Business

Credit Card Default Rates Surge: Top 100 Banks At 2.45%, Rest Hit All-Time High OOf 7.51%

(CTN News) – In the constantly evolving realm of the financial sector, the concern over credit card default rates has taken center stage.

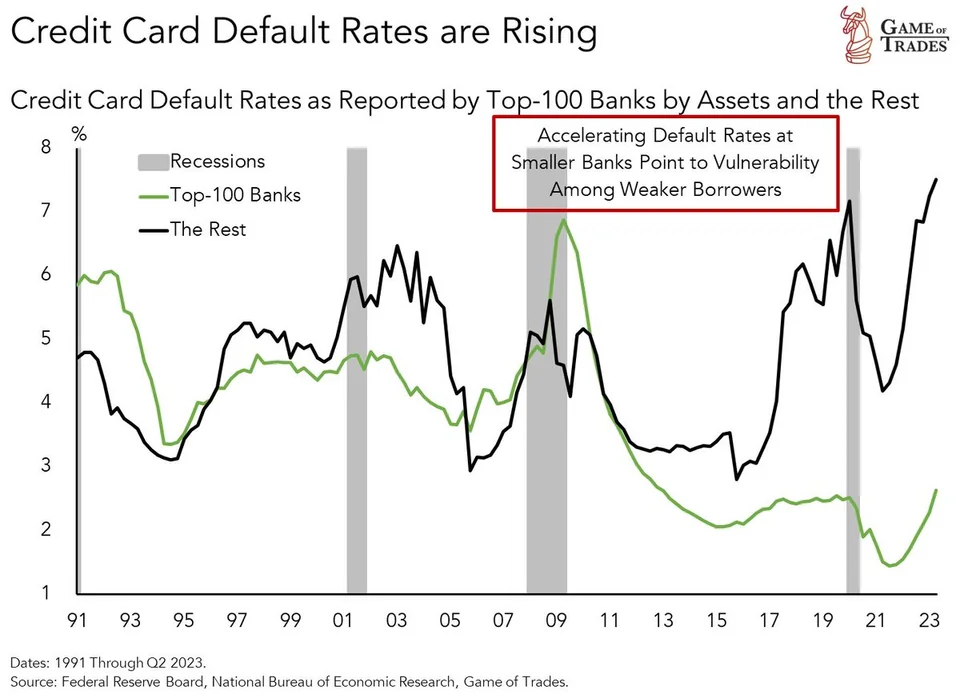

Recent data highlights a striking trend: default rates among the top 100 banks sit at a relatively modest 2.45%, while the rest of the financial institutions grapple with a staggering 7.51%.

This surge in default rates is the highest ever recorded, prompting critical questions about the state of consumer finances and the broader economy.

In this blog post, we will explore the factors contributing to this unprecedented rise and its implications for both banks and consumers.

Credit Card Default Rates

Credit card default rates indicate the percentage of credit card accounts that have become delinquent for 90 days or more, signifying that cardholders have failed to meet their payment obligations as agreed.

These rates serve as a crucial gauge of both consumer financial health and the stability of the banking sector.

The Top 100 Banks vs. Others

The stark contrast in default rates between the top 100 banks and the remaining financial institutions is a cause for concern. The top 100 banks, with their lower default rate of 2.45%, seem to have weathered the storm more effectively.

However, it’s vital to note that even this lower rate carries significance, particularly considering the economic challenges stemming from the COVID-19 pandemic.

In contrast, the rest of the banks grapple with a default rate of 7.51%, more than three times higher than that of the top 100 banks.

This disparity suggests that smaller and regional banks may face unique challenges in maintaining the creditworthiness of their cardholders.

Factors Driving the Surge

Several factors contribute to the alarming rise in credit card default rates:

- Economic Uncertainty: Lingering effects of the pandemic have created an environment of economic uncertainty, with job losses, income instability, and rising inflation leaving many consumers struggling to meet their financial obligations.

- Lending Practices: Some banks may have adopted more lenient lending practices during the pandemic, leading to a higher risk of defaults among their cardholders.

- Credit Card Debt: Consumers carrying high levels of credit card debt are particularly vulnerable to defaults, especially if they encounter unexpected financial challenges.

- Interest Rates: Higher interest rates on credit card balances can make it harder for consumers to repay their debts, thereby leading to more defaults.

Implications for Banks and Consumers

For banks, the surge in credit card defaults carries significant financial implications. Higher default rates can result in increased provisions for bad debt, impacting their profitability.

Banks may also become more cautious about extending credit, making it harder for consumers to access credit cards or secure favorable terms.

Consumers, on the other hand, should exercise caution and prudence in managing their credit card debt. Avoiding high balances, making timely payments, and seeking financial advice when needed can help mitigate the risk of default.

The unprecedented rise in credit card default rates, particularly among smaller banks, is cause for concern. It reflects the challenges consumers face in an uncertain economic climate.

As the financial landscape continues to evolve, both banks and consumers must adapt to ensure the responsible use of credit cards and maintain financial stability.

Monitoring the situation closely and seeking strategies to navigate these challenging times successfully remains crucial for both parties.

The Impact of Your Credit Card Interest Rate When it comes to interest rates, securing the lowest possible rate is always a wise financial decision.

On the surface, the difference between a 15% APR and a 20% APR may appear modest, but if you maintain a revolving balance on your credit card, a lower interest rate can potentially save you thousands of dollars.

Let’s illustrate this with an example.

Comparison of Credit Card Interest Costs

- Credit Card Balance: $7,500

- Monthly Payment: $150

- Interest Rate (APR) 15%

- Months to Pay Off Debt: 78

- Total Interest Paid: $4,145

- Credit Card Balance: $7,500

- Monthly Payment: $150

- Interest Rate (APR) 20%

- Months to Pay Off Debt: 106

- Total Interest Paid: $8,254

Of course, the ideal way to manage credit cards is to pay off your balance in full every month. If you can establish this habit and avoid accumulating credit card debt, the APR on your account won’t affect your budget at all.

In fact, paying off your full statement balance monthly allows you to avoid credit card interest charges entirely.

How to Reduce Your Credit Card Interest Rate

If you’re working on paying down credit card debt, securing a lower interest rate can help you save money and accelerate your debt reduction.

Here are several strategies to consider for lowering your credit card APR:

- Balance Transfer: You may be eligible to open a new credit card offering a low-rate or 0% APR balance transfer promotion. While these introductory interest rates typically last for 12 to 18 months, aggressively tackling your debt during this period can significantly reduce or even eliminate your credit card debt.

- Using a balance transfer calculator can help you account for transfer fees, introductory rates, and more to calculate potential savings. It’s advisable to compare multiple balance transfer credit card offers to find the best fit for your situation. Keep in mind that you generally need good to excellent credit to qualify for these offers.

- Consolidation Loan: Another option is to pay off your existing credit card debt with a debt consolidation loan. Depending on factors such as your credit score, debt-to-income ratio, and more, you might qualify for a personal loan with a lower interest rate than what you’re currently paying on your credit cards.

- A low-rate debt consolidation loan can save you money and expedite the debt repayment process. Additionally, by consolidating your revolving credit card debt into an installment loan, you could reduce your credit card utilization rate, potentially improving your credit score.

- Request a Lower Rate: Remember that your credit card APR isn’t set in stone. You can reach out to your credit card issuer and inquire about the possibility of lowering your interest rate. In some cases, your request may be successful.

- When making your request, inform the issuer if you’ve received credit card offers with lower interest rates that you’re considering. Having a history of on-time payments on your account and a good credit score can also work to your advantage when negotiating a rate reduction.