Since its launch in 2009, Bitcoin has grown into the dominant cryptocurrency, with a market cap exceeding $600 billion as of 2022. Underpinning Bitcoin’s functionality and value is the process of mining, whereby specialized computers compete to validate transactions and mint new bitcoins by solving complex cryptographic puzzles.

In the early years, hobbyists could mine bitcoin from home PCs, but the difficulty has long surpassed everyday computing power. Professional mining today requires warehouses of specialized ASIC hardware, consuming enormous amounts of electricity. This high barrier excludes casual cryptocurrency enthusiasts from participating.

Cloud mining services like minethrive legit promise to make bitcoin mining accessible by allowing customers to rent remote mining power and earn bitcoin without running their rigs. But are these services legit and profitable?

Minethrive Legit Technology Fundamentals

Bitcoin functions as decentralized digital cash powered by blockchain technology. Here is a quick primer:

– Bitcoin network runs via distributed nodes, not any centralized entity

– Nodes maintain a shared public ledger of all transactions called the blockchain

– New transactions are verified by miners and added in “blocks.”

– Miners use specialized hardware to solve complex math puzzles and validate blocks

– The protocol rewards successful miners with newly minted bitcoin

– The system is secured cryptographically through public/private key pairs

– Supply is limited to 21 million bitcoins released gradually through mining

This “digital gold” created the foundation for cryptocurrencies. The ability to send money online without central banks or intermediaries has ignited enormous demand. Now, let’s examine how Bitcoin mining secures the network.

How Bitcoin Mining Works

Bitcoin mining serves two crucial functions:

1. Verifying transactions and recording them via adding new blocks

2. Issuing new bitcoin into circulation as mining rewards

Here are the basics of how Bitcoin mining functions:

– Miners assemble pending transactions into candidate blocks

– Miners repeatedly hash the block header, trying to get a result below the target difficulty

– The first miner to solve the cryptographic puzzle announces the block to the network

– Other nodes verify the block is valid and meets the difficulty criteria

– The new block is added to the existing blockchain

– The miner who mined the block is rewarded with newly minted bitcoin

This competitive process ensures transactions are verified in a decentralized manner. It also distributes new bitcoin into the money supply on a schedule encoded into the protocol.

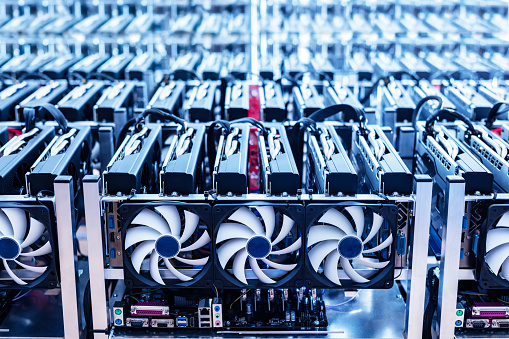

The Evolution of Bitcoin Mining Hardware

In Bitcoin’s early days, the network hash rate was low enough for regular home computers to profitably mine Bitcoin with their CPUs. But equipment and technology advanced rapidly:

CPU Mining – Using customary computer central processing units was feasible until 2010.

GPU Mining – Graphics processing units offered 50-100x more mining power efficiency. Bitcoin ASICs soon outpaced GPUs.

FPGA Mining – Custom field-programmable gate arrays delivered better performance than GPUs but cost more.

ASIC Mining – Application-specific integrated circuits are chips customized solely for Bitcoin mining. ASIC rig farms now dominate.

Better Hash Algorithms – Some newer cryptocurrencies use memory-hard hashes that resist ASICs to preserve decentralization.

But for Bitcoin, ever-increasing mining difficulty now necessitates specialized ASIC hardware storing hundreds of specialized mining chips in massive warehouses. Solo home PC mining is no longer viable.

Cloud Mining Overview

Cloud mining allows individuals to pay for a service provider’s remote data center mining capacity. Instead of buying, configuring, and maintaining expensive mining rigs, users can purchase hash rate contracts and receive bitcoin without dealing with the hardware.

Here are the basics of how most Bitcoin cloud mining services work:

– Users sign up and purchase contracts for fixed amounts of hashing power

– The hash rates are pointed at mining Bitcoin under the provider’s account

– As the ASIC rigs generate bitcoin, proceeds are shared among users based on their share of hashpower

– Earnings are deposited regularly (often daily) into the user’s account

– Fees are deducted for electricity and maintenance costs

– When the contract expires, users can reinvest proceeds into more hashrate

Cloud mining opens up Bitcoin mining to anyone needing technical expertise or large capital expenditures. But there are downsides to consider:

Lower Earning Potential – Rewards must be split with the provider versus owning your hardware.

Contract Unprofitability – Contracts can lose money if bitcoin price drops or mining difficulty rises enough.

Scams – Cloud mining lacks regulation, so scams are common. Due diligence is critical.

Lack of Control – Need more visibility into actual mining operations and cannot audit practices.

Let’s look at one of the largest providers, Minethrive, to understand their services.

Inside Minethrive: Company Background

Minethrive launched in 2018 as one of the earliest legitimate cloud mining companies. They have served over 115,000 users with mining facilities spanning several countries.

Here are some key facts about their organization:

– Based in the UK with registration #11775383

The leadership team has decades of blockchain and engineering experience

– Backed by sizable venture capital investment

– Operates 20+ megawatts of data centers located in Iceland, Georgia, Canada, and Ukraine

– Utilizes the latest hardware from Bitmain, MicroBT, and other top mining equipment makers

– Mines a variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Dogecoin, and more emerging coins

– Services over 100,000 users in 180 countries supported in multiple languages

While no cloud mining provider is risk-free, Minethrive strives to be transparent and reputable in a sector rife with scams. They have built a positive community reputation thus far. But always conduct your detailed due diligence before investing.

Estimating Potential Profits from Minethrive Cloud Mining

When considering any mining investment, it’s critical to estimate potential returns to assess viability and payback timeframes. Here are some tips for projecting possible Bitcoin profits with Minethrive:

Use mining calculators – Input hash rate, hardware cost, power costs, and other parameters to model possible yields.

Review Minethrive projections – Each contract states expected mining outputs at the time of purchase. Treat these as rough estimates.

Factor in pool fees – Account for Minethrive’s 15% maintenance fee deducted from mining proceeds before payouts.

Assume a flat BTC price – Use a conservatively low static bitcoin price rather than rely on appreciation. Any future gains are upside.

Account for increasing difficulty – The Bitcoin network difficulty adjusts upwards frequently. Model gradual difficulty increases into long-term projections.

Compare hardware mining costs – Evaluate whether contract costs deliver a competitive or better effective hash rate than operating your ASICs.

Start small – Don’t commit massive amounts upfront. Test with a low-tier contract and increase allocation once satisfied.

By combining prudent assumptions into profitability estimates, you can assess potential ROI timeframes and yields for Minethrive’s Bitcoin cloud mining packages.

Getting Started with Minethrive

If you decide to try Bitcoin cloud mining with Minethrive, here is an overview of the process:

1. Visit Minethrive.io and register for an account

2. Confirm your email and complete identity verification

3. Review the contract options and decide on a package

4. Select your preferred payment method and complete purchase

5. Your purchased hash rate immediately starts mining

6. Sit back and watch as mining proceeds accumulate in your account wallet

7. Withdraw to your Bitcoin wallet on your desired schedule

8. Consider reinvesting a portion of proceeds to grow your hashrate over time

It just takes a few minutes to get started with Bitcoin cloud mining. However, there are best practices to follow to maximize security and financial prudence.

Tips for Maximizing Cloud Mining Results

Here are some tips to optimize results and reduce risks when mining Bitcoin in the cloud with Minethrive:

– Enable two-factor authentication and use unique complex passwords

– Withdraw a portion of proceeds regularly to your secure wallet

– Split contract allocation between multiple hashrates and cryptocurrencies

– Reinvest wisely rather than unthinkingly reinvesting everything

– Only risk money you are willing to lose access to if a provider fails

– Discuss tax implications in your jurisdiction and set aside coins to pay taxes

– Carefully evaluate Minethrive’s partners, facilities, and business practices

– Start small and scale up over time once satisfied with the service

– Monitor mining metrics like bitcoin price and difficulty level

– Talk to Minethrive support promptly if any issues arise

Cloud mining could offer moderate rate rewards over time by applying security awareness and financial prudence. But risks around bitcoin’s volatile price swings and rising mining costs remain ever-present.

Bitcoin Mining Key Risks and Considerations

While Minethrive provides easy access to cloud mining, users should weigh risks before proceeding:

– Bitcoin price could drop sharply, making contracts unprofitable

– Increasing mining difficulty erodes profitability, especially in the long-term

– Minethrive could engage in dishonest practices like overselling hashrate

– Account hacking if security protocols aren’t followed

– Mining proceeds need to be withdrawn to personal wallets to avoid losses

– Mining income may be taxable in your jurisdiction

– Long contract lock-in periods with no ability to exit early

– No guarantee that Minethrive will deliver projected mining proceeds

These risks come with any cloud mining provider. Do extensive due diligence on Bitcoin mining track record and business practices before investing sizable sums. Start small to evaluate services firsthand.

Conclusion

Cloud mining with Minethrive offers a reasonably accessible avenue into Bitcoin mining without the daunting complexity and capital costs of operating ASIC rigs directly. It delegates the equipment, maintenance, facilities, and operations to professionals while users sit back collecting bitcoin.

However, prudent due diligence is required, as in any cryptocurrency investment. Realistically estimate profit scenarios, follow security protocols, and reinvest wisely. As part of a diversified crypto portfolio, cloud mining could yield moderate gains over the long term. Weigh the risks and rewards carefully based on Bitcoin’s fundamentals.

Hopefully, this guide provided a comprehensive introduction to bitcoin and cloud mining to empower investment decisions. Please reach out with any other questions!

⚠ Article Disclaimer

The above article is sponsored content any opinions expressed in this article are those of the author and not necessarily reflect the views of CTN News