Business

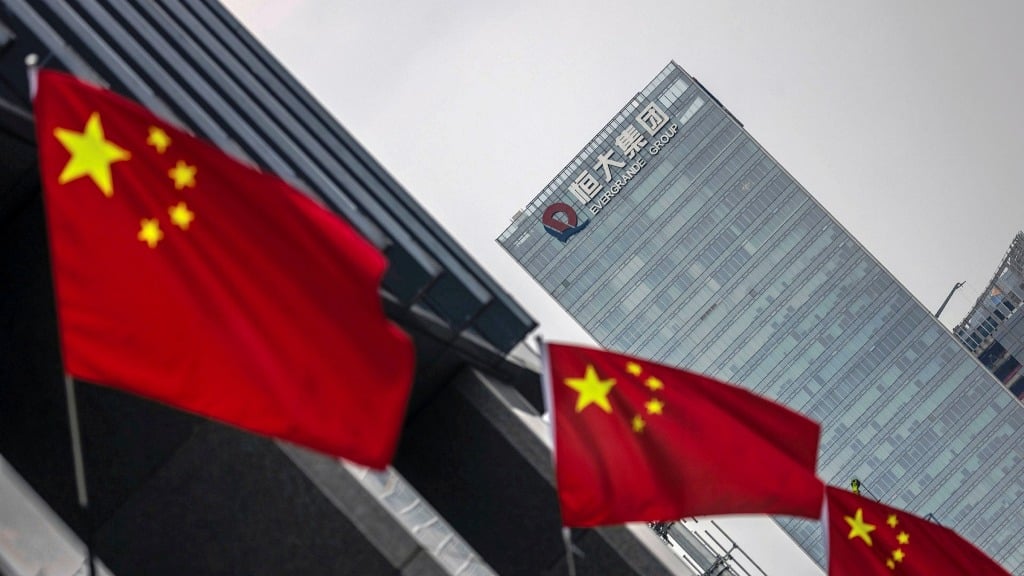

China’s Evergrande Files for Bankruptcy Protection as Economy Implodes

As China’s economic crisis worsens, China’s property giant Evergrande has filed for bankruptcy protection in the United States. It will help the deeply indebted corporation to safeguard its assets in the United States while it negotiates a multibillion-dollar agreement with creditors.

Evergrande declared bankruptcy in 2021, sending shockwaves through global financial markets. The decision comes as troubles in China’s real estate industry add to the world’s second largest economy’s woes.

On Thursday, China Evergrande Group filed for Chapter 15 bankruptcy protection in a New York court. Chapter 15 bankruptcy preserves a foreign company’s assets in the United States while it tries to restructure its debts, the BBC reports.

According to its website, the group’s real estate unit has over 1,300 projects in over 280 Chinese cities. It also owns an electric car manufacturer and a football club.

Evergrande has been attempting to renegotiate its debt repayment agreements with creditors after falling behind on payments. It was the world’s most indebted property developer, with debts believed to exceed more than $300 billion (£235 billion).

Evergrande shares have been off the market since last year.

Country Garden, another large Chinese property behemoth, warned last week that it could lose up to $7.6 billion in the first six months of the year. Some of China’s largest real estate corporations are struggling to raise funds to complete projects.

“The key to this issue is to complete unfinished projects because this will at least keep some of the financing flowing,” said Steven Cochrane of Moody’s Analytics, an economic research organisation.

He added that many properties are pre-sold, but if construction is halted, customers are unable to make mortgage payments, putting additional burden on developers’ finances.

Earlier this month, Beijing declared that China’s economy had entered deflation, citing a drop in consumer prices in July for the first time in more than two years.

Because of its slow growth, China is not seeing the increasing prices that have alarmed many other countries and spurred central bankers around the world to raise borrowing costs dramatically.

Imports and exports fell substantially this month as lower global demand jeopardised the world’s second-largest economy’s recovery chances.

Official numbers reveal that exports plummeted 14.5% year on year in July, while imports declined 12.4%.

China’s central bank unexpectedly slashed key interest rates for the second time in three months earlier this week in an effort to bolster the economy.

China facing economic crisis

China, the world’s second-largest economy, is having a difficult time. For a long time, the Asian behemoth has been under enormous strain, as seen by bad economic data and downgrades by global brokerages. The entire world is now feeling the effects of China’s economic collapse.

But why is the world concerned about the country’s downturn? Here’s everything you need to know.

For starters, China is a dominant global participant in almost every area, with the International Monetary Fund’s (IMF) 2017 World Economic Outlook estimating that the country will contribute more than 22% of world GDP.

Despite its image, China is a key bilateral trading partner for many countries and a large provider of goods, earning it the moniker of the world’s manufacturing hub.

Almost all of the world’s largest corporations, from Tesla to Apple, have their supply chains entrenched in China.

Simply said, China has the world’s largest manufacturing economy and is the world’s greatest exporter of goods. Furthermore, the country is the world’s greatest consumer of a variety of critical commodities, including metals.

It is worth noting that China consumes roughly half of the world’s metals.

As a result, a decline in China’s economic activity can significantly disrupt the global demand-supply balance, which is not a good development at a time when the world is just beginning to recover from an economic slowdown caused by a variety of factors including inflation, the Russia-Ukraine conflict, and extreme weather events.

There is no doubting that the Chinese economy is in trouble, and while Beijing has promised to expand the private sector and protect firms, its efforts appear to be falling short. The country’s July economic activity data offers a troubling image, with key measures like as retail sales, industrial output, and investment output falling short of expectations.

This has sparked fears of a deeper and longer-lasting slowdown in GDP.

Data on Chinese economic activity has been underperforming predictions since the beginning of the second quarter, causing major anxiety in global markets.

However, this is not the first time China’s economy has encountered difficulties. China experienced similar shocks during the 2008-09 global financial crisis and the 2015 capital outflow concern.

However, the Chinese economy emerged stronger on both occasions, with the government driving infrastructure spending and expanding property markets.

However, it appears that excessive infrastructure spending over the years has come back to haunt Beijing in the form of heavy debt, and the property bubble had already burst during the epidemic, beginning with the Evergrande disaster.

The cumulative impacts have posed major threats to the country’s financial viability, which has been exacerbated by the worldwide downturn caused by the pandemic.