Business

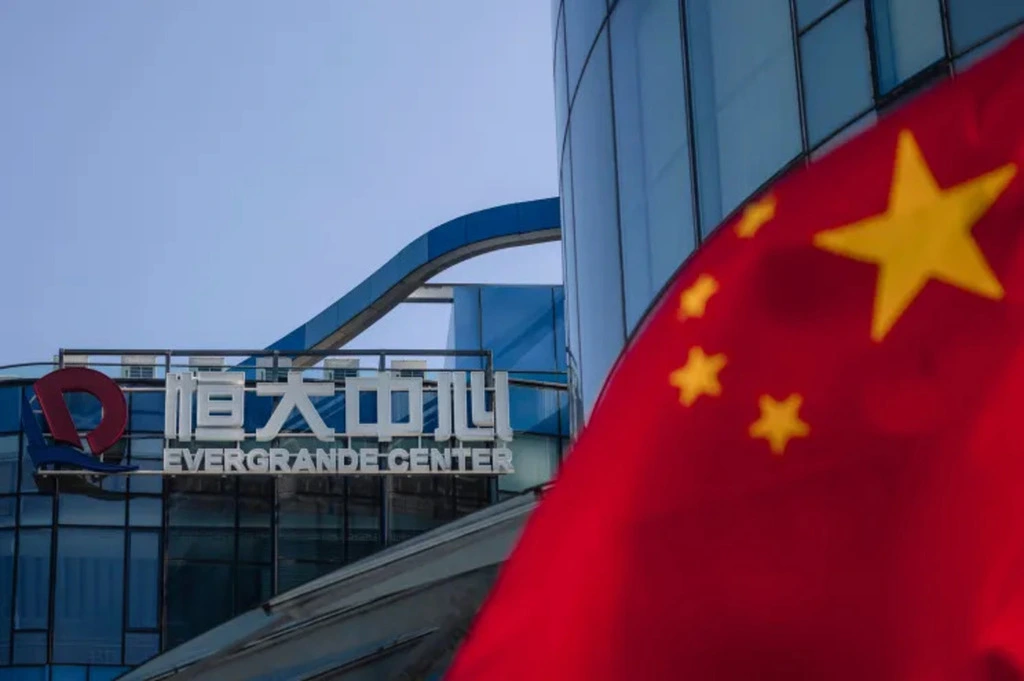

China’s Evergrande Group Warns it Could Run Out of Money

China’s Evergrande Group, which is struggling beneath $310 billion in debt, warned Friday it may run out of money to “perform its financial obligations” – sending regulators scrambling to reassure investors that China’s financial markets can be protected.

Evergrande Group’s inability to comply with official pressure to reduce debt has fueled concern that a possible default could trigger a financial crisis. Beijing wants to avoid a bailout, so global markets might be unaffected, but banks and bondholders may suffer.

Evergrande said in a statement that there is no guarantee that it will have the funds to continue to meet its financial obligations after reviewing its finances.

Soon after, regulators tried to ease investor fears by stating that China’s financial system is strong and its default rate is low. It was noted that most developers are financially sound, and Beijing is committed to keeping lending markets functional.

The China Securities Regulatory Commission stated on its website that the spillover impact of the group’s risk events on the capital markets is controllable. A similar position was taken by the central bank and bank regulator.

Read: How The World Can Avoid the Next Evergrande Group Crisis

Last year, China tightened restrictions on developers’ use of borrowed money in an effort to rein in surging corporate debt that is seen as a threat to macroeconomic stability.

Since 2018, China’s Communist Party has prioritized reducing financial risk. Since the communist revolution of 1949, authorities allowed the first corporate bond default in 2014. Defaults have been gradually increased to force borrowers and investors to be more disciplined.

Despite this, corporate, government, and household debt totalled nearly 300% of GDP last year, which is unusually high for a middle-income country. According to economists, a financial crisis is unlikely, but debt could hamper economic growth.

Evergrande owes 310 billion yuan ($2 trillion) to domestic banks and bond investors, which makes it the biggest debtor in the global real estate industry. The company also owes $19 billion to foreign bondholders.

Evergrande has assets worth 2.3 trillion yuan ($350 billion), but the company has been unable to convert that into cash to pay bondholders and other creditors. A stake in a subsidiary was sold for $2.6 billion in October, but the buyer did not follow through on the purchase.

A statement from Evergrande said the company needs to fulfil a $260 million obligation. It said if the obligation could not be met, other creditors might demand repayment earlier than normal.

Read: China Evergrande Suspends Trading of its Shares Without Reason

The company missed deadlines for paying interest on some bonds, but made payments before a grace period expired, resulting in a default. In addition, Evergrande said some bondholders can choose to receive apartments currently under construction as part of their payment.

Evergrande’s chairman, Xu Jiayin, was summoned to meet with Guangdong officials on Friday, according to a government statement. According to the statement, a government team would be sent to Evergrande’s headquarters to assist with risk management.

Evergrande’s struggles have prompted warnings that a financial squeeze on real estate – an industry that propelled China’s 1998-2008 economic boom – could lead to trouble for banks and a sudden and dangerous collapse of growth.

Another developer, Kaisa Group Holdings Ltd., also warned it might fail to pay a $400 million bond due next week.

Midsize developer Fantasia Holdings Group failed to make a payment of $205.7 million to bondholders on Oct. 5.

Since the government began tightening its control over the sector’s finances in 2017, hundreds of smaller Chinese developers have gone bankrupt.

During the three months ending in September, China’s economic growth decreased unexpectedly to 4.9% over a year earlier due to the slowdown in construction. If financing curbs remain in place, analysts expect growth to further decelerate.

Source: The Associated Press