Cryptocurrency

Bitcoin Surges Over $31,400, Reaching Highest Level Since 2022: Here’s a buy zone if correction occurs

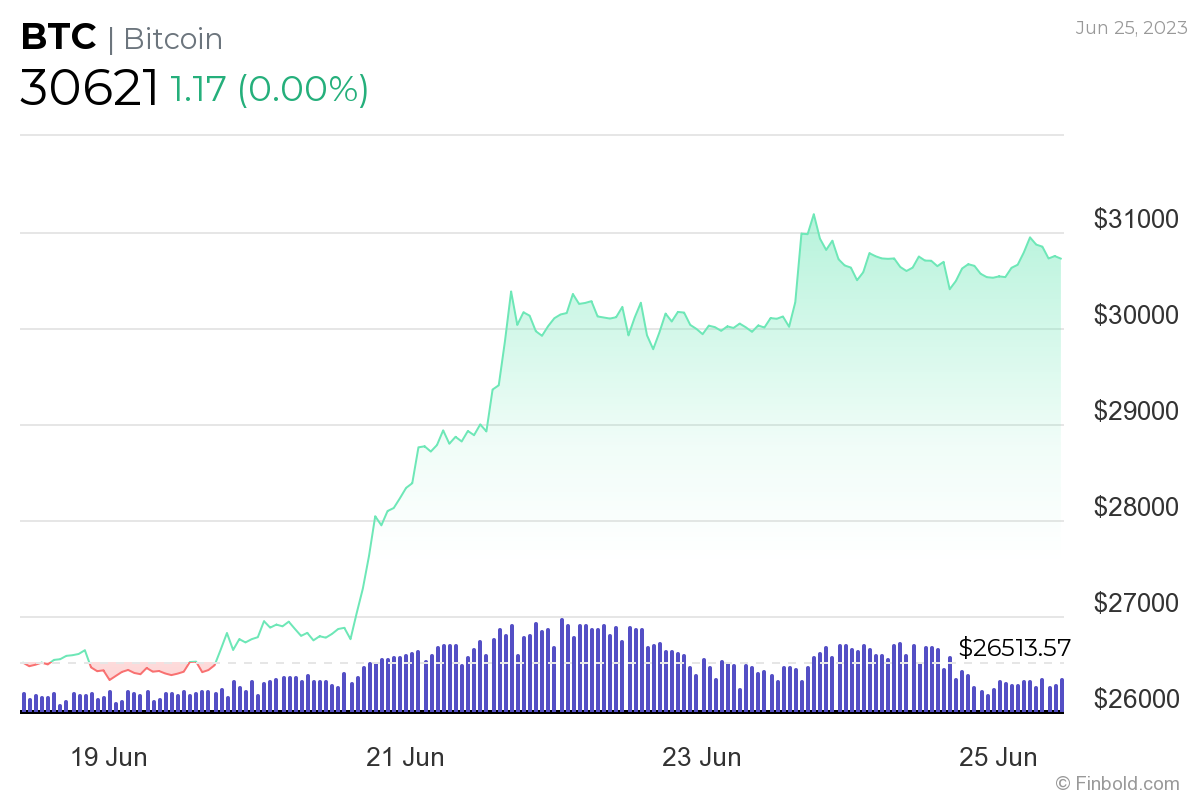

(CTN News) – Bitcoin, the pioneering cryptocurrency, has experienced a significant surge in price, reaching over $31,400 on Friday, its highest level since 2022. This rally has been primarily driven by growing institutional interest in the digital asset.

While uncertainties surrounding regulatory concerns and macroeconomic factors persist, the recent price level of over $30,000 has proven to be a crucial resistance point throughout 2023.

Amidst differing opinions on the sustainability of Bitcoin’s gains, expert analysts suggest that a minor correction to around $28,500 could present an opportunity to accumulate the asset.

Bitcoin’s Rise and Expert Analysis:

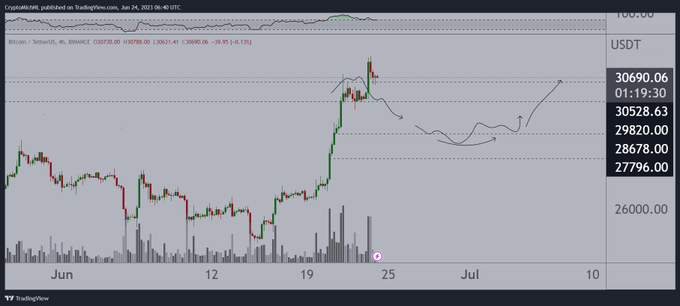

Bitcoin has witnessed an impressive 85% increase in value this year. However, concerns about the longevity of this rally remain. Crypto trading expert Michaël van de Poppe expressed doubts about Bitcoin’s ability to sustain its current surge in a tweet on June 24.

He suggested that if Bitcoin experiences a minor correction to around $28,500, it will present an ideal opportunity to accumulate the asset. During uptrends, he noted that price tends to continue running rather than experiencing deep corrections.

Institutional Interest Boosting Bitcoin’s Value:

The surge in Bitcoin’s value can be largely attributed to the growing interest from major financial institutions. Notably, BlackRock, the world’s largest investment management company, has recently applied to register a Bitcoin spot exchange-traded fund (ETF).

Additionally, the launch of a digital asset trading platform by EDX Markets, backed by renowned firms such as Charles Schwab, Fidelity Digital Assets, and Citadel, has further instilled investor confidence in the crypto space.

These developments come when regulatory scrutiny from the Securities Exchange Commission (SEC) has intensified against crypto exchanges like Binance and Coinbase for allegedly listing unregistered securities.

Bitcoin’s Price Analysis:

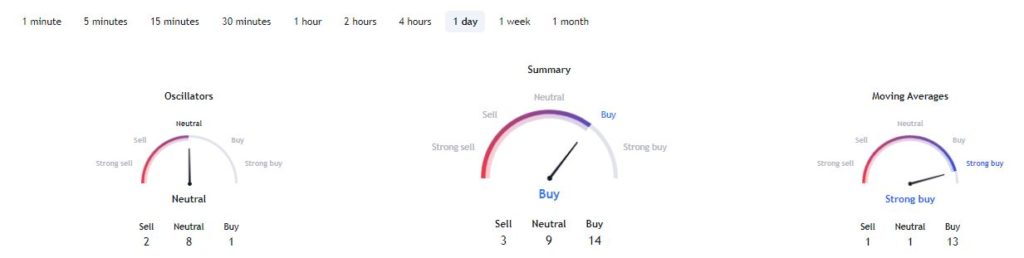

Bitcoin is currently trading comfortably above the resistance level of $30,000, with a valuation of $30,621. On the weekly chart, the cryptocurrency has grown over 15%. The one-day technical analysis of Bitcoin indicates a bullish trend, with a “buy” sentiment at 14 and moving averages suggesting a “strong buy” at 13.

Oscillators remain neutral, with a sentiment score of 8. However, it’s worth noting that despite its significant growth this year, Bitcoin still trails behind its previous record high of over $60,000 achieved in 2021.

Conclusion:

Bitcoin’s recent surge in price, surpassing $31,400, can be attributed to the increasing institutional interest in the cryptocurrency. While concerns about the sustainability of these gains persist due to regulatory and macroeconomic uncertainties, expert analysts suggest that a minor correction could present an opportunity to accumulate the asset.

Launching a digital asset trading platform and BlackRock’s application for a Bitcoin ETF registration have bolstered investor confidence. Bitcoin’s current price analysis indicates a bullish trend, although it has yet to surpass its previous record high.