News

India’s Decision to Scrap 2000-Rupee Note: Impact on the Economy Explained

(CTN News) – The Indian central bank said on Friday that the country’s biggest value currency note would be removed from circulation. Though the 2000-rupee note that entered circulation in 2016 will remain a valid currency, its holders have been requested to return or swap them by September 30, 2023.

This decision recalls another unexpected action the Narendra Modi administration took in 2016: the overnight removal of 86% of the money in circulation.

Analysts and economists believe this time will be different since a smaller amount of notes is withdrawn over a longer period.

The 2016 introduction of 2000-rupee notes aimed to quickly replenish the cash circulation in the Indian economy following the demonetization.

The central bank has made it clear that it wants to reduce the number of high-value notes in circulation and has, for the previous four years, stopped producing 2000-rupee notes.

The Reserve Bank of India said in a statement that “this denomination is not commonly used for transactions,” which is why it decided to stop issuing these notes.

The government and the central bank did not explain the change, although observers note that it occurs just before state and federal elections, when cash transactions are likely to increase.

An economist with L&T Finance Holdings, Rupa Rege Nitsure, called the move “a wise decision” because it came before the general elections. “People who have been using these notes as a store of value may face inconvenience,” she warned.

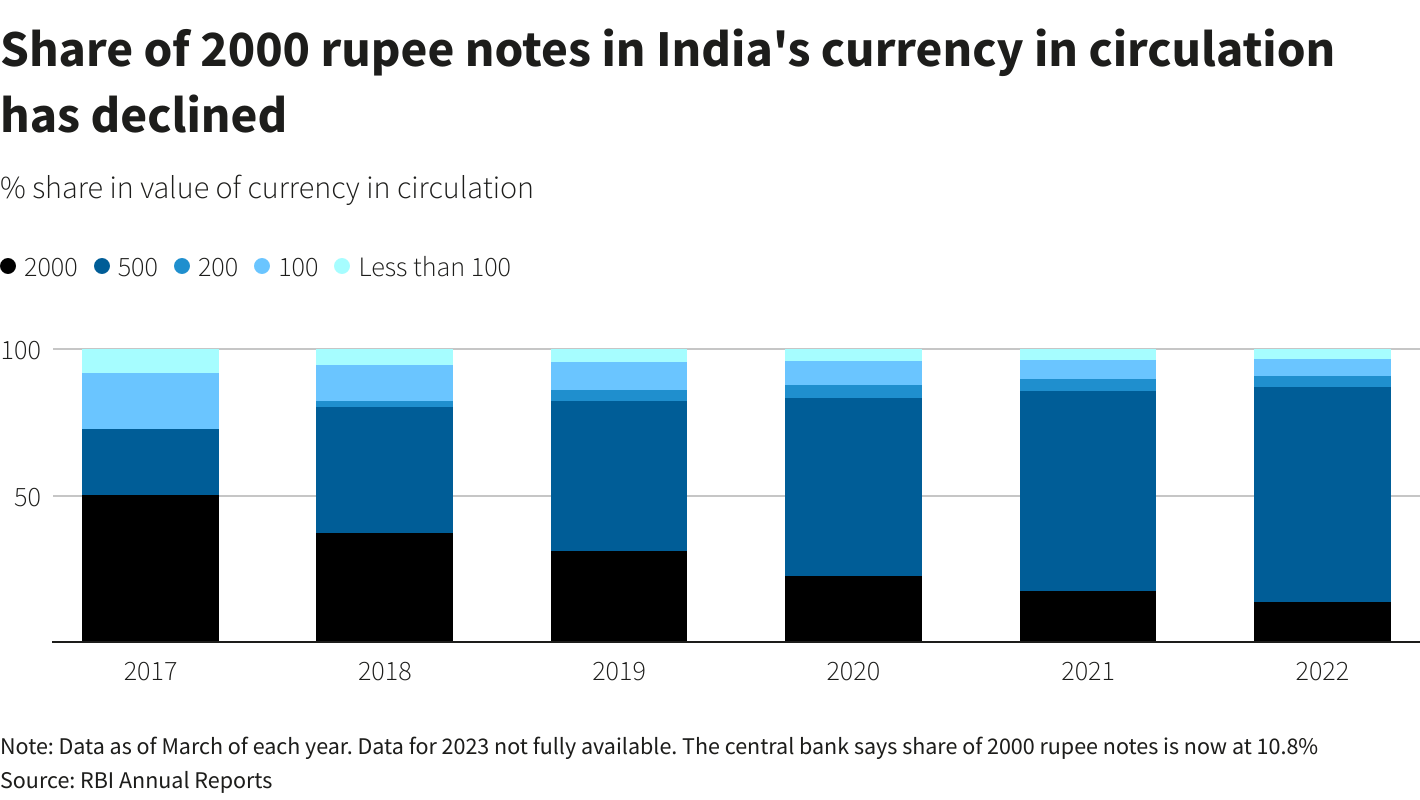

Value of 2000-Rupee Notes in Circulation and Its Proportion in Currency

There are currently 3.62 trillion Indian rupees ($44.27 billion) worth of 2000 rupiah notes in circulation. About 11% of all currency in circulation is represented here.

Nitsure reassured the public that “this withdrawal will not create any big disruption,” because lower denomination bills are readily available. “Also, the breadth of digital transactions and e-commerce has expanded significantly over the past 6-7 years.”

However, according to Yuvika Singhal, an economist at QuantEco Research, small enterprises and cash-oriented sectors like agriculture and construction could experience inconvenience in the short term.

Singhal speculated that there would be a temporary uptick in discretionary purchases like gold if people decided to spend their notes instead of depositing them in the bank.

Effect on Bank Deposits and Deposit Growth

Bank deposits will increase as consumers comply with the government’s request to deposit or exchange the notes for lower denominations by September 30. This occurs at a period when growth in bank deposits is trailing expansion in bank loans.

Karthik Srinivasan, group head – of financial sector ratings at rating agency ICRA Ltd., said this will reduce the need for increases in deposit rates.

The liquidity of the banking sector will also increase.

“Since all the 2000-rupee notes will come back in the banking system, we will see a reduction in cash in circulation,” explained Madhavi Arora, economist at Emkay Global Financial Services.

Srinivasan predicted that if banks received more deposits and increased banking system liquidity, short-term interest rates in the market would fall as these money would be invested in shorter-term government securities.