Business

What Is ROI And How To Calculate ROI?

What Is ROI? – If you are a business owner, investor, or marketer, you have probably heard of the term ROI before.

ROI, or Return on Investment, is a performance metric used to evaluate the efficiency and profitability of an investment or business venture.

In simple terms, it measures the amount of profit earned in relation to the amount of money invested.

Understanding ROI is crucial for making informed business decisions and maximizing profits. In this article, we will discuss what ROI is, how to calculate it, and how to use it to make informed decisions.

What is ROI?

ROI is a financial metric used to measure the profitability of an investment. It is expressed as a percentage and shows the amount of money earned about the amount invested.

ROI can be used to evaluate the profitability of various types of investments, including marketing campaigns, stocks, real estate, and business ventures.

ROI can be positive, negative, or zero. A positive ROI indicates that the investment has generated a profit, while a negative ROI indicates a loss.

A zero ROI indicates that the investment has neither generated a profit nor incurred a loss.

Why is ROI Important?

The return on investment (ROI) is a financial metric used to determine the profitability of an investment.

It helps business owners, investors, and marketers to make informed decisions by evaluating the efficiency and profitability of an investment.

ROI can be used to compare the profitability of various investments and determine which investment will provide the highest return on investment.

Moreover, ROI is a crucial metric for measuring the success of marketing campaigns. It helps businesses determine whether a marketing campaign is generating a positive return on investment.

By measuring ROI, businesses can adjust their marketing strategies and optimize their campaigns for maximum profitability.

How to Calculate ROI?

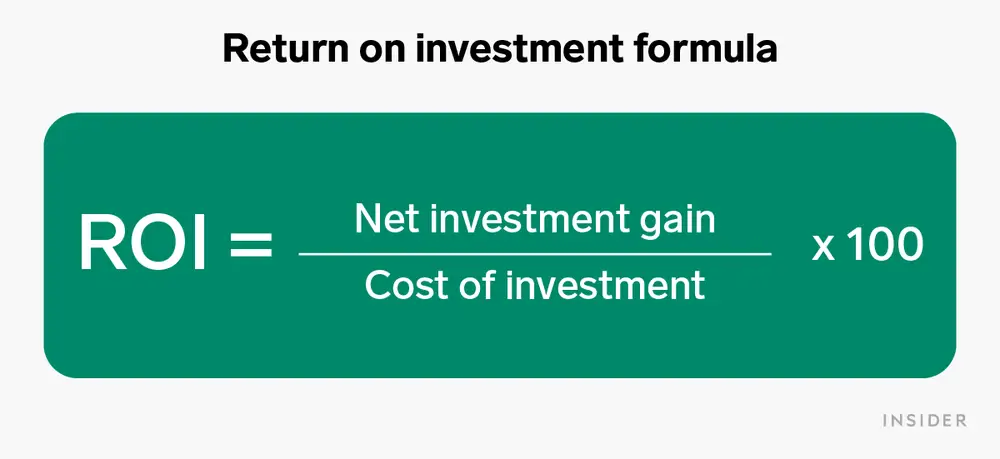

Calculating ROI is relatively simple. There are two ways to calculate ROI: the basic ROI formula and the advanced ROI formula.

Basic ROI Formula

The basic ROI formula is:

ROI = (Gain from Investment – Cost of Investment) / Cost of Investment * 100%

In this formula, the gain from investment refers to the amount of money earned from the investment, and the cost of investment refers to the amount of money invested.

For example, suppose you invested $1,000 in a marketing campaign and earned $1,500 in revenue. Using the basic ROI formula, the ROI would be:

ROI = ($1,500 – $1,000) / $1,000 * 100% = 50%

This means that the marketing campaign generated a 50% return on investment.

Advanced ROI Formula

The advanced ROI formula is:

ROI = (Net Income / Cost of Investment) * 100%

In this formula, net income refers to the total profit earned from the investment, and the cost of investment refers to the amount of money invested.

For example, suppose you invested $10,000 in a business venture and earned $15,000 in revenue. The total expenses incurred in the venture were $5,000. Using the advanced ROI formula, the ROI would be:

ROI = ($15,000 – $5,000) / $10,000 * 100% = 100%

This means that the business venture generated a 100% return on investment.

How to Use ROI to Make Informed Decisions

ROI can be used to make informed decisions in various ways. Here are some ways in which ROI can be used to make informed decisions:

1. Evaluating Investments

It is possible to evaluate the profitability of various investments using ROI. By comparing the ROI of different investments, businesses can determine which will provide the highest return on investment.

2. Measuring the Success of Marketing Campaigns

ROI is a crucial metric for measuring the success of marketing campaigns. By measuring the ROI of a marketing campaign, businesses can determine whether the campaign is generating a positive return on investment or not.

If the ROI is negative, businesses can adjust their marketing strategies and optimize their campaigns for maximum profitability.

3. Analyzing Business Performance

ROI can be used to analyze the performance of a business over time. By measuring the ROI of a business venture over a period, businesses can determine whether the venture is generating a positive return on investment or not.

This can help businesses identify areas needing improvement and optimize their operations for maximum profitability.

4. Comparing Competitors

ROI can be used to compare the profitability of businesses within the same industry.

By comparing the ROI of different businesses, businesses can determine which businesses are performing well and which ones need improvement.

Conclusion

ROI is an essential metric for measuring the profitability of an investment. It helps businesses to make informed decisions by evaluating the efficiency and profitability of an investment.

ROI can be calculated using the basic or advanced formula, and it can be used to evaluate investments, measure the success of marketing campaigns, analyze business performance, and compare competitors.

By understanding ROI, businesses can make informed decisions and maximize profits.

FAQs

- What is a good ROI for a business? A good ROI for a business depends on the industry and the type of investment. Generally, a positive ROI is considered good, and a higher ROI is better.

- Can ROI be negative? Yes, ROI can be negative. A negative ROI indicates that the investment has incurred a loss.

- What factors can affect ROI? Several factors can affect ROI, including the type of investment, the cost of investment, the revenue generated from the investment, and the expenses incurred.

- Is ROI the only metric used to measure investment performance? No, ROI is not the only metric used to measure investment performance. Other metrics, such as net present value, internal rate of return, and payback period, can also be used to evaluate investment performance.

- Can ROI be used to evaluate the performance of a business venture over time? Yes, ROI can be used to evaluate the performance of a business venture over time. By measuring the ROI of a business venture over a period, businesses can determine whether the venture is generating a positive return on investment or not.

RELATED CTN NEWS: