Business

The Dark Side of Trading Simulators: How They Mislead Novice traders

Trading simulators promise to make you a master trader in no time, but do they deliver on that promise? Well, let’s just say that not everything that glitters is gold.

These virtual trading platforms may seem like a no-risk way to become a pro trader, but the truth is, many of them come with a dark side that can lead novice traders down a path of false confidence and ultimately harm their performance.

In this article, we’re going to explore the sneaky side of trading simulators, and how they can lead novice traders to lose money.

TOP 5 sneaky tactics trading simulators are using to get more users:

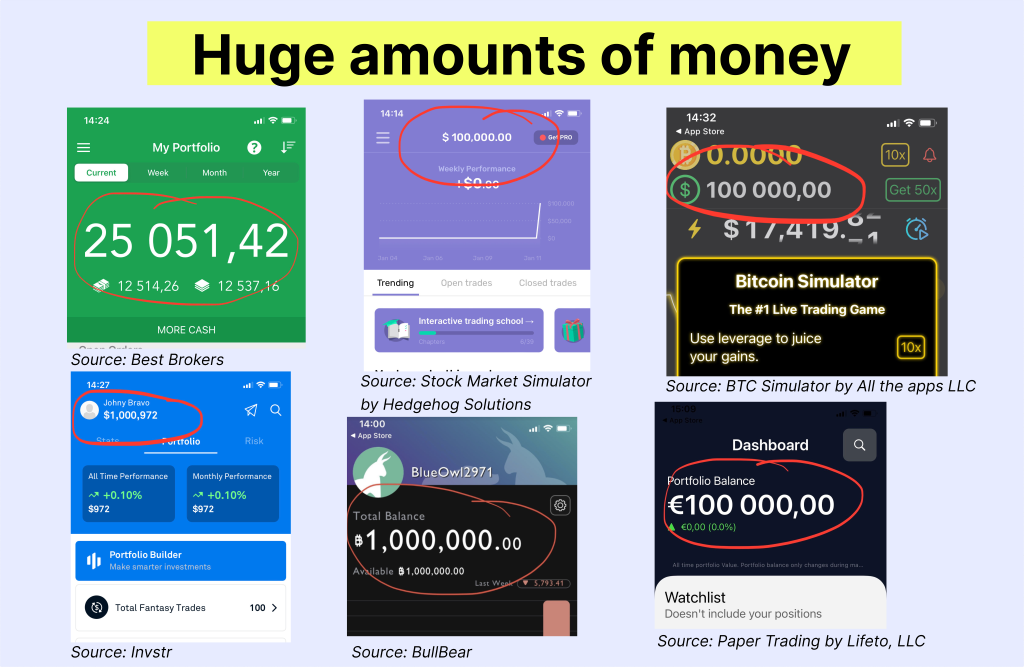

1. Giving a huge amount of virtual money

$100 000, $1 000 000 – these are the most common virtual money amounts app developers are giving to the users. When you have a lot of virtual money, you may feel invincible and think that you can’t lose.

This can lead to poor decision-making and overconfidence, which can be a recipe for disaster in the real market. You may also develop bad habits, such as over-trading or failing to properly manage your risks.

In the real world of trading, most people start with a relatively small amount of capital, typically between $100 and $250. That’s why choosing trading simulator with a small amount of virtual capital is a much more realistic and beneficial experience for traders. It will help learn to manage risk and develop good trading habits that will serve well in the real world.

2. Possibility to undo losing trade

Undoing a losing trade doesn’t teach you how to handle losses in the real market.

Let’s face it, in the real world of trading, losses are inevitable. But, by undoing a losing trade in a simulator, you’re not learning how to cope with losses and make better decisions in the future.

It’s like cheating on a test, sure you’ll get a good grade, but you’ll never learn the material.

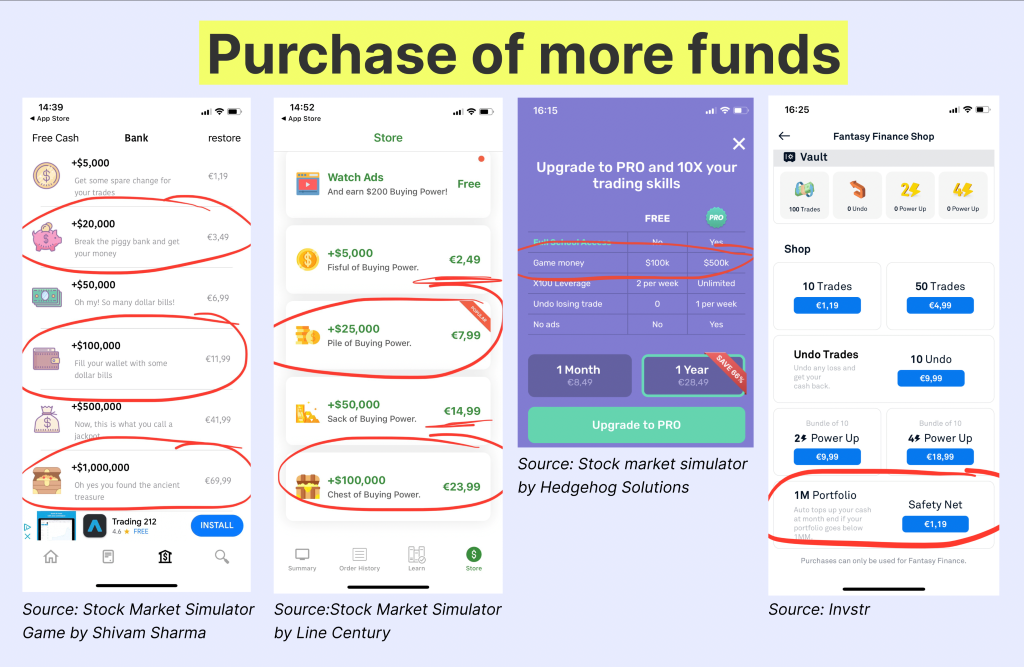

3. Purchase of more funds

10 undo losing trades for just EUR 9.99, extra $100k game money for just EUR 11.99 – these are just a few options most of the trading simulators offer to buy.

For example, one of the trading simulators offers the possibility to buy a safety net for EUR 1.19, which automatically tops up your cash at the end of the month if your portfolio goes below 1 million. However, this approach can’t teach traders proper risk management. In real life, if you lose, for example, $500, it won’t refresh at the same level even if you pay a symbolic fee.

4. Trading with enormous leverage (x100 etc)

Trading with x100 leverage can be like riding a rollercoaster, one minute you’re soaring to new heights, the next you’re plummeting to the depths of despair.

Sure, it’s thrilling to watch your trades with x100 leverage bring in big profits, but one losing trade can wipe out all those gains in a flash.

Using a high leverage can lead to impulsive decisions and overconfidence, as traders may feel like they have more “ammunition” to make bigger trades.

This can make them more likely to over-trade and make emotionally charged decisions, rather than sticking to a well-thought-out trading plan.

Despite the fact that high leverage can be harmful, many trading simulators allow to trade with x100 leverage although under the new ESMA leverage regulations, the highest allowed leverage is x30 (for major currency pairs).

Below you can see one of the Reddit users who shared his experience of trading with x1, x10 and x100 leverage and how scary high leverage losses can be. 👇

5. No stop-loss and take-profit function

Some of the trading simulators don’t offer the stop loss function. The stop loss and take profit options are important risk management tools that can help traders limit their losses and lock in profits.

Not having these options in a trading simulator can make it less effective in preparing traders for real trading.

Let’s be honest, trading simulators offering in-app purchases like the ability to undo losing trades or reset your account to a whopping $1,000,000 are all about one thing: making profit to app developers!

These features may seem like a dream come true, but they’re not something you’ll find in the real trading world. In the real trading world, when you lose, you lose, and there’s no magic undo button to save the trade.

Of course, someone could say, ‘Yes, but they are just using gamification tools to engage users.’

However, the real story is that many of them are affiliated with brokers, so their main goal is to get the user to sign up for the broker as quickly as possible.

This is achieved by giving the trader the false impression that they can make a lot of money with trading and that they have learned all the main things to be a profitable trader in the real life.

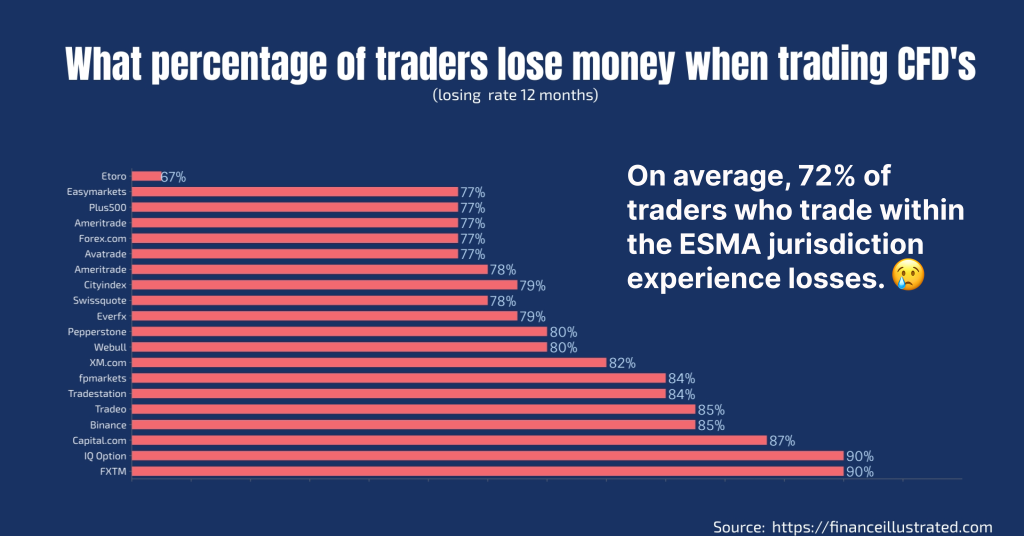

💡 In 2018, the ESMA implemented the MiFID II directive, which requires all online derivatives trading brokers operating in the European Union to publicly disclose the percentage of their

clients who lose money. On average, 72% of traders who trade within the ESMA jurisdiction experience losses.

And one of the reasons it might happen is because of these trading simulators which give new traders the confidence that they are willing to risk their money much sooner than they actually should.

List with the trading simulators which are using sneaky tactics:

1. BullBear simulator – $1 000 000 virtual capital, no stop-loss/take profit orders.

2. Investmate – no stop-loss/take profit orders, static prices.

3. Best brokers trading simulator – giving $25 000 virtual starting capital.

4. Three Investeers – 100 000 virtual capital. When choosing PRO plan, possibility to undo losing trade, x100 leverage, $500k virtual capital.

5. Invstr – Starting cash $ 1 000 000. Fantasy finance shop, where users can buy possibility to undo losing traders and auto top up your cash at month end if your portfolio goes belowe 1MM. No stop-loss/take profit orders and candlestick charts in a free version.

6. Stock market Simulator by Line century – in-app store where you can purchase $100 000 buying power for EUR 23,99.

7. BTC Simulator by All the Apps LLC – $1000 000 virtual starting capita, possibility to spin the fortune wheel and get up to $100k extra and x100 leverage.

8. Paper trading by Lifeto – $100 000 virtual starting capital, no stop-loss.

TOP 3 trading simulators with ethical educational approach

#1 The Trading Game – Best for Novice Traders

The Trading Game is all on one trading simulator and school that aims to educate users on Forex, Stocks, Commodities, Indices and Crypto and provide tools to help novice traders improve their trading skills.

When you first enter the game, you have the option to choose the amount of money you want to start with. This game is all about making sure you learn how not to lose money.

Risk management tools, a learning section looking at different strategies to see which might work best for you, expert advice, performance tracker, and most important – it’s totally free. Trusted by 2,405,000+ students worldwide

#2 Investopedia – For trading insights

With more than 3 million users across the world, Investopedia definetely is a Top G in the financial learning sector.

The site offers a dictionary of financial terms and a variety of educational articles, guides, and videos on topics such as stock market investing, retirement planning, and financial analysis.

Investopedia also provides a simulated trading platform, allowing users to practice their investment strategies in a risk-free environment.

In addition, Investopedia also provides news, analysis, and market data on a wide range of financial instruments and markets.

Even if the website is a bit outdated and needs improvements this is a good place where traders can learn about trading for free.

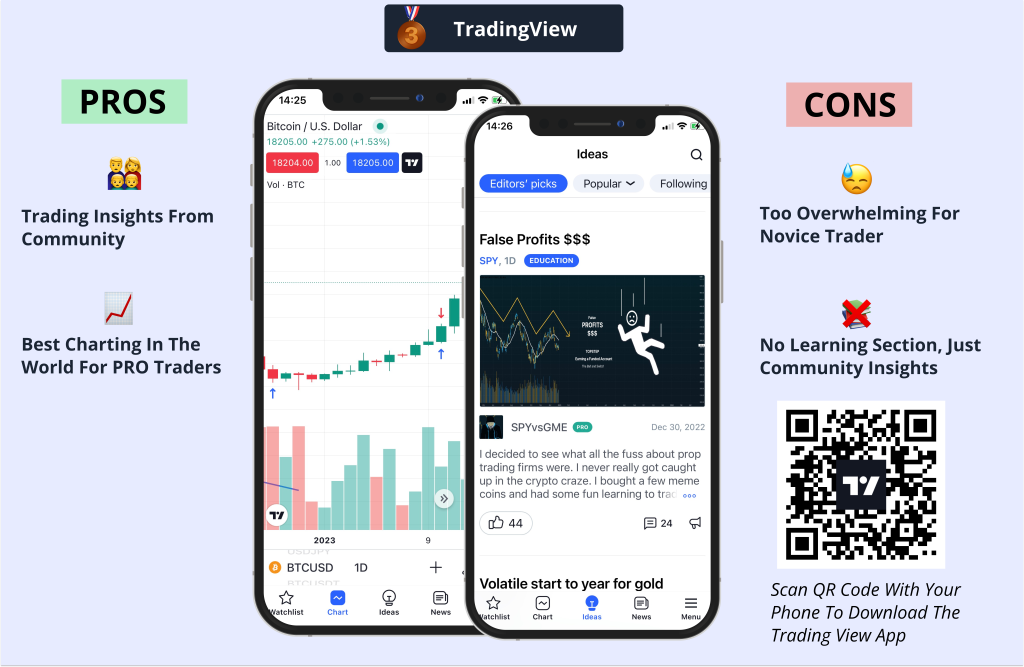

#3 TradingView – Best for PRO traders

TradingView is a financial charting and analysis platform that allows users to view and analyze stocks, forex, cryptocurrency, and other financial markets.

It features a variety of technical indicators, charting tools, and customizable alerts to help traders make informed decisions.

Additionally, TradingView offers a community aspect, where users can share and view ideas, strategies, and market insights with other traders. For beginners, this platform might be too complicated, but if you are a PRO trader, it is definitely worth a try.

Related CTN News:

State-Run Banks Announce Higher Interest Rates For Loans

Japan Firm Installs Whale Meat Vending Machines To Boost Sales

FTX Founder Bankman-Fried Opposes Tighter Bail, Accusing Prosecutors Of ‘bullying’ Him