News

The Supreme Court’s Ruling on President Biden’s Student Debt Forgiveness Plan: What’s at Stake?

(CTN News) – The Supreme Court is expected to rule on President Joe Biden’s student debt forgiveness plan this week. The plan, which aims to provide relief to federal student loan borrowers, has faced legal challenges, and the court’s decision will determine the program’s fate.

This article examines the forgiveness plan, its eligibility criteria, the potential cost to the federal government, and the resumption of student loan payments.

Overview of President Biden’s Student Debt Forgiveness Plan

President Biden’s proposed student debt forgiveness plan aims to alleviate the burden of federal student loan borrowers. The plan offers debt forgiveness of up to $20,000 for eligible borrowers. The forgiveness amount depends on the borrower’s income and whether they have received Pell Grants.

Eligibility Criteria and Benefits of the Forgiveness Plan

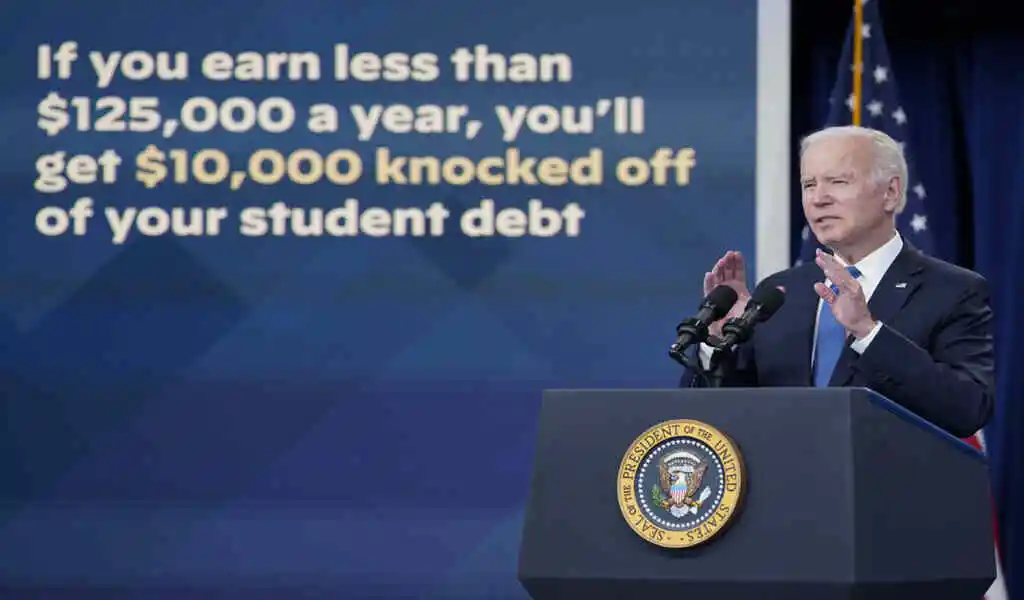

Under the forgiveness plan, borrowers with federal direct student loans, including graduate Plus loans, are eligible for up to $10,000 in loan forgiveness if they earn less than $125,000 a year ($250,000 a year for couples filing jointly).

Those who have received Pell Grants can be eligible for an additional $10,000 in loan forgiveness. The Biden administration estimates that approximately 43 million borrowers could benefit from this relief, with 20 million borrowers potentially having their debt balances completely cleared.

Potential Cost of the Debt Forgiveness Program

One significant concern regarding President Biden’s forgiveness plan is the cost to the federal government. The nonpartisan Congressional Budget Office estimates suggest that forgiving the debt could amount to around $400 billion. This cost has been a point of contention among critics of the plan.

Resumption of Student Loan Payments: Challenges Ahead

After a three-year pause, federal student loan interest will begin accruing on September 1, and payments will be due in October. While the forgiveness plan, if approved, may reduce borrowers’ monthly payments, many still face challenges in making their payments.

Around 1 in 5 borrowers have financial risk factors that could make it difficult to resume their student loan payments. Factors such as inflation, rising costs of necessities like food and rent, and other financial constraints contribute to the challenges borrowers may face.

Conclusion:

The program’s future hangs in the balance as the Supreme Court prepares to deliver its ruling on President Biden’s student debt forgiveness plan. The plan’s eligibility criteria, the potential cost to the federal government, and the imminent resumption of student loan payments pose significant implications for millions of borrowers. The court’s decision will determine whether borrowers will receive debt relief or be solely responsible for their loans.