Business

Suspiciously Timed Trade Sparks Insider Trading Speculation In Splunk-Cisco Deal

(CTN NEWS) – In the world of high-stakes finance, where billions of dollars change hands daily, it’s not uncommon to come across eyebrow-raising trades that seem to defy all odds.

The recent case of an impeccably timed trade involving Splunk calls, just one day before Cisco Systems announced its blockbuster acquisition of the AI-driven cybersecurity firm, Splunk, has sent shockwaves through the financial world.

With a near 46,000% return on investment within 24 hours, suspicions of insider trading are running high. In this blog post, we delve into the details of this extraordinary trade and the mounting speculation surrounding it.

The “Crazy Trade”

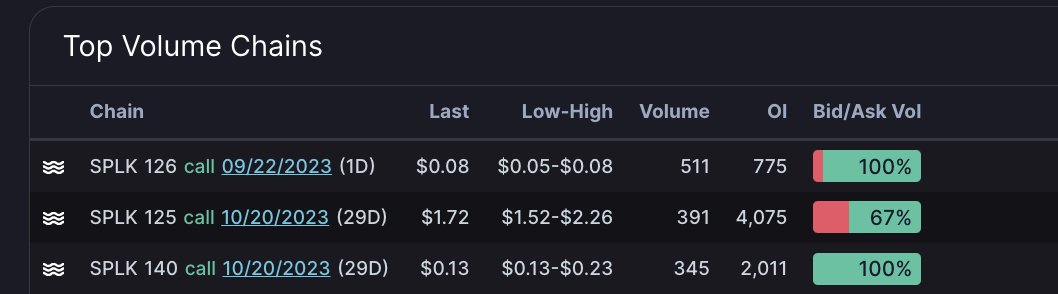

On the surface, the trade in question seemed like any other. On Wednesday, an individual opened 127 Splunk call options, also known as $SPLK calls, with an investment totaling $22,000.

Call options grant the holder the right to purchase assets, such as stocks or bonds, at a predetermined price before a specific date. However, what makes this trade extraordinary is its impeccable timing.

Hours after this trade was executed, the financial world was rocked by the news that Cisco Systems, a networking equipment giant, had made a historic move by acquiring Splunk for approximately $28 billion.

The trader, seemingly prophetic in their actions, exited their positions swiftly, turning their $22,000 investment into a staggering $10 million in less than a day.

Social media lit up with speculation that this could be a clear case of insider trading.

Insider Trading Speculation

Bloomberg Intelligence analyst James Seyffart did not mince words when he weighed in on the matter. He remarked, “This person is either the dumbest or luckiest person in the market.”

The trade’s timing was so uncanny that it has raised suspicions of insider information being the driving force behind it.

Insider trading involves trading securities based on material, non-public information about a company, and it is illegal in many jurisdictions.

If proven true, this would undoubtedly be a case of insider trading at its most blatant.

Regulatory bodies like the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC) take insider trading very seriously and typically move swiftly to investigate and prosecute such cases.

The Cisco-Splunk Deal

Cisco‘s acquisition of Splunk is no small matter. It marks the biggest technology acquisition of the year and has significant implications for the tech industry.

Cisco, known for its focus on software in recent years, aims to merge the two firms to create one of the world’s largest software companies.

Their goal is to become a dominant player in the fields of security and observability in the age of AI. This deal positions them to responsibly harness the power of AI by leveraging their substantial scale, visibility into data, and foundation of trust.

Conclusion

The impeccably timed trade involving Splunk calls just before Cisco’s acquisition announcement has ignited intense speculation about insider trading.

While some may consider it a stroke of incredible luck, many financial experts are leaning towards the possibility of illicit insider information being at play.

Regulatory bodies will undoubtedly scrutinize this trade, and if wrongdoing is found, it could lead to severe consequences for the individual involved.

Regardless of the outcome, this case serves as a stark reminder of the importance of maintaining transparency and integrity in the financial markets, where trust is paramount.

RELATED CTN NEWS:

Toshiba’s 74-Year Stock Market Era Comes To An End As Investors Secure Majority Stake

Thailand Secures 9th Place In 2023 “Business-Friendly Countries” List: Report

FTX Sues Sam Bankman-Fried’s Parents Alleging Misappropriation And Influence Peddling