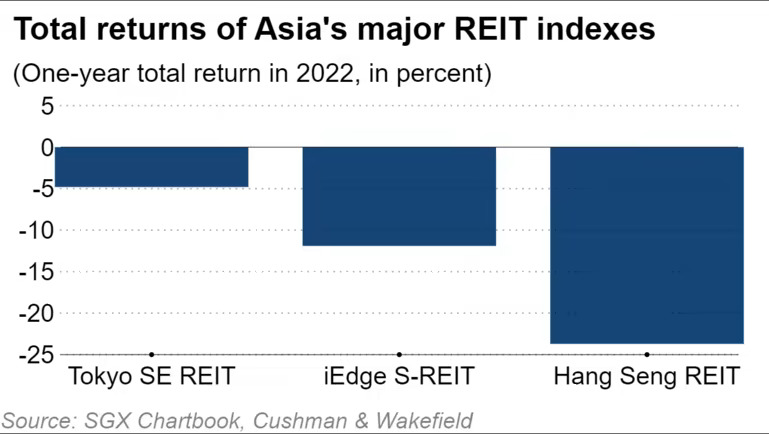

This performance mirrors a trend observed in other Asian markets, where the combined market valuation of REITs dropped by 14.7% from the previous year.

Investor Caution and Its Impact

Investor caution is evident in the decline of REIT acquisition and merger activities around mainland China assets in markets like Singapore and Hong Kong.

These two markets together account for more than 80% of the total REIT market share in Asia. In Hong Kong, a benchmark index of the city’s REITs dropped by more than a quarter in 2023, as investors steer clear of China-linked assets.

Beyond the property sector’s woes, Hong Kong faces additional challenges due to the implementation of the national security law in 2020, eroding the territory’s autonomy and raising concerns about regulatory risks.

Despite the challenges, there is some optimism. ESR Group, a Hong Kong-listed real estate investment manager with assets across Asia, reported a 9% year-on-year increase in the value of its portfolio to $147 billion in August.

The group remains committed to supporting existing and new REITs as part of its strategy for diversifying capital partnerships.

Conclusion

China’s property crisis has cast a shadow over Asian REITs, adding to the existing pressures of rising interest rates and global inflation.

While some REITs have been directly affected by their exposure to the Chinese market, others have felt the broader impact of investor caution in the region.

Despite the challenges, opportunities still exist for real estate investors in Asia, driven by strong urbanization trends and growing city-based populations, which continue to generate demand for real assets.

As the region navigates price uncertainty and market volatility, it remains to be seen how Asian REITs will adapt and recover in the face of ongoing challenges.

RELATED CTN NEWS:

Suspiciously Timed Trade Sparks Insider Trading Speculation In Splunk-Cisco Deal

Toshiba’s 74-Year Stock Market Era Comes To An End As Investors Secure Majority Stake

Thailand Secures 9th Place In 2023 “Business-Friendly Countries” List: Report