(CTN News) – In October, tens of millions of borrowers will be required to pay their monthly federal student loan bills for the first time since March 2020, as the Department of Education confirmed.

The pandemic-related pause on payments and interest accumulation will end later this summer, with payments due in October.

Biden Administration’s Student Loan Forgiveness Program Awaits Supreme Court Ruling

The Biden administration had previously indicated that the pause would end either 60 days after June 30 or 60 days after a Supreme Court ruling on a separate student loan forgiveness program, whichever comes first.

The Department of Education has clarified that student loan interest will resume on September 1, 2023, and borrowers will receive notification well before payment restarts.

However, given the varying due dates for bill statements from loan servicers, borrowers are advised to contact their servicer promptly, particularly if they intend to enroll in an income-driven repayment plan.

These plans, which determine payments based on income and family size, can help lower monthly payments but require specific paperwork submission.

Economic Recovery Amidst Job Gains and Lingering Soft Spots

While the economy has largely recovered from pandemic-related disruptions, some areas still face challenges.

Layoffs have been announced at prominent companies, inflation remains a concern despite recent cooling, and the collapse of Silicon Valley Bank triggered a regional banking crisis.

Against this backdrop, borrowers eagerly await a Supreme Court decision on the Biden administration’s student loan forgiveness program, expected in late June or early July.

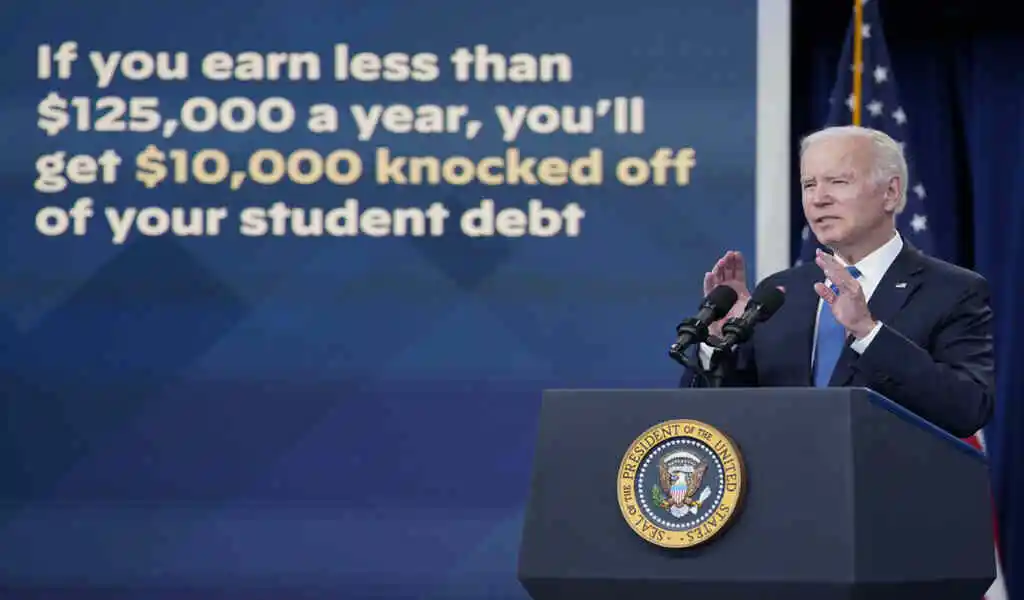

The proposed program aims to forgive federal student loan debt for individuals who earned less than $125,000 in 2020 or 2021, and for married couples or heads of households who earned less than $250,000 annually.

Additionally, borrowers who received a federal Pell grant while in college may be eligible for up to $20,000 of debt forgiveness.

However, lawsuits challenging the program suggest that the administration may be overstepping its authority and using the pandemic as a pretext for debt cancellation.

Lawsuits and the Future of Student Loan Forgiveness

No debt has been canceled thus far, but if the Supreme Court upholds the program, the government could swiftly forgive the debts of approximately 16 million borrowers who have already been approved for relief.

Alternatively, if the court strikes down the program, the administration may consider modifications and pursue alternative avenues, although this process could take several months.