(CTN NEWS) – In a significant legal triumph for the cryptocurrency industry, a U.S. judge ruled on Thursday that Ripple Labs Inc did not contravene federal securities law when it sold its XRP token on public exchanges.

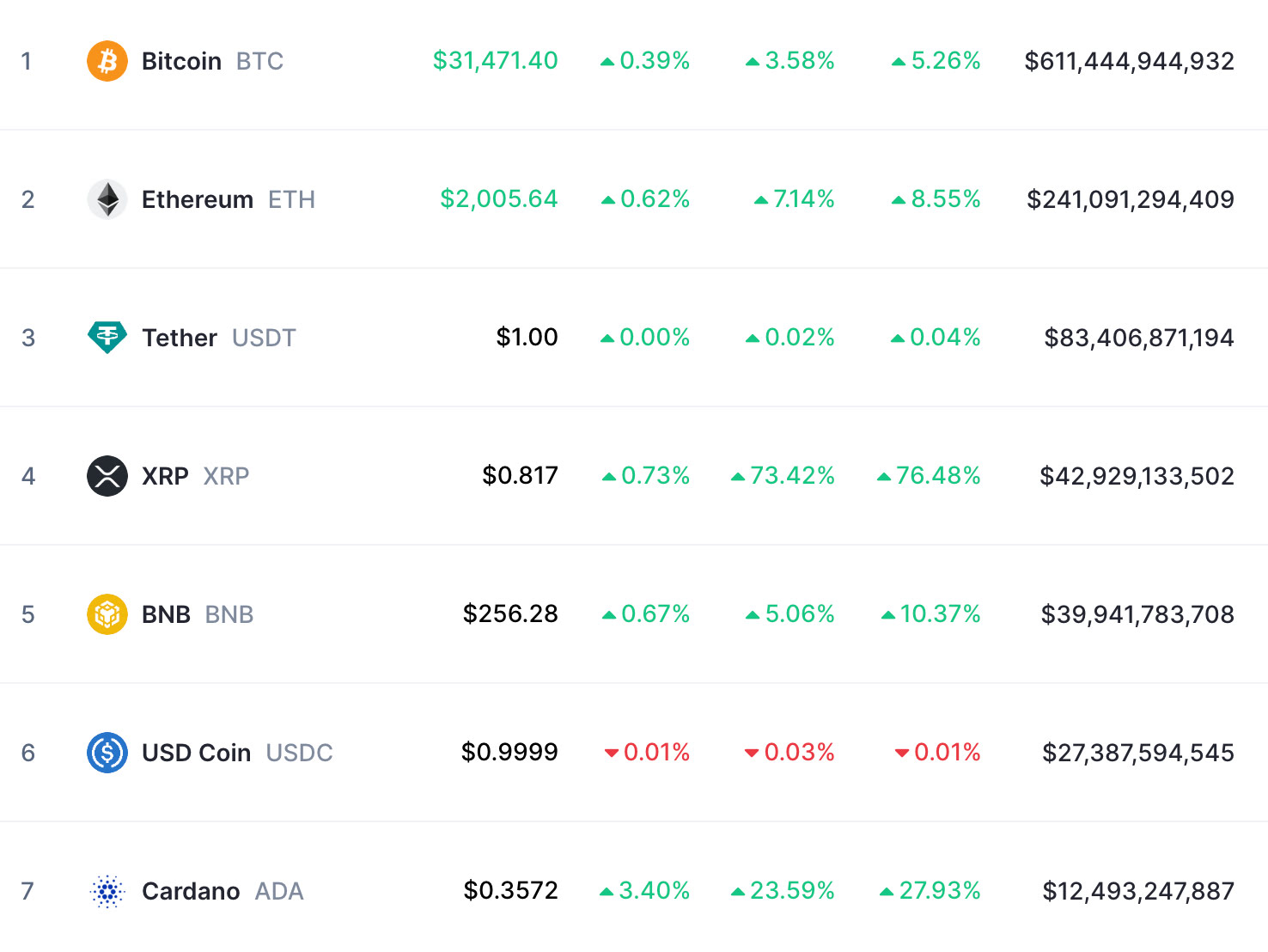

This landmark decision propelled the value of XRP to surge, experiencing a notable 75% increase by late afternoon, as reported by Refinitiv Eikon data.

This ruling, issued by U.S. District Judge Analisa Torres, marks the first favorable outcome for a cryptocurrency firm facing litigation from the U.S. Securities and Exchange Commission (SEC).

However, it’s important to note that the SEC did secure a partial victory in the case as well.

Although the ruling in this case is based on its unique circumstances, it is expected to serve as a valuable precedent for other cryptocurrency companies embroiled in legal disputes with the SEC regarding the regulatory scope of their products.

This decision may offer these firms some leverage in their battles with the regulatory authority.

A representative from the SEC expressed satisfaction with a portion of the judgment wherein the judge determined that Ripple had indeed violated federal securities law by directly selling XRP to sophisticated investors.

It is worth noting that once a final judgment is rendered or with the judge’s permission, there is a possibility for the ruling to be appealed.

The spokesperson for the SEC stated that the regulatory body is currently examining the ruling and its implications.

Brad Garlinghouse, the CEO of Ripple, hailed the decision as a significant victory not only for Ripple but also for the broader cryptocurrency industry in the United States, in an interview.

Coinbase, the largest cryptocurrency exchange in the U.S., announced its intention to resume XRP trading on its platform.

Paul Grewal, the Chief Legal Officer of Coinbase, shared on Twitter that they have thoroughly assessed Judge Torres’ well-considered decision and have determined it is appropriate to relist XRP.

On Thursday, the stock of Coinbase experienced a notable increase, closing up by 24% at a price of $107 per share.

Ripple Prevails as Judge Rules XRP Sales Were Not Securities in SEC Case

The Securities and Exchange Commission (SEC) had filed accusations against Ripple, its current and former chief executives, alleging an unregistered securities offering worth $1.3 billion through the sale of XRP, a cryptocurrency created by Ripple’s founders in 2012.

The outcome of this case has garnered significant attention within the cryptocurrency industry, as it challenges the SEC’s assertion that the majority of crypto tokens qualify as securities and fall under the agency’s stringent investor protection regulations.

The SEC has initiated over 100 enforcement actions related to cryptocurrencies, claiming that numerous tokens are securities, although many of these cases have been resolved through settlements.

In the limited number of instances where cases have proceeded to court, judges have generally concurred with the SEC’s position, affirming that the crypto assets in question were indeed securities.

Securities, unlike commodities, are subject to strict regulation, necessitating registration with the SEC by the issuer and the provision of detailed disclosures to inform investors about potential risks.

However, Judge Torres ruled differently in the Ripple case. She determined that the sales of XRP on public cryptocurrency exchanges did not qualify as offers of securities, as purchasers did not reasonably anticipate profits linked to Ripple’s endeavors.

These transactions were characterized as “blind bid/ask transactions,” where buyers were unaware of whether their payments went to Ripple or other XRP sellers.

Drawing from a U.S. Supreme Court precedent, Torres identified that an investment qualifies as a security when it involves “an investment of money in a common enterprise with profits to come solely from the efforts of others.”

According to her ruling, XRP sales on cryptocurrency platforms by Ripple’s CEO Brad Garlinghouse, co-founder and former CEO Chris Larsen, as well as other distributions including employee compensation, did not involve securities.

SEC Secures Partial Victory in Ripple Case as Judge Rules XRP Sales to Hedge Funds Were Unregistered Securities Offerings

The SEC secures a partial victory as Judge Torres concludes that Ripple’s sales of XRP, amounting to $728.9 million, to hedge funds and sophisticated buyers were unregistered securities offerings.

According to Torres, Ripple’s marketing specifically targeted institutional investors, promoting a speculative value proposition for XRP that relied on the company’s efforts to develop the underlying blockchain infrastructure of the digital asset.

She further stated that a jury should determine whether Ripple CEO Brad Garlinghouse and co-founder Chris Larsen assisted the company in violating securities laws.

Additionally, she made it clear that the defendants cannot assert during the trial that they were not adequately informed that XRP constituted a cryptocurrency, as the concept of “fair notice” does not require the SEC to individually notify all potential violators within an industry.

Torres emphasized that the law does not mandate the SEC to provide warnings on an individual or industry level.

Legal Ruling in Ripple Case Offers Support to Coinbase and Sparks Calls for Legislative Clarity in the Crypto Industry

Gary DeWaal, a lawyer at Katten Muchin Rosenman, believes that the recent ruling will provide support to Coinbase in its own legal battle with the SEC.

The market’s reaction to the ruling reflects a significant development for the entire cryptocurrency industry, with experts considering it a momentous event.

Both the Ripple and Coinbase cases revolve around the question of registration requirements and the classification of specific digital assets as securities within the framework of U.S. law.

Given the ongoing uncertainties, there have been increasing calls from the crypto industry for legislative measures to establish clear guidelines for tokens.

The ruling has reignited demands for Congress to take action and provide clarity on the regulatory status of digital assets.

Representative Tom Emmer, a Republican and Majority Whip of the House of Representatives, took to Twitter to express that the ruling affirms the distinction between a token and an investment contract, emphasizing the need for legislation to solidify this distinction.

Reporting by Jody Godoy and Chris Prentice in New York, and Tom Hals in Wilmington, Delaware; Editing by Chizu Nomiyama, Conor Humphries, Leslie Adler, and David Gregorio.

RELATED CTN NEWS:

Is Bitcoin A Good Investment? Benefits And Risks Of Investing In Bitcoin

Cryptocurrency Scams: How To Spot Them And Protect Your Money?

What Is A Wash Sale And How Does It Impact Your Investments?