The Japanese economy has faced some serious challenges in recent years: stagnation, heavy reliance on exports, an aging population, persistent budget deficit, etc. Reflecting these hurdles, the USD/JPY pair has lingered at low levels for an extended period, with only feeble attempts at growth. Propelling the Japanese yen to rise again proves to be a difficult task, given the multifaceted influences on its exchange rate, including the country’s economic landscape, political stability, and inflationary dynamics.

Key factors contributing to the stagnation of the Japanese economy involve demographic shifts, diminished global demand, and subpar productivity. Japan grapples with an aging populace, resulting in a shrinking labor force and escalating social expenditures.

Forecasts indicate that by 2060, individuals aged 65 and above will comprise over 40% of the total population. Amidst global economic sluggishness and trade tensions, the demand for Japanese products and services on the world stage is waning, adversely affecting exports and constraining avenues for economic expansion.

The persistently low labor productivity in Japan compared to other developed nations further diminishes the competitiveness of its products in the global markets.

Consequently, while Japan’s unemployment rate, currently at 2.5%, may not be among the highest in the developed world, it adversely impacts the standard of living for the population. The resultant low economic growth and stagnation contribute to a decline in living standards and an upswing in social inequality.

Despite these significant challenges, the Japanese economy harbors potential for recovery and growth. Realizing this potential demands comprehensive reforms aimed at enhancing productivity and competitiveness. A potential avenue for reform lies in the labor market. Introducing flexibility and expanding part-time work opportunities could encourage the population to have a more balanced attitude towards their job.

Furthermore, technological advancements and innovation are key to bolstering productivity and competitiveness in Japan. This necessitates substantial investments in research and development, coupled with initiatives to spur the adoption of new technologies.

Leveraging its position in the global market, Japan could fortify its currency. Promoting the export of goods and services might augment yen demand from other nations, thereby bolstering its value. This necessitates the Japanese government’s commitment to free trade and a reduction of trade barriers.

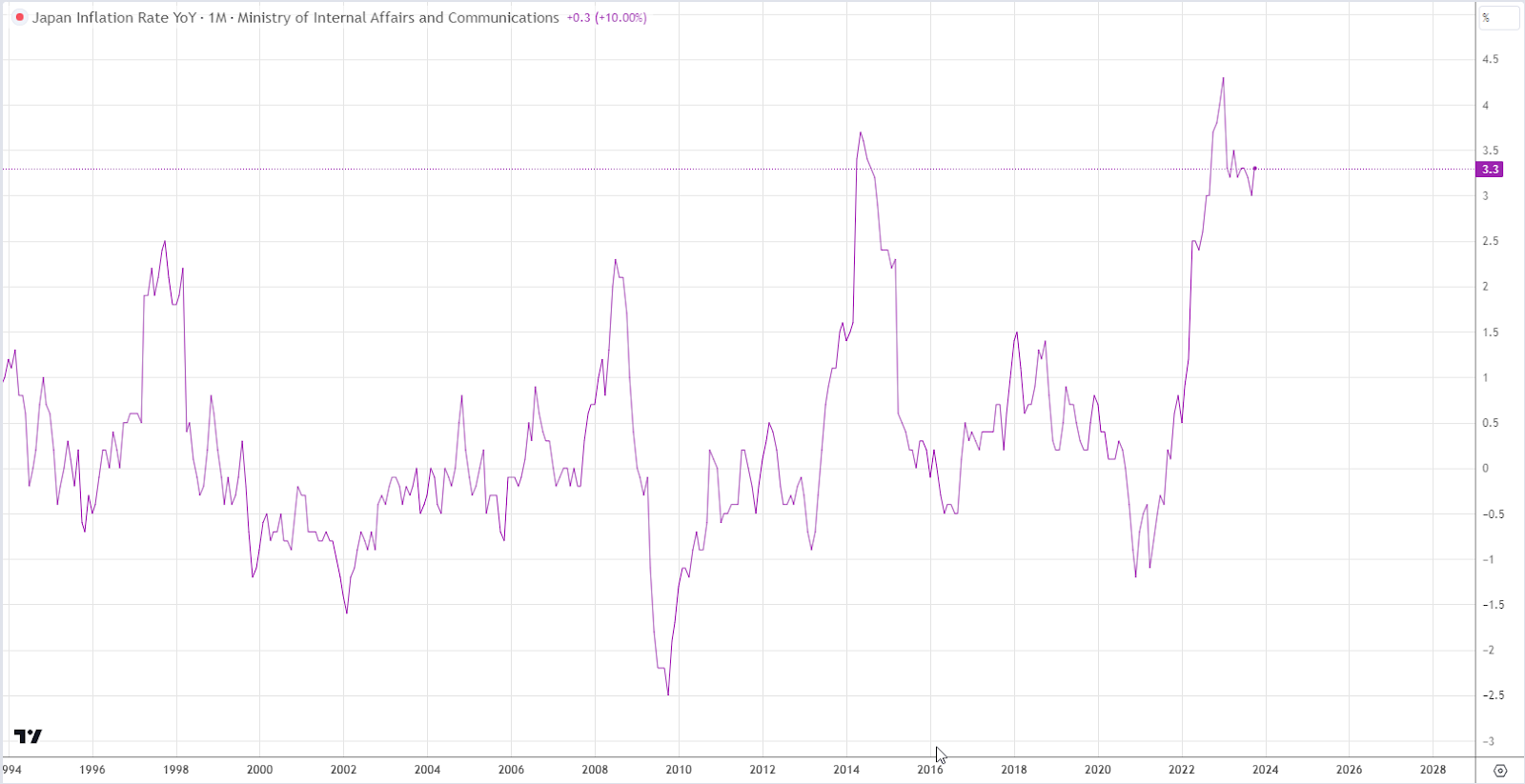

It is crucial to maintain control over inflation, as high inflation could erode the yen’s value. The Japanese government can use its monetary policy to steer inflation, for example, by adjusting interest rates or engaging in currency interventions.

Finally, attracting foreign investment is paramount to supporting the yen’s growth. Ensuring a stable political and economic environment, as well as enhancing the country’s appeal are vital prerequisites here.

Overall, the resurgence of the Japanese yen requires a comprehensive approach that includes stimulating economic growth, managing inflation, enhancing the international image, and maintaining political stability.

SEE ALSO: BuzzFeed President Marcela Martin To Resign For New Opportunities

⚠ Article Disclaimer

The above article is sponsored content any opinions expressed in this article are those of the author and not necessarily reflect the views of CTN News