News

CardRates Explores the Average Credit Card Debt by Nation

Credit cards offer the convenience of buy now, and pay later option. But easy swiping can lead to a growing debt burden that may take years to clear. Global debt is reaching a historic high. It becomes crucial to understand the variations in credit card debt across the world.

The Global Perspective on Credit Card Usage

Credit cards have become an aspect of the finances of individuals worldwide. According to the World Debt Report, credit card usage has increased between 2017 and 2021. The penetration still remains below 50% in most countries around the world.

High-income economies exhibit greater credit card usage compared to lower-income nations. The United States stands out as the global leader in credit card ownership and usage.

Data collected from the Federal Reserve’s 2021 Report on the Economic Well-Being of U.S. Households reveal many insights. Approximately 79% of adults in the U.S. have at least one credit card. In the U.K., another developed country, consumer credit card penetration stood at 66% in 2020.

Developing nations and lower-income economies exhibit lower levels of credit card usage. Several African countries have low credit card adoption rates in comparison globally. For example, both Nigeria and Ethiopia have credit card penetration rates of less than 1%.

The key reasons behind these disparities in credit card usage across countries are:

- Consumer behavior

- Cultural influences

- Economic development

- Financial infrastructure

All these contribute to the difference in credit card usage. Additionally, the significance of accessibility of banking services and credit.

Developing nations progress in modernizing their payment systems and consumer credit offerings. Credit card usage is high in such places. It remains uncertain whether they will achieve credit card penetration rates.

Top Nations with the Highest Credit Card Debt

The United States tops the charts when it comes to credit card debt. As of 2021, the median credit card debt per American adult stood at $5,910. Almost 10 times higher than the median worldwide debt of $621. Canada and Australia follow close behind, with medians of $2,035 and $2,092.

The story shifts when comparing high-GDP nations. The US retains its leading position among this group while India has the lowest debt at $302 per adult. Most Western European countries fall somewhere between.

National economic prosperity does not correlate with average credit card debt by Nation. American consumer habits likely contribute to the high balances. This underscores the importance of factors such as spending habits and money management.

Credit Card Penetration: A Deeper Look

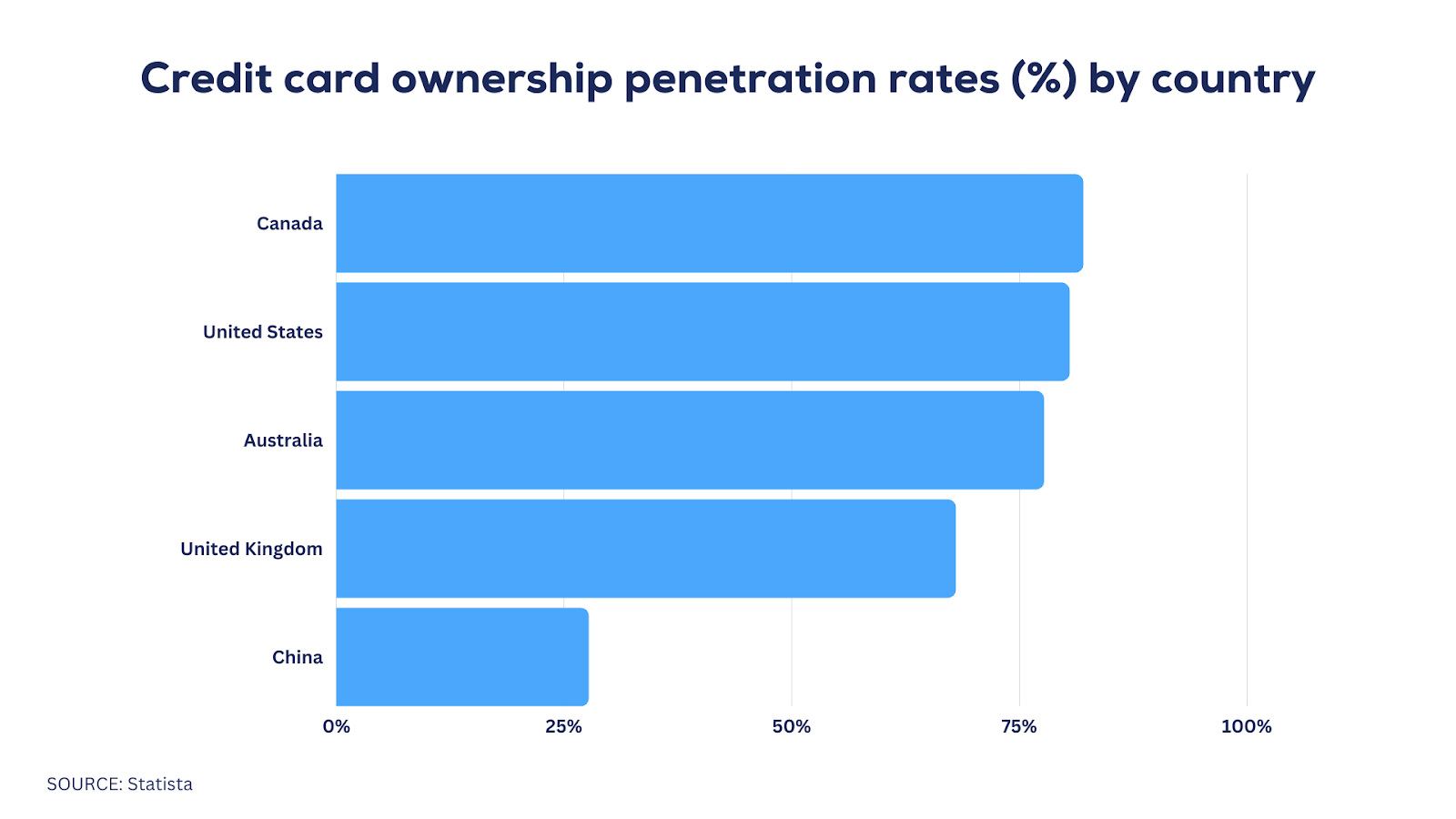

While debt highlights country averages, credit card penetration provides insights into ownership levels. According to 2021 statistics, the global average penetration rate stood at 24.4%. The degree of penetration exhibits significant disparities across different geographic regions:

- North America: 64%

- Europe: 54%

- Latin America: 23%

- Asia Pacific: 16%

Canada leads the pack with an impressive 82% penetration rate as of 2021. Australia, the US, and the UK follow close behind, ranging between 65-75%.

Within Europe, credit card prevalence differs. Nordic nations like Finland and Denmark exceed 95% ownership. Meanwhile, countries like Germany, Austria, and the Netherlands report usage rates below 45%. With a preference for debit cards and cash transactions.

The factors of adoption rate such as consumer behavior, infrastructure, interest, and fees. Monitoring ownership levels and penetration sheds light on credit usage trends worldwide.

Strategies to Combat Rising Credit Card Debt

While credit cards offer convenience, sky-high interest rates often exacerbate debt issues. The average credit card interest rate globally falls between 13-15%. Meanwhile, consumers in Brazil and Turkey face rates over 45%.

Several strategies can help consumers tackle credit card debt:

- Balance transfer cards: Transferring balances to a lower-interest card saves on interest charges.

- Interest rate reductions: Card issuers may reduce rates for consistent timely payments.

- Debt consolidation loans: Taking a lower-interest loan repays cards completely.

- Debt relief services: Credit counseling services negotiate with issuers for better terms.

Improving credit scores increases eligibility for better rates and terms. Using credit, limiting inquiries, and monitoring credit reports are key to building scores. Seeking help from reputable sources can aid consumers in debt resolution.

The Behavioral Aspect: Addressing the Root Cause

Behind these debts lies in behavior and money management skills. Financial literacy is essential to make informed borrowing decisions.

- Present bias: Overvaluing instant gratification and undervaluing future costs.

- Overconfidence: Overestimating ability to repay debts.

- Anchoring: Using arbitrary benchmarks like least payments to guide repayment.

Experts propose nudging consumers towards beneficial behaviors as a solution. For instance:

- SMS payment reminders counter present bias and forgetfulness.

- Warnings about lower payments serve to underscore anchoring effects.

- Credit limit decreases to curb overspending.

Financial counseling plays a crucial role in assisting consumers. To identify and change their financial habits in a personalized manner.

Proactive planning, spending discipline, and proper education can curb bad debt. Seeking help from credit counseling services is also wise.

Conclusion

Credit card debt varies worldwide, affected by regional behaviors and economic factors. While high-income nations lead in ownership, developing economies are catching up. Alarming debt levels in countries like the US also signal dangerous money habits.

Global consumers need to become more aware of responsible usage. Achieving financial stability necessitates moderating spending, minimizing charges, and improving financial management habits. With effective strategies, individuals can transform credit cards into assets rather than liabilities.

FAQs

Why does the U.S. have such high credit card debt compared to other nations?

America’s high credit card debt can ease accessing credit, and consumer behavior. This prioritizes spending over saving, and economic conditions such as stagnant wages.

How do interest rates impact average credit card debt in different countries?

Higher interest rates increase the cost of carrying debt, causing balances to accumulate. Lower rates in countries like India explain the lower credit card debt.

Are there nations where credit cards are rarely used?

Many developing countries in Africa and Asia have lower credit card penetration. High poverty levels and underbanked populations often limit credit card adoption.