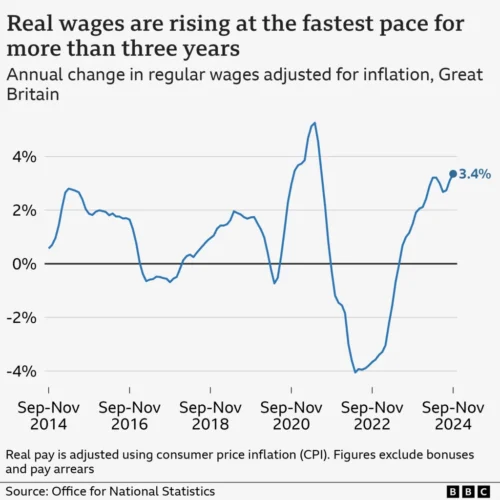

Strong wage growth in the private sector has propelled the fastest increase in UK pay after inflation in over three years.

The Office for National Statistics (ONS) reports that pay packets increased by an average of 3.4% between September and November compared to the same period a year ago, after accounting for the impact of price increases.

The expansion of earnings in the private sector was more robust than that of public sector employment.

Although increased earnings may cause inflation to increase, the Bank of England is expected to reduce interest rates next month.

The current rate is 4.75%, but traders have anticipated a decrease to 4.5% in February. This is because inflation, which gauges the rate at which prices increase over time, unexpectedly decreased last month.

The Bank of England closely monitors the pay and employment data when determining interest rates. The most recent ONS figures indicate that the average weekly earnings in the UK reached £660 in November when inflation was 2.6%. The most recent figure is 2.5%.

The disparity between pay and inflation is tangible, as it has not maintained this level of separation for approximately three and a half years. Sarah Coles, the director of personal finance at Hargreaves Lansdown, stated, “It is resulting in a surplus at the end of the month.”

Ms Coles cautioned that the potential for higher inflation and delayed interest rate cuts was present due to the potential for rising wages. However, she also stated, “on balance, the lack of economic growth and a month of falling inflation are likely to mean a rate cut in February is still on the cards.”

Ashley Webb, an economist at Capital Economics in the United Kingdom, stated that the resurgence in private sector pay growth “may be concerning” to a few of the Bank’s policymakers. However, he predicted that most would focus on indicators of a “loosening” labour market and reduce rates.

The unemployment rate in the United Kingdom was estimated to have increased to 4.4%, while vacancies decreased by 2.9% to 812,000 from October to December. Despite this decline, the number of vacancies still exceeds pre-Covid pandemic levels.

The ONS recommended that its employment market figures be interpreted with “caution” due to concerns regarding the data’s relatability, exacerbated by the low response rates to its survey.

Petra Tagg, Manpower UK’s recruitment director, mentioned on the BBC’s Today program that companies have been “providing competitive salaries” to attract skilled employees for engineering, IT, and artificial intelligence roles.

However, she indicated that employees were “less likely to be moving [companies] as people are more nervous to look for employment in these… quite concerning times”.

Economists at Pantheon Macroeconomics, whose employment decreased in December, stated that “firms halted hiring” due to the tax hikes announced in the Budget for businesses.

Rachel Reeves, the Chancellor of the Exchequer, has been under pressure due to the UK economy’s stagnation. She has determined that firms should bear the burden of a £40bn increase in taxes, which includes a reduction in the threshold for employers and an increase in the National Insurance rate.

Businesses have consistently cautioned that the additional expenses may impact the economy’s capacity to expand, reduce business rates, and increase minimum wages. Employers anticipate having less cash to provide wage increases and create new employment.

However, Rob Wood, the chief UK economist at Pantheon, stated, “There is little indication of a significant labour market downturn from jobless claims and redundancies.” The labour market is progressively loosening.

Ms Coles stated that the “good news on wages” could be fleeting as the year progressed, as there was a “risk” that businesses experiencing increased costs would reduce their staff and wage increases.

The United Kingdom has recently experienced a paucity of workers in various sectors. This can impede economic growth but also result in higher compensation for workers in those industries as employers attempt to recruit them or current managers attempt to retain them.

However, inflation may ensue when consumers increase their spending due to increased disposable income, which increases the demand for products and increases retail prices.

When factoring in inflation, the actual wage growth was 3.4%. This occurred despite a notable annual rise in regular pay, which averaged 5.6% from September to November compared to last year’s timeframe.

Liz Kendall, the Secretary of State for Work and Pensions, stated that the employment and wage statistics provided “further evidence” that the United Kingdom needed to increase its workforce.

She further stated that the government was “attempting to increase living standards and stimulate economic growth” by reforming Jobcentres and “ensuring that every young person has the opportunity to either learn or earn.”

SEE ALSO: Bank of England Considers Easing Financial Regulations to Boost Growth