A massive recession is looming for 19 Eurozone economies as increased prices reduce consumers’ purchasing power. As a result, inflation in the European Union countries that use the euro currency has reached double digits.

Following an annual 9.1% increase in August, consumer prices in the 19 Eurozone countries increased by a record 10% in September, according to data released on Friday by the E.U. statistics office Eurostat. Inflation was as low as 3.4% just a year ago.

Price hikes exceeded expectations and are already at their greatest level since the euro’s records-keeping process began in 1997. The primary offender, jumping 40.8% more than a year ago, was energy prices. Prices for food, alcohol, and tobacco increased by 11.8%.

Myriam Maierhofer, a 64-year-old trainer and coach for staff development, stated while shopping at the weekly outdoor market in Cologne, Germany, “I’m already looking a lot more for great discounts.” “Since I don’t toss things away as quickly, I’ve learned to be more frugal with my food purchases.

Additionally, I reduced the heat in the rooms once more this morning.

As the world economy recovers from the COVID-19 epidemic, the supply of natural gas from Russia has been steadily reduced, and there have been delays in the delivery of raw materials and parts.

Energy prices have soared because of the Russian cuts, and energy-intensive industries like fertilizer and steel claim they can no longer produce some goods profitably.

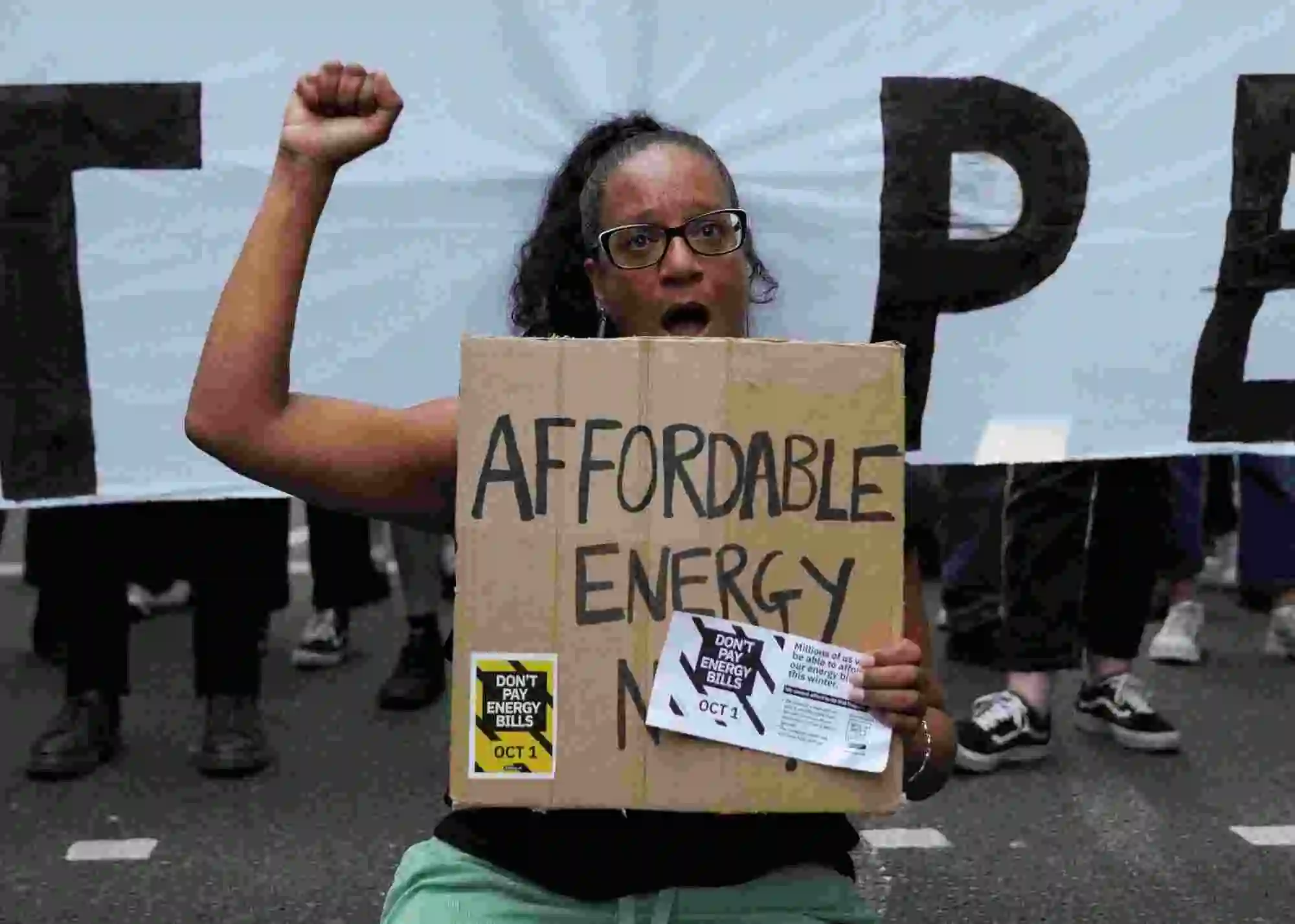

Consumers also have less money to spend because of the high cost of petrol, food, and utility bills. This is the primary cause of analysts’ predictions of a recession, or a severe and protracted decline in economic activity, for this year’s end and the first few months of the following.

Interest Rate hikes in Eurozone Countries

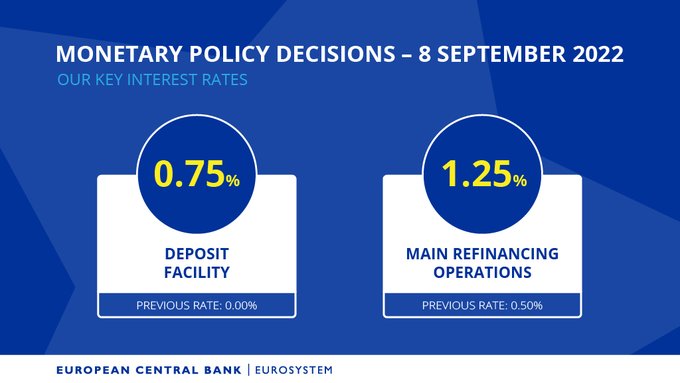

The European Central Bank is increasing prime rates to fight inflation by preventing higher costs from being factored into people’s wages and price expectations, but it is unable to do so on its own to cut energy prices.

According to Jessica Hinds, senior Europe economist at Capital Economics, Friday’s inflation data was expected to cause the ECB “great anxiety.” She predicted that at its upcoming meeting on October 27, the central bank’s rate-setting council would likely increase its benchmark rates by excessive three-quarters of a percentage point.

Higher interest rates make borrowing, investing, and spending more expensive for individuals and businesses, which reduces demand for goods and controls inflation. The ECB’s preferred inflation target of 2% for the economy has been significantly exceeded.

With the U.S. Federal Reserve as its leader, central banks all over the world are swiftly hiking interest rates in an effort to lower inflation, which reached 8.3% in August. The 9.9% inflation rate recorded in the U.K. last month has been surpassed by the Eurozone.

Officials in Europe see the reductions in Russian natural gas as energy blackmail intended to pressure and splinter European countries over Western sanctions and their support for Ukraine. Russia assigns blame to technical issues.

Because natural gas is used to generate energy, heat houses, and power factories, the increased gas prices that have resulted from entail higher heating bills and higher electricity expenditures.

Taxing Oil Company Profits in Eurozone

On Friday, the energy ministers of the European Union voted a windfall tax on fossil fuel company profits as well as other steps to ease the energy crisis. Individual nations have also allotted hundreds of billions to help people and businesses.

The government announced plans to invest up to 200 billion euros ($195 billion) to help with soaring gas costs in Germany, the largest economy in Europe, where consumer prices increased by 10.9% for the first time in decades.

The government is reactivating a stabilizing economic fund that was previously utilized during the global financial crisis and the coronavirus outbreak, according to Chancellor Olaf Scholz on Thursday.

While shopping at the Cologne market, 35-year-old Christian Schrader noted that while food prices weren’t as concerning, “you start to think about which rooms need to be heated in the apartment and attempt to explain to the children that we just play in one room.”

He claimed that “the social dimension” was a major concern. “Populism, extremist impulses, and social division have frequently been fueled by inflation. I’m more anxious about this dimension.

Source: The Associated Press

Keywords: eurozone members, inflation in the eurozone, monetary policy in the eurozone, eurozone monetary policy