(CTN News) – After more than three years of relief, federal student loan borrowers are preparing to resume their monthly payments starting in October.

The pandemic-induced pause, initially initiated in March 2020, provided financial respite to approximately 44 million borrowers by suspending their loan accounts.

Despite extensions granted by both the Trump and Biden administrations, Congress has now barred any further extensions, leading to the impending expiration of the pause this fall.

This article aims to guide borrowers through the transition back to payment obligations and address key questions regarding interest, due dates, repayment plans, and potential loan forgiveness programs.

Interest Resumption:

As of September 1, interest will recommence on federal student loans. Throughout the pandemic, interest rates were effectively set to 0%, but they will now revert to their pre-pause levels. The rates, which vary depending on the type of loan, will be reflected in borrowers’ upcoming bills.

Payment Restart Dates:

While most borrowers will experience their first payments in October, specific due dates may differ. At least 21 days prior to the due date, borrowers will receive their bill detailing the payment amount and deadline. Graduates from the spring term typically enjoy a grace period of six to nine months post-graduation before their payments begin.

Unchanged Payment Amounts:

In general, borrowers can anticipate their monthly payments to remain unchanged from their pre-pandemic levels. The freeze essentially preserved the status quo for federal student loans, unless a borrower made optional payments or adjustments to their account, such as loan consolidation. Income-driven repayment plans, which establish payments based on income and family size rather than debt, also remained unaffected by income changes during the pause.

Servicer Changes:

Many borrowers will discover that their loan servicer— the entity responsible for handling payments— has changed since the pause began in March 2020. Borrowers can check the Federal Student Aid website to identify their current servicer. Ensuring that the servicer has accurate contact information is crucial.

Automatic Payments:

Even for borrowers enrolled in automatic payments before the pandemic, reenrollment through the servicer’s website is likely required. Enrolling in auto pay offers a 0.25% interest rate reduction, and the setup process generally takes a month or two.

Choosing Repayment Plans:

While borrowers are automatically enrolled in a standard 10-year repayment plan, various income-driven options are available to reduce monthly payments. These plans consider income and family size rather than debt. Borrowers can apply for an income-driven plan online, using a simulator to compare payment amounts under each plan. Although these plans can alleviate financial strain, they might lead to higher overall payments due to accruing interest and an extended repayment period.

Consequences of Non-Payment:

Starting from September 1, not making payments will result in growing debt due to accruing interest. However, an “on-ramp period” lasting until September 30, 2024, will shield borrowers from certain repercussions of missed payments. During this period, loan servicers won’t report missed payments as defaults to credit rating agencies.

Default Recovery Program:

Borrowers in default before the pandemic pause can utilize the Department of Education’s “Fresh Start” program. This initiative transfers loans to a servicer, restores loans to “in repayment” status, and removes the default from the credit report. The process can be completed through myeddebt.ed.gov or by calling 800-621-3115.

Student Loan Forgiveness Updates:

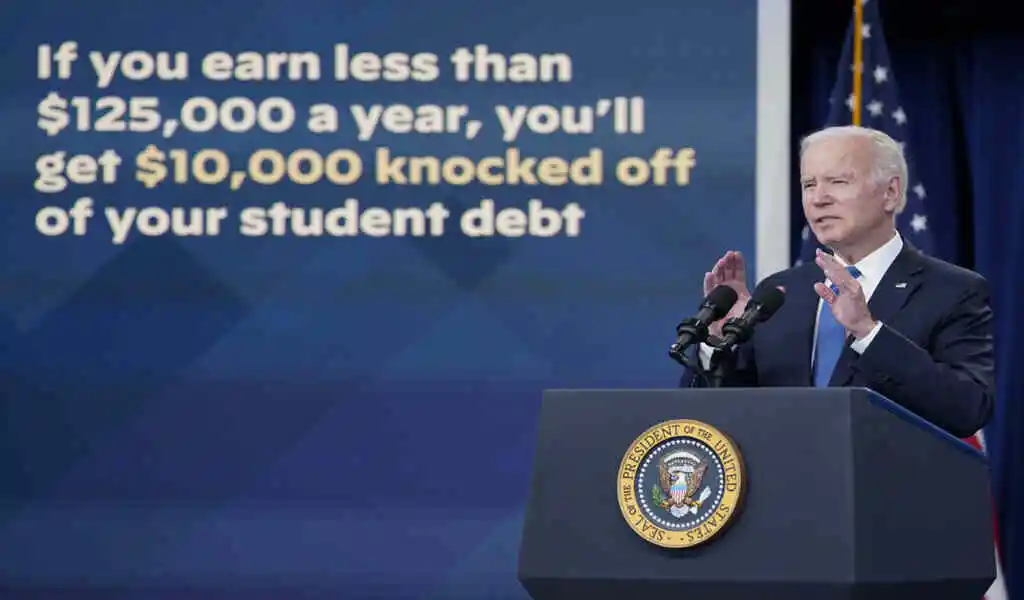

In June, the Supreme Court invalidated President Biden’s student loan forgiveness program, leaving payments to resume without this specific relief. The administration is pursuing alternative routes for debt relief, but these require formal rule-making processes and may face legal challenges.

Existing Loan Forgiveness Programs:

The Biden administration has expanded existing debt cancellation programs, resulting in loan discharges totaling around $116 billion for more than 3.4 million borrowers by August. Changes have simplified eligibility for the Public Service Loan Forgiveness program and allowed easier applications for those deceived by for-profit colleges or experiencing permanent disability.

Conclusion:

With the impending end of the student loan payment pause, borrowers should prepare for the resumption of monthly payments. Familiarizing themselves with the reinstated interest rates, due dates, repayment plans, and forgiveness programs can help borrowers navigate this transition successfully.

Further Student Loan Forgiveness Reading

Biden’s Student Loan Forgiveness Application Has Been Launched – 5 Tips Before You Submit

Biden’s Student Loan Forgiveness Application But First, A Few Things For Applicants

Biden’s Student Loan Forgiveness Could Help More Than 40 Million