Tech

The Apple Savings Account Offers 4.15% Interest

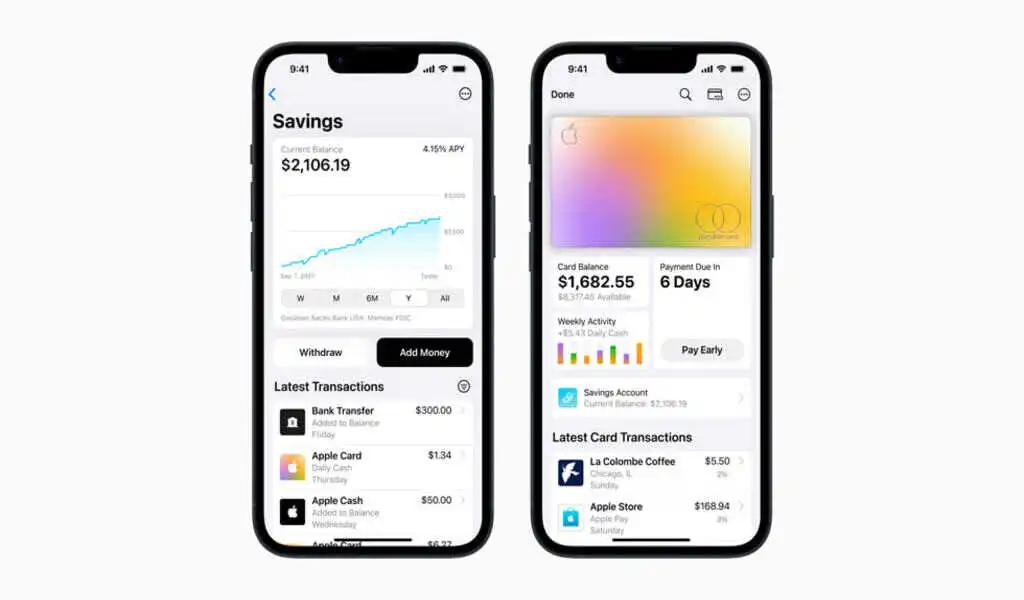

(CTN News) – The Apple Card savings account launched on Monday with an annual percentage yield of 4.15%, one of the highest rates in the industry.

As Apple mentioned, it does not require a minimum deposit or balance to set up an account, and users can do that from the Wallet app in the iPhone.

In a press release published by the company, it was stated that all Daily Cash rewards earned through the Apple Card would automatically be deposited into the savings account.

There is an Apple Card reward program known as Daily Cash that offers up to 3% back on purchases made using the Apple Card.

It is possible for users to change the location in which their Daily Cash is deposited at any time, as well as add funds from their bank accounts to build on their earnings at any time.

Goldman Sachs is the bank that Apple will be working with to launch the savings account.

4.15% is a higher annual percentage yield than the national average for savings accounts, which is only 0.35%, according to the Federal Deposit Insurance Corporation.

Furthermore, it is important to keep in mind that competing savings accounts offered by large credit unions, online banks, and brick-and-mortar banks may also offer customers a significant annual percentage yield.

When customers deposit at least $5,000 into CIT Bank’s savings account, they will receive an APY of 4.75% if they maintain a minimum balance of $5,000.

Marcus by Goldman Sachs offers a 3.9% annual percentage yield (APY) without a minimum balance requirement or monthly fees.

In Capital One’s savings account, there is no minimum balance requirement, and users can earn an annual percentage yield of 3.5%. In addition, Vio Bank offers an account that has a 4.77% annual percentage yield with no minimum balance required.

There is a dashboard that will appear in the Wallet app, where Apple Card users will be able to manage their savings accounts via a dashboard where they will be able to track the interest earned on their savings accounts, as well as withdraw money from their accounts.

SEE ALSO:

Microsoft Office Lifetime Access For $45