Cryptocurrency

Bitcoin’s Value Falls Below $26,000 Amid SpaceX’s Bitcoin Holdings Write-Down

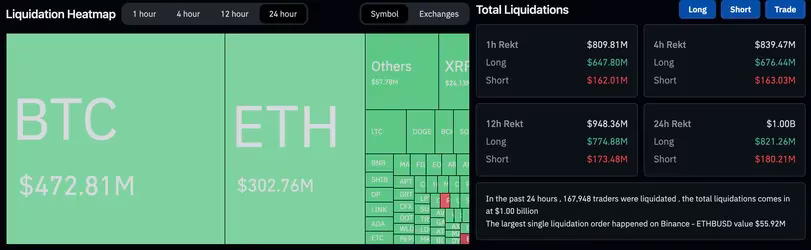

(CTN NEWS) – On Thursday, the value of Bitcoin dropped beneath $26,000, marking its lowest point since June. This decline was part of a larger downturn in the cryptocurrency market, triggered by news from the Wall Street Journal.

According to the report, SpaceX has recorded a substantial reduction in the value of its Bitcoin holdings and has proceeded to liquidate the cryptocurrency.

At the start of Friday, the value of the planet’s most esteemed cryptocurrency rested at $26,400, displaying an almost 8% decrease over the preceding 24 hours and a 10% decline compared to the previous week.

During the prior Thursday evening, the Bitcoin price had descended even further, reaching approximately $25,400 before experiencing a minor rebound.

Ether, the second-largest global cryptocurrency, experienced a comparable setback, declining to $1,680—a drop of 6.6% within the preceding 24 hours.

A substantial 16% drop characterizes the decline in the value of Ripple’s XRP token within the last 24 hours, making it notably more pronounced than the declines witnessed in other prominent cryptocurrencies.

This sharper descent of XRP can be attributed to a federal judge’s ruling on Thursday, granting permission to the SEC for a partial appeal in its ongoing legal battle against Ripple.

Bitcoin’s Correlation with Stocks Hits Two-Year Low, Reflecting Historical High Amidst Fed’s Inflation-Control Push

While Bitcoin’s correlation with traditional stocks has reached its lowest point in the past two years, 2022 witnessed a remarkable surge to an all-time high in response to the Federal Reserve’s endeavor to counter inflation through rate hikes.

Sylvia Jablonski, Chief Investment Officer at Defiance ETFs, pointed out, ‘While inflation alone could be an argument for the growth of crypto assets, it brings along other factors such as investors seeking safety from a potential recession, and shying away from assets considered riskier like Bitcoin.’

She added, ‘I suspect that the higher beta equities and cryptocurrencies are experiencing the effects of the late summer lull—typical low-volume, range-bound trading that occurs in August.

The hawkish stance of the Fed serves as an additional deterrent, keeping investors on the sidelines and prices within a tight range.’

Recent data from Kaiko reveals that Bitcoin’s and Ether’s 90-day volatility reached multiyear lows this week, at 35% and 37% respectively.

John Todaro from Needham commented on Bitcoin’s rebound to $30,000 in late June, saying, ‘The rally lacked vigor as it occurred on light trading volume.’

He also noted that the anticipated launch of a spot Bitcoin ETF, one of the most significant positive catalysts for the crypto market, has lost some momentum this week.

Todaro added, ‘Given the setback this week, as well as the expectation of prolonged higher rates, the prospects for Bitcoin and the broader crypto market have receded.

Remaining potential drivers include the Halving projections in Q1-Q2 ’24 and any ongoing comments from the SEC regarding ETFs.’

On Thursday, several leading cryptocurrencies by market capitalization, including Binance’s BNB coin, Ripple’s XRP, Solana, and Polygon, experienced declines of over 3%. Ether also saw a drop of 4%.”

SpaceX’s Crypto Holdings Impact: Wall Street Journal Report Triggers Market Decline

The onset of the crypto market’s decline on Thursday evening was initiated by a report from the Wall Street Journal, indicating that Elon Musk’s SpaceX had marked down the valuation of its Bitcoin assets by a combined sum of $373 million over the course of the preceding two calendar years.

The company also divested its cryptocurrency holdings, though the specific timing of this sale remains unclear.

The influence of Musk and his enterprises on cryptocurrency valuations has been substantial, often resulting in noteworthy market fluctuations based on the billionaire’s social media posts.

Notably, this selloff by SpaceX mirrors a similar action taken by another Musk-owned venture, Tesla, which revealed in a past earnings report that it had divested 75% of its Bitcoin holdings.

RELATED CTN NEWS:

Indonesia Unveils Pioneering State-Backed Cryptocurrency Bourse To Foster Crypto Market Growth

Ripple’s Legal Victory Sends XRP Surging And Boosts Crypto Industry Confidence

Is Bitcoin A Good Investment? Benefits And Risks Of Investing In Bitcoin