Business

Meme Stocks Mania: What Happened With GME Stock and AMC Stock Today?

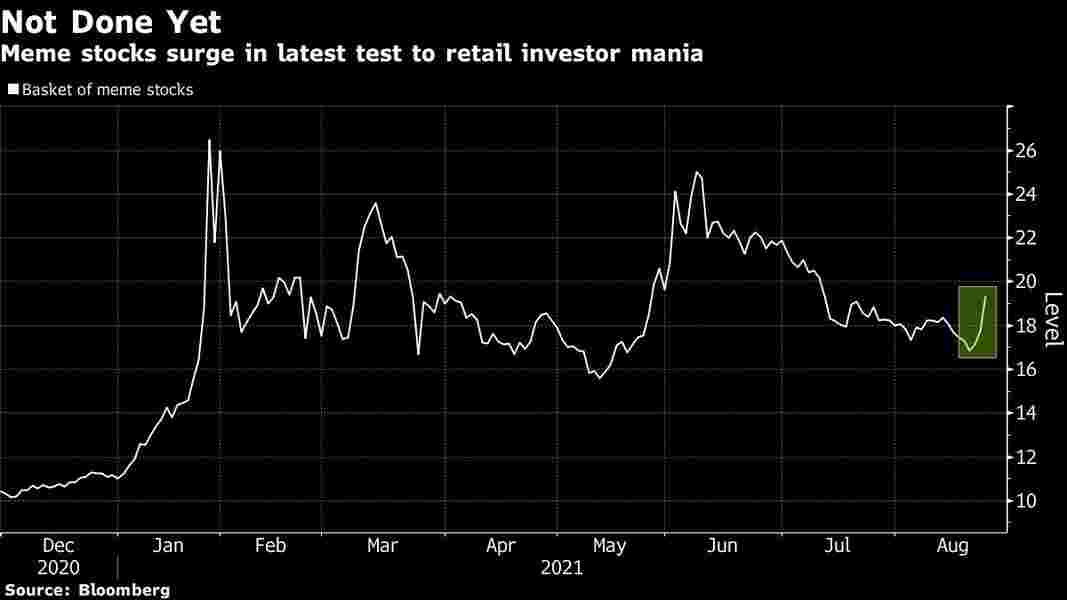

It seems meme stocks have chosen they need to be back at the center of attention today. In an apparently newsless evening for the semi resource class, meme stock goliaths GameStop (NYSE: GME stock) and AMC (NYSE: AMC) both popped vertically for a portion of their greatest evening gains in weeks. All in all, what’s behind this meme stocks madness and its enormous value energy?

The short answer: nothing, truly. No bullish profit, no acquisitions, or large declarations from these brands are catalyzing gains. Maybe, it appears to be that meme stock devotees and short-crush financial backers are behind the development.

Exchanging volume across the meme stock market is a long way past everyday midpoints. GME stock saw more than 14 million offers trade hands against an everyday normal of 5.3 million; in the interim, AMC saw 221 million offers exchange against a normal of 169 million.

Meme Stocks Mania Takes Off Again With GME Stock, AMC Bull Runs

The exchanging volume is setting off another short press between the two stocks; GME stock has 17% of its buoy undercut, while 16% of AMC’s buoy is short. Thus, GME stock took off an incredible 27% in the early evening, and AMC became more than 20%. The crushes were not consigned to simply GameStop and AMC, either — well-known meme plays Clover Health (NASDAQ: CLOV) and Workhorse (NASDAQ: WKHS) became 10% and 6%, separately, albeit both exchanged at below the norm volumes.

What’s intriguing about the crushes is that they all happened at around a similar time. Subsequent to exchanging sideways through the morning, these stocks started to see a quick appreciation starting soon after 1 p.m. EST. This proposes that the endeavors were composed across retail contributing conversation channels. These days, many conversations around meme stocks and short crushes is consigned to stages like Telegram and Discord.

The value force is in any event, taking financial backers over at meme stock Mecca r/WallStreetBets off guard well. One can see that notices of the GME and AMC tickers were stale until the hour that the value force started flooding, after which, makes reference to developed dramatically. This recommends that the message board isn’t who is behind this planned purchasing exertion.

Disregard Bitcoin — Look at These 3 Cryptos Instead

In 2021, Dogecoin went up more than 12,000%. SafeMoon went up over 20,000%. Yet, in the event that you missed those increases, there’s still an ideal opportunity to get in on the crypto blast.

Luke Lango — InvestorPlace’s occupant crypto master — just delivered the names of 3 tokens each financial backer ought to claim.

Also, you can get their names — for FREE — in his most recent report.

GameStop GME stock jumps 35% as buy signal breakout appears on the monthly chart

GameStop is conveying capacity to the players again today with another enormous short crush run. The stock took off almost 35% today.

It’s been extreme sledding for GameStop investors this mid-year, with the stock moping between $140-200/share for a long time. Things livened up a bit today, as the stock bested its greatest cost level since July 1, 2021 today.

GameStop (GME) shares are having their best daily performance of the summer. With the stock up 30% on the day.

GameStop (GME) shares hit an intraday exchanging high of $225/share recently, and keeping in mind that it shows up there might be some benefit taking by dealers going into the nearby, the stock is having its greatest day of the mid-year. Numerous brokers, financial backers, and spectators are attempting to clarify the present offer value move and keeping in mind that there are some basic reasons supporting the move, however, the stock is additionally in an extremely fascinating spot on the diagram.

GameStop (GME) monthly chart shows some more momentum can come into the stock if it breaks out above last month’s high of $216.86/share.

While the offers have pulled back a bit in the last hour of exchanging today, there is a key purchase signal level to focus on the GameStop month-to-month outline. A breakout above last month’s high of $216.83/share triggers an external month-up purchase signal. This energy could proceed into September if the stock breaks out over August’s high point. At the present moment, there are a couple of days left in August, however, dealers will currently have another fence post to look for another sign of proceeded with energy.

https://twitter.com/technosucks/status/1430222609329819657?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1430222609329819657%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.shacknews.com%2Farticle%2F126298%2Fgamestop-gme-stock-jumps-35-as-buy-signal-breakout-appears-on-monthly-chart

The present offer value development up 35% at one point during exchanging isn’t occurring in a vacuum. GameStop was as of late added to the S&P 400 MidCap Index and a lot of establishments have been purchasing and selling the stock in the course of recent weeks. There was likewise some information over the course of the end of the week that prominent GameStop short merchant Melvin Capital is having $500 million pulled out by their amigos Citadel. Fortification is the main market marker for GameStop and has gone under investigation because of their convoluted associations with short dealers and Robinhood.

It’s a decent day in case you are long GameStop shares, yet numerous financial backers actually observe themselves to be submerged subsequent to becoming tied up with the short press publicity in January 2021. The truth will surface eventually if GameStop will get back to its unsurpassed high offer costs, however, the present move isn’t anything to laugh at. Force might be getting back to the meme stocks, and specialized merchants have a sign to focus on the month-to-month diagram interestingly the entire summer.

Source: investorplace

For More Trending News, Visit Here: https://www.chiangraitimes.com/trending-new