Learning

Unlocking the Power of Invoice Factoring: A Game-Changer for Small Businesses

For small businesses, navigating the financial landscape can be a challenging task. In order to thrive and grow, these enterprises require access to capital, especially during times of expansion or economic uncertainty. Fortunately, there are various financing options available, from traditional loans to lines of credit. One such powerful but often overlooked option is invoice factoring. We will explore the concept of invoice factoring, its benefits, and how it can be a game-changer for small businesses seeking financial support.

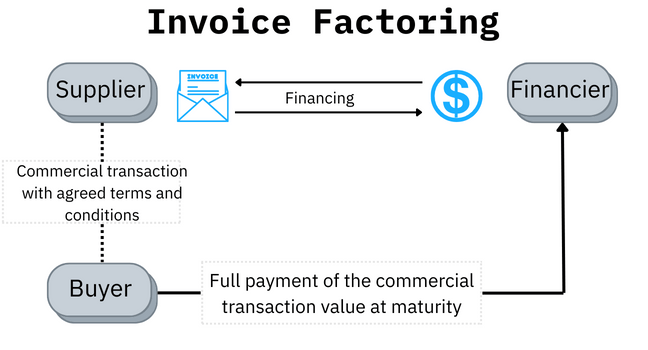

Understanding Invoice Factoring

Invoice factoring is a financial practice where a company sells its outstanding invoices to a third-party company, known as a factor, at a discount. The factor then assumes responsibility for collecting the payment from the clients on those invoices. This approach allows businesses to access immediate cash flow rather than waiting for the lengthy payment cycles some contracts can have.

If a small business is fulfilling a government contract, government invoice factoring is available. This option only works for companies that have secured contracts with governmental agencies or departments. These contracts are usually only factored by finance institutions experienced in financing them. These types of contracts often offer more extended payment terms, which can cause cash flow constraints for small businesses. By factoring in their invoices, these companies can overcome such challenges and maintain financial stability while pursuing growth opportunities.

The Game-Changing Benefits of Invoice Factoring

Discover the following benefits that can transform your small business’s financial landscape.

- Improved Cash Flow: One of the most significant advantages of invoice factoring is the immediate infusion of cash into the business. Small companies no longer have to wait or bother their slow-paying clients to pay their bills, allowing them to promptly meet day-to-day expenses and invest in growth initiatives.

- Mitigating Credit Risks: Invoice factoring also helps reduce credit risks. The factor assumes responsibility for credit checks and collections, protecting businesses against non-payment or delayed payment by clients. This allows small businesses to focus on their core operations without worrying about the financial stability of their clients.

- Flexible Financing: Unlike traditional loans, invoice factoring doesn’t add debt to a company’s balance sheet. It is a form of accounts receivable financing that provides a more flexible approach to managing cash flow, ensuring businesses can meet their financial obligations without the burden of additional liabilities.

- Access to Growth Opportunities: With a reliable source of working capital, small businesses can confidently pursue growth opportunities such as expanding their product lines, entering new markets, or investing in marketing initiatives to attract more clients.

Other Financing Options for Small Businesses

While factoring can be an excellent option for certain businesses, it’s essential to explore various financing avenues to identify the best fit for individual needs. These are some other basic financing options for small businesses.

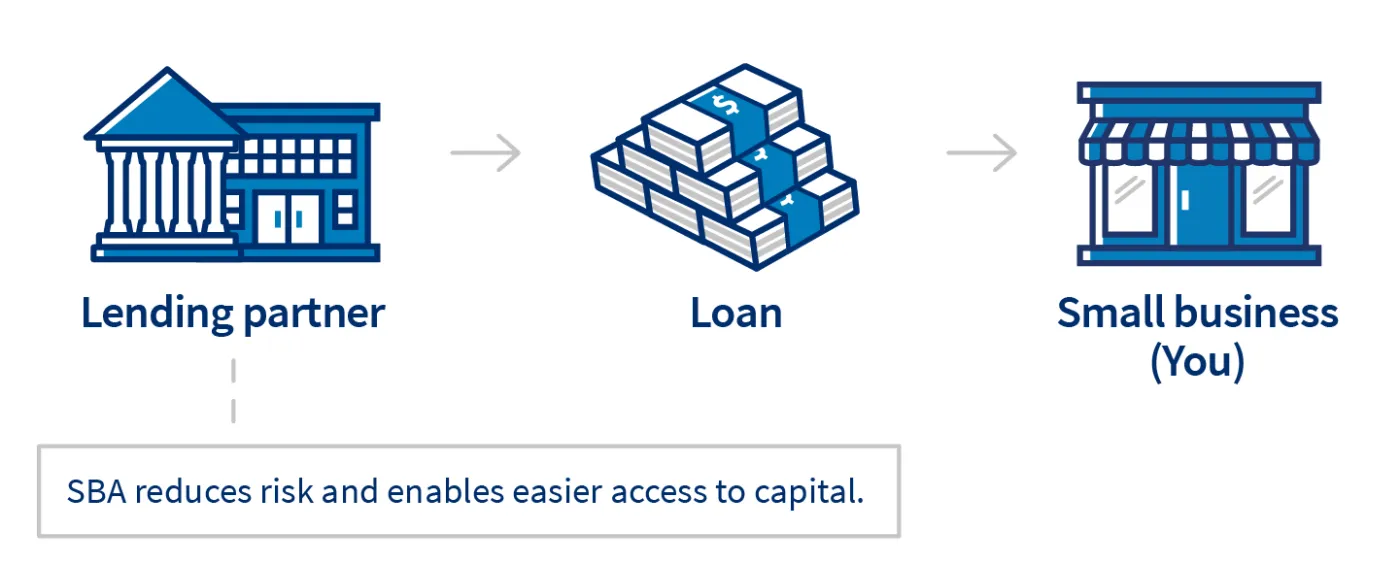

- SBA Loans: Small Business Administration (SBA) loans are government-backed loans designed to support small businesses. They offer attractive interest rates and terms, making them an appealing choice for entrepreneurs with solid business plans.

- Traditional Loans: Traditional bank loans are a standard financing option for businesses with a strong credit history and collateral. However, the application process can be lengthy, and approval may not be guaranteed, especially for newer or smaller enterprises.

- Non-Traditional Loans: Non-traditional loans are types of loans that traditional financial institutions like banks and credit unions don’t offer. These loans can come from alternative lenders or private individuals and may have different terms and conditions than standard loans. Some examples of non-traditional loans include government contract financing, peer-to-peer loans, payday loans, and title loans.

- Asset-Based Financing: Asset-based financing involves securing a loan against the business’s assets, such as inventory, accounts receivable, or equipment. This type of financing can be more accessible for businesses with valuable assets but limited credit history.

- Lines of Credit: Business lines of credit function like credit cards, offering businesses access to a predetermined amount of funds they can use and repay as needed. This option provides flexibility but may come with higher interest rates.

- Crowdfunding and Venture Capital: For startups or businesses with innovative ideas, crowdfunding platforms and venture capital investors offer an opportunity to raise capital by pitching their projects to a broader audience or experienced investors.

Conclusion

When it comes to financing options for small businesses, invoice factoring stands out as a potent and often underutilized tool. By converting outstanding invoices into immediate cash flow, businesses can confidently overcome cash flow constraints, mitigate credit risks, and pursue growth opportunities. However, entrepreneurs must explore various financing avenues, considering their unique needs and circumstances, to make informed decisions about their financial future. With the proper financial support, small businesses can unlock their true potential and contribute significantly to the economy.