Cryptocurrency

Bitcoin Velocity Revisits Pre-Breakout Levels: What Does It Signal for BTC Price?

(CTN News) – The cryptocurrency landscape is often characterized by its dynamism, marked by price fluctuations, technological advancements, and shifting market sentiment.

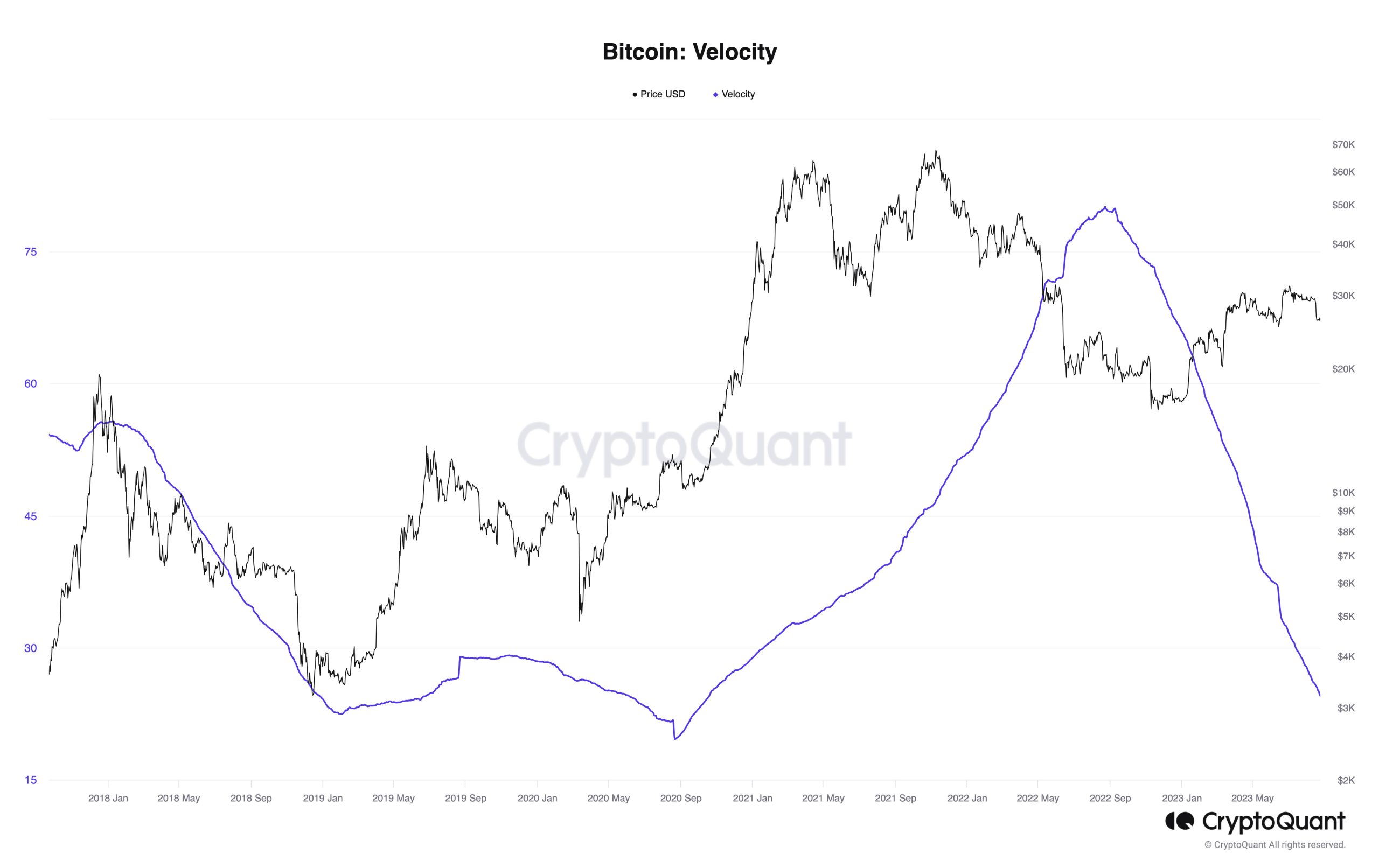

A recent development with Bitcoin Pro has garnered attention within the crypto community: the decline in Bitcoin velocity to levels last witnessed before the Q4 2020 price breakout.

As Bitcoin’s velocity—a measure of the frequency at which BTC changes hands—hits these lows, questions arise about its implications for the cryptocurrency’s price trajectory and the broader market dynamics.

Understanding Bitcoin Velocity

Bitcoin velocity refers to the rate at which Bitcoin is used for transactions over a specific period. It is a critical metric in assessing the utilization and adoption of the cryptocurrency in real-world transactions.

When the velocity is high, it indicates that BTC is changing hands rapidly, suggesting active trading and spending. Conversely, a low velocity suggests that Bitcoin is being held for longer periods and is circulating less frequently.

The relationship between Bitcoin velocity and its price isn’t always straightforward, but changes in velocity can offer insights into market sentiment and potential trends.

Recalling the Q4 2020 Breakout

To contextualize the current scenario, it’s crucial to revisit the events of Q4 2020. During this period, Bitcoin witnessed a substantial price rally, surging to new all-time highs and capturing global attention

. This rally was accompanied by increased market participation, as both retail and institutional investors flocked to the cryptocurrency.

Bitcoin’s velocity played a role in this rally. A notable decline in velocity was observed leading up to the Q4 2020 breakout. This reduction in circulation indicated that Bitcoin was being held, perhaps in anticipation of price appreciation.

As the demand for Bitcoin increased, scarcity became a dominant narrative, contributing to the upward price momentum.

Low Velocity: Current Implications

Fast forward to the present, and Bitcoin’s velocity has revisited the lows last seen before the Q4 2020 breakout. This occurrence has reignited discussions about its potential implications for the cryptocurrency’s price trajectory.

One perspective is that a low velocity could once again signal increasing holding behavior, potentially foreshadowing a period of price appreciation.

This aligns with the concept of “HODLing” within the crypto community, where investors hold onto their assets in anticipation of higher valuations. A reduced velocity could indicate that market participants are accumulating Bitcoin, reflecting a belief in its long-term value.

However, it’s important to exercise caution when interpreting velocity trends as a sole indicator of price movement.

While low velocity preceded the Q4 2020 breakout, other market dynamics, such as macroeconomic factors, regulatory developments, and technological advancements, also played roles in driving that rally.

Market Sentiment and Economic Conditions

Bitcoin’s velocity isn’t solely influenced by investor behavior. It can also be affected by broader economic conditions and market sentiment.

For example, during periods of uncertainty, investors might choose to hold onto their Bitcoin as a hedge against economic instability. Similarly, regulatory announcements and shifts in market sentiment can impact trading frequency and velocity.

In the current economic landscape, where global events and macroeconomic factors are contributing to volatility across various asset classes, Bitcoin’s low velocity might be reflective of a cautious approach.

Investors might be choosing to wait and observe how global events unfold before making significant trading decisions.

Technological and Adoption Factors

Beyond market sentiment, technological factors and adoption trends can also influence Bitcoin’s velocity. The introduction of layer-2 scaling solutions, such as the Lightning Network, can potentially impact how frequently Bitcoin is used for smaller transactions.

These solutions aim to enhance scalability and reduce fees, making microtransactions more viable.

As these technologies mature, they could lead to changes in Bitcoin velocity patterns.

Additionally, the level of merchant adoption and the integration of cryptocurrencies into everyday transactions can impact velocity. If more businesses accept Bitcoin as payment, it could lead to increased usage and higher velocity.

Conclusion

Bitcoin velocity hitting lows last seen before the Q4 2020 breakout is a noteworthy development that has piqued the interest of the crypto community.

While it might spark discussions about potential price trends, it’s crucial to consider a holistic view of the cryptocurrency landscape.

Bitcoin’s price movements are influenced by a multitude of factors, including market sentiment, macroeconomic conditions, regulatory developments, technological advancements, and adoption trends.

Low velocity might suggest increased holding behavior and confidence in Bitcoin’s long-term value, but it’s only one piece of the puzzle. The cryptocurrency market is dynamic and ever-evolving, with numerous variables at play.

As the ecosystem continues to mature, understanding these nuances becomes even more critical for investors, analysts, and enthusiasts seeking to navigate the complex world of digital assets.