(CTN NEWS) – Welcome to our comprehensive guide on trade setup for Tuesday. In this article, we will provide you with the top 15 things you need to know before the opening bell rings.

Whether you are a seasoned trader or a beginner looking to enter the market, these insights will help you make informed decisions and navigate the market with confidence.

Trade Setup for Tuesday: Understanding the Market Dynamics

Before diving into the top 15 things to know before the opening bell, let’s briefly discuss the market dynamics.

The financial market is a complex ecosystem influenced by various factors such as economic indicators, geopolitical events, company earnings, and investor sentiment. Understanding these dynamics is crucial for successful trading.

Top 15 Things to Know Before the Opening Bell

Important Nifty support and resistance levels

The pivot point calculator predicts that the Nifty will likely find support at 18,570, then 18,553 and 18,524. In the event that the index rises, 18,626 will serve as the main obstacle, followed by 18,644 and 18,672.

Nifty Bank

The Bank Nifty dropped 45 points to 43,944 and continued to trade in a narrow range.

On the daily charts, the index has developed a small-bodied bearish candlestick pattern, but it is still holding above the 20 DEMA, which is a key support.

On the upside, support is anticipated at 43,750 and then 43,500 levels, according to Chandan Taparia, Senior Vice President, Analyst-Derivatives at Motilal Oswal Financial Services.

“Now it has crossed and held above 44,044 levels for an up move towards 44,250, then 44,500 levels,” Taparia added.

The pivot point calculator predicts that the Bank Nifty will find support around 43,885, followed by 43,826 and 43,730, and resistance at 44,077, followed by 44,136 and 44,232.

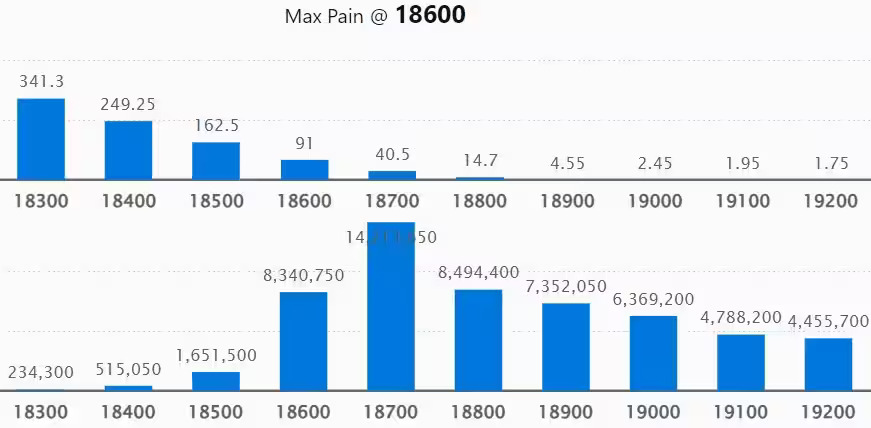

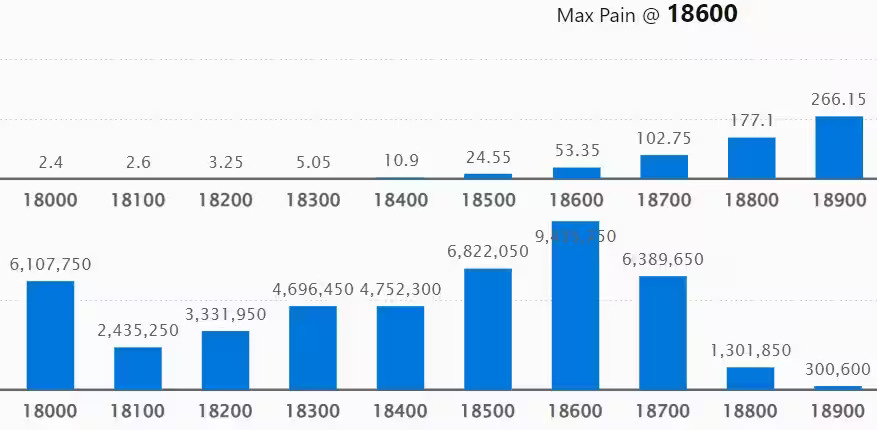

Data On Call Options

The highest call open interest (OI) on the weekly options front was at the 18,700 strike, which is anticipated to be a key resistance level for the Nifty, with 1.42 crore contracts.

84.94 lakh contracts at the 18,800 strike came next, while 83.4 lakh contracts made up the 18,600 strike.

The highest strike for call writing was 18,900, which added 7.85 lakh contracts. The next highest strikes were 18,600 and 18,800, which added 7.63 and 7.4 lakh contracts, respectively.

Maximum Call unwinding occurred at strike 18,700, which resulted in the loss of 13,14 lakh contracts. Strikes 19,600 and 18,500 then had losses of 9.88 lakh and 2.2 lakh contracts, respectively.

Data Put Option

On the put side, the 18,600 strike had the highest open interest, with 94.35 lakh contracts, and is anticipated to serve as a crucial support level for the Nifty50 in the ensuing sessions.

The 18,500 strike, which involved 68.22 lakh contracts, and the 18,700 strike, which involved 63.89 lakh contracts, came after this.

The 18,600 strike had the most put writing, adding 37.6 lakh contracts. The 18,500 and 18,400 strikes saw the next-largest additions of 20,27 and 12,16 lakh contracts, respectively.

The 18,700 strike had the most put unwinding, losing 1.37 lakh contracts. Next were the 18,800 and 17,600 strikes, losing 1.27 lakh and 1.17 lakh contracts, respectively.

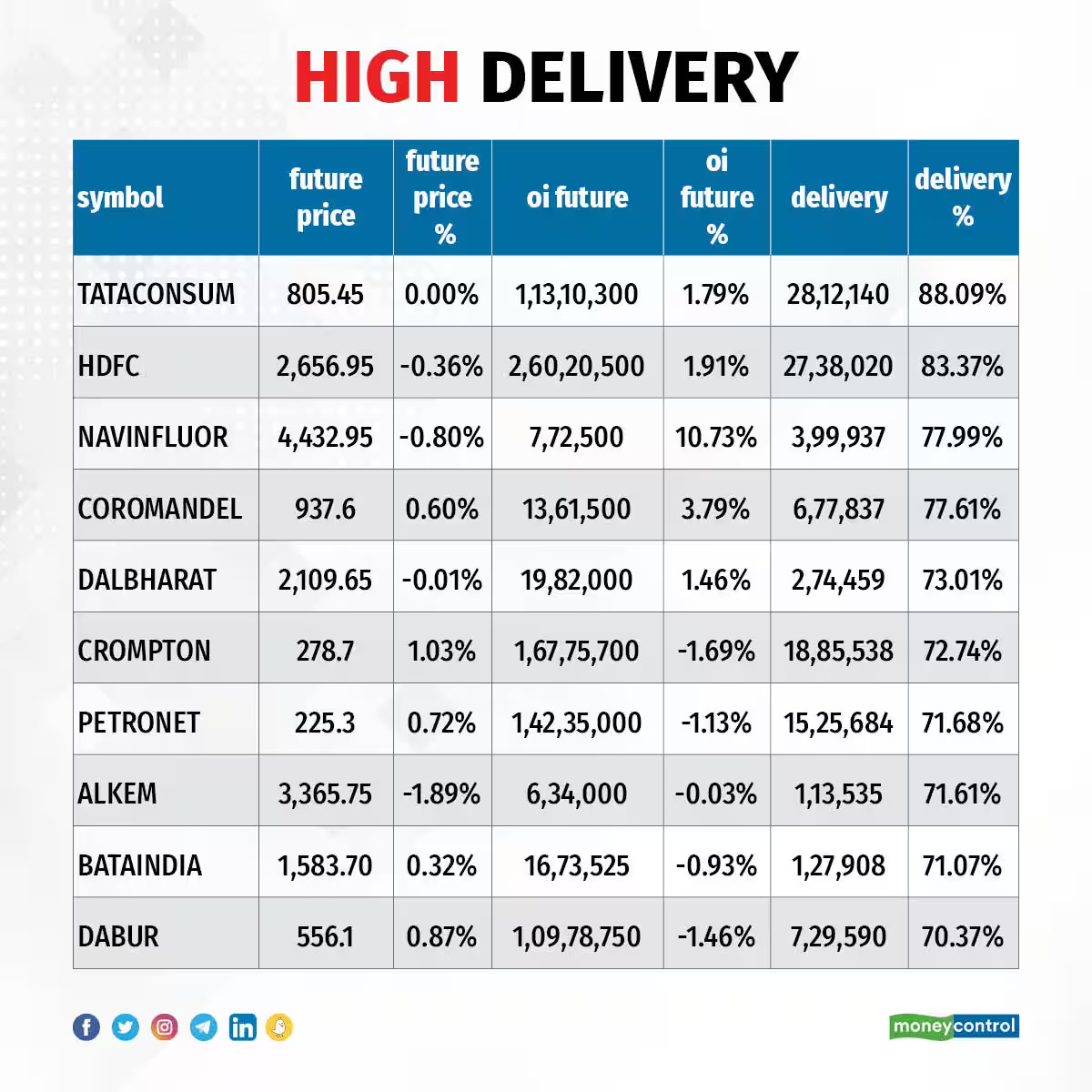

Stocks With a High Percentage Of Deliveries

A high delivery percentage indicates that stock is generating attention from investors.

Tata Consumer Products, HDFC, Navin Fluorine International, Coromandel International, and Dalmia Bharat, among others, had the greatest delivery rate.

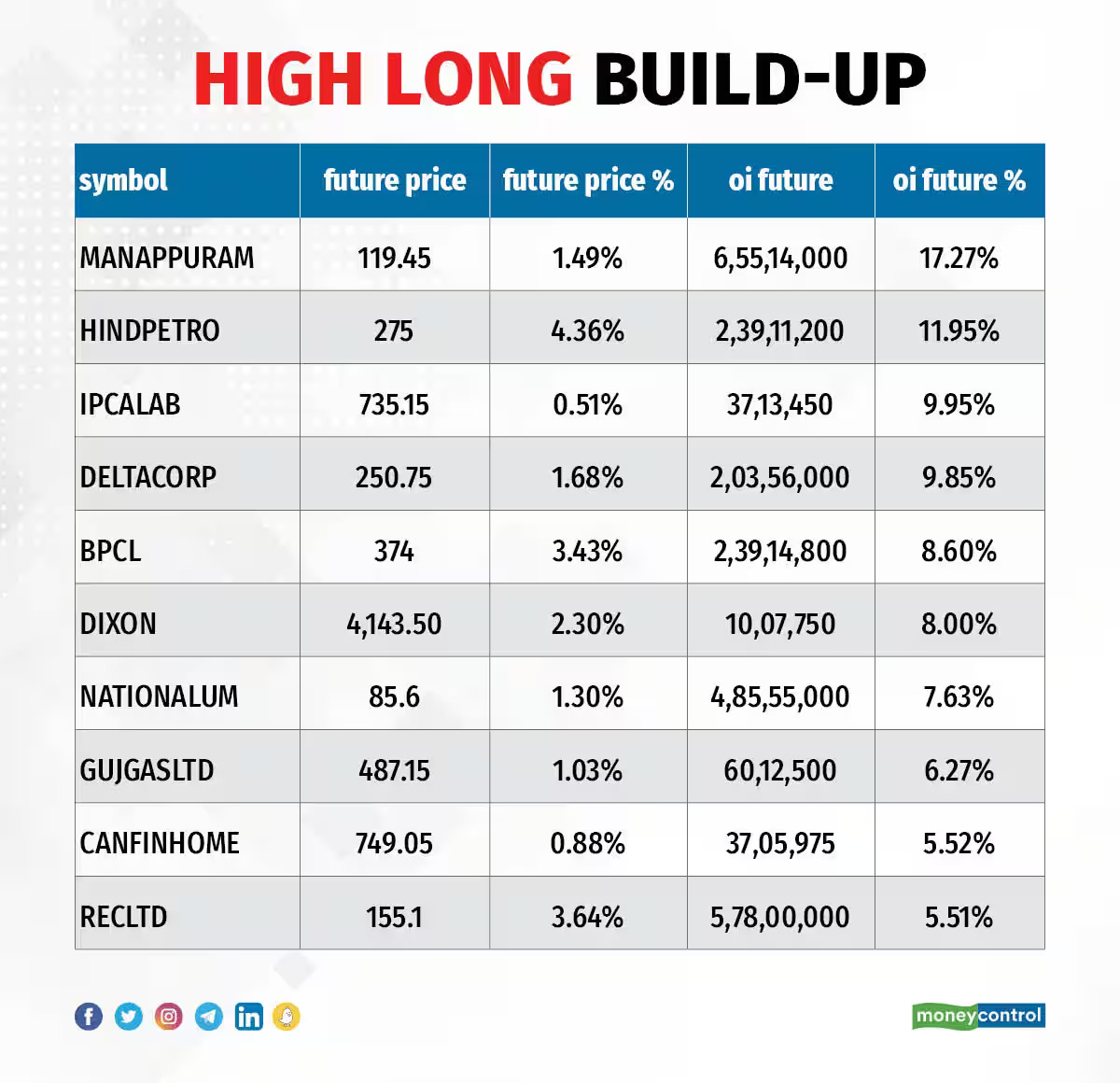

Long build-up seen in 80 stocks

Increases in open interest (OI) and price are signs that long holdings have grown.

80 stocks witnessed a significant build-up based on the OI percentage, including Manappuram Finance, Hindustan Petroleum Corporation, Ipca Laboratories, Delta Corp., and BPCL.

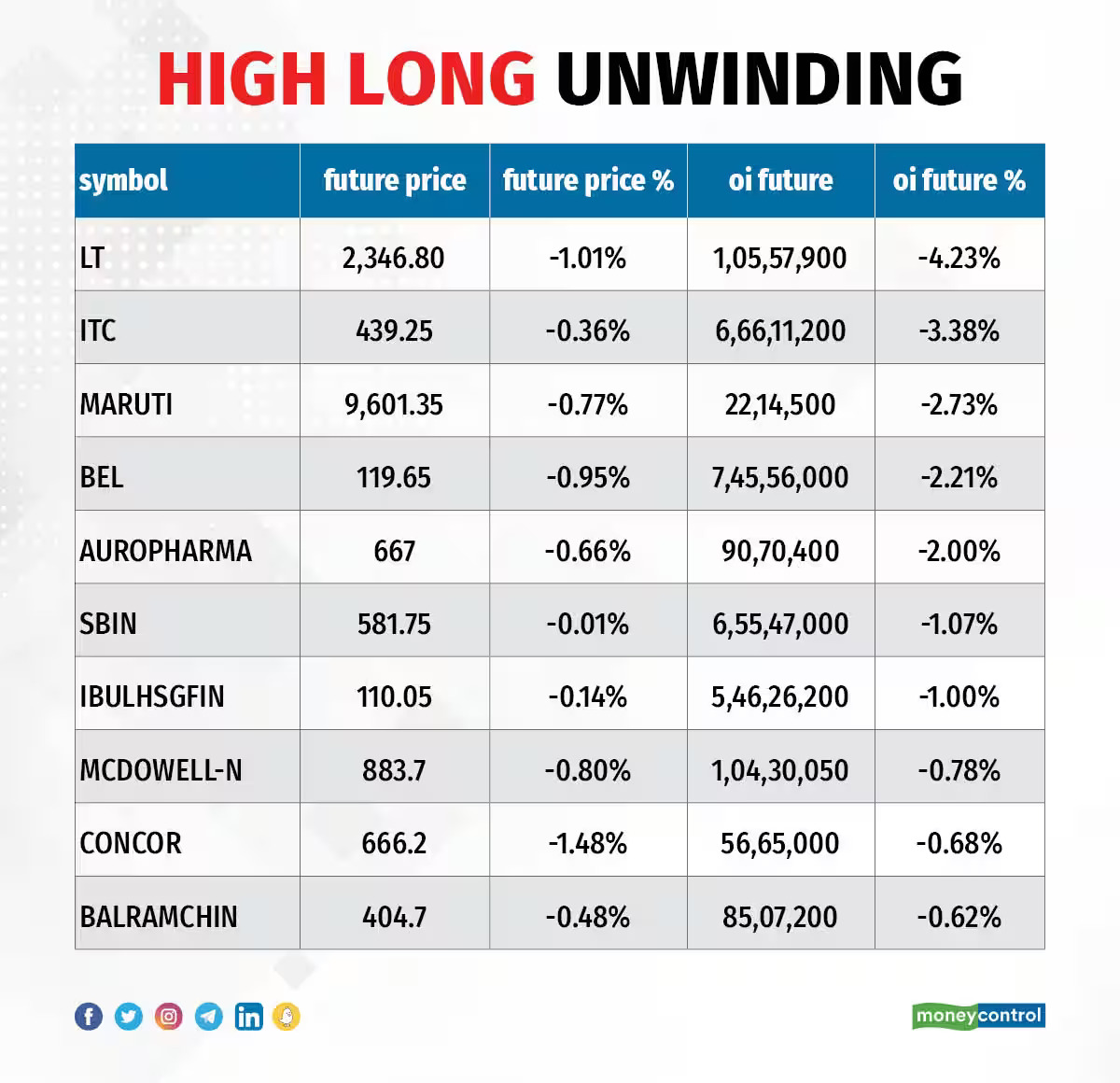

12 stocks experience a long unwind

A protracted unwinding is typically indicated by a fall in OI and price.

Twelve stocks, including Larsen & Toubro, ITC, Maruti Suzuki India, Bharat Electronics, and Aurobindo Pharma, had a protracted unwinding based on the OI %.

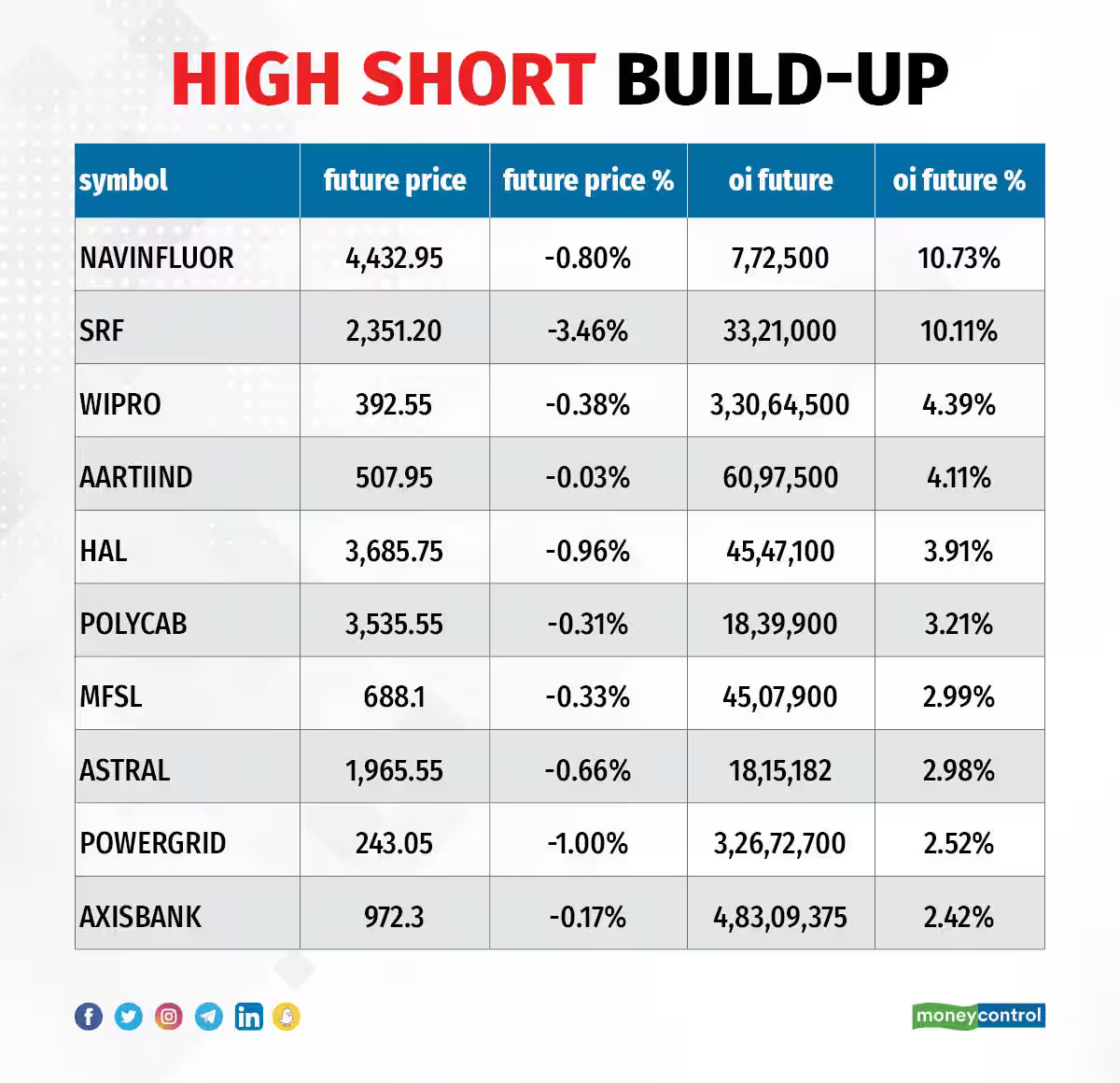

12 stocks experience short build-up

An accumulation of short positions is indicated by a rise in OI and a decline in price.

27 stocks, including Navin Fluorine International, SRF, Wipro, Aarti Industries, and Hindustan Aeronautics, had a brief build-up based on the OI percentage.

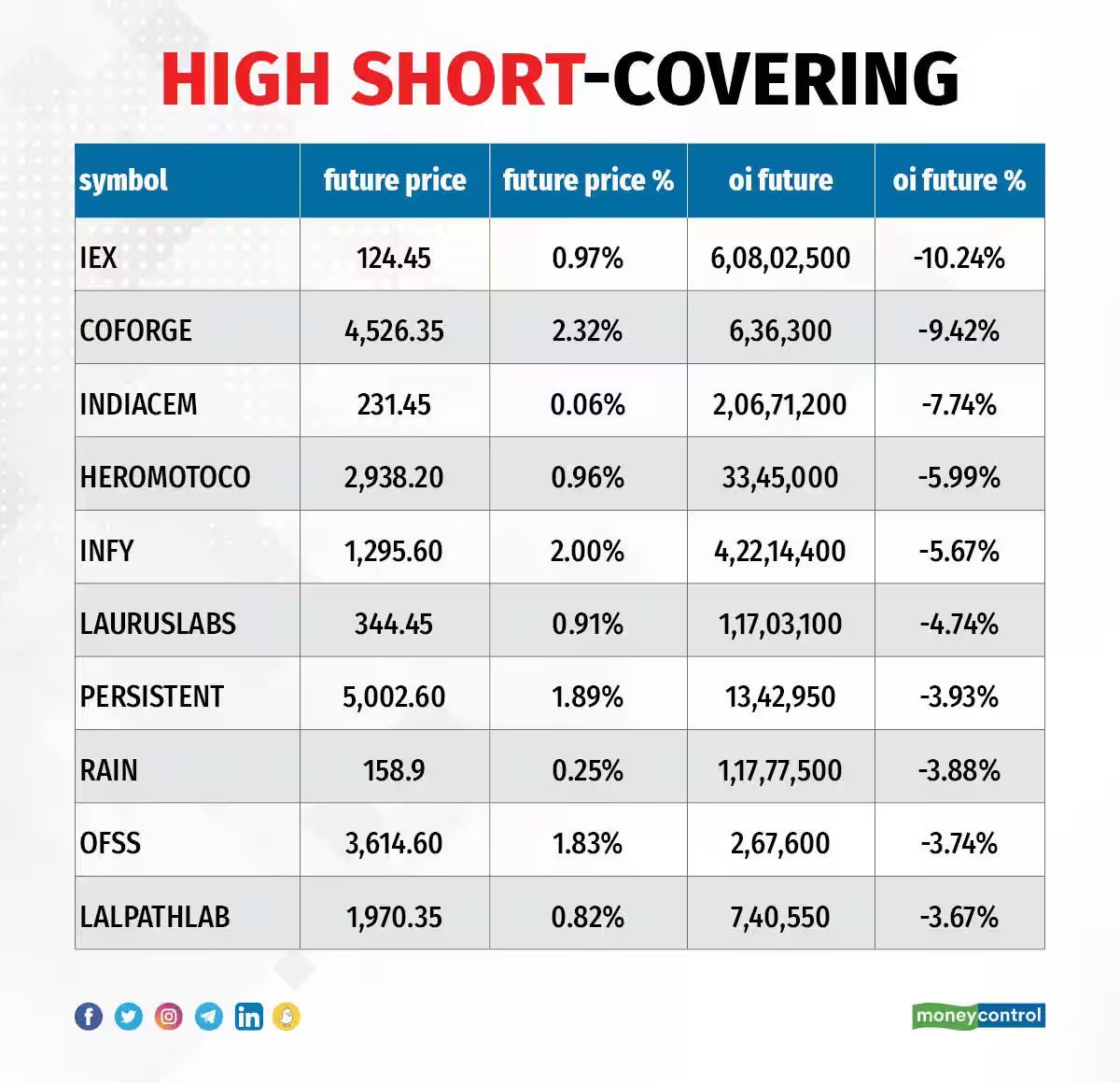

Short-covering is seen in 68 stocks.

Short-covering is demonstrated by a drop in OI and an increase in price.

68 stocks were on the short-covering list based on the OI %. Indian Energy Exchange, Coforge, India Cements, Hero MotoCorp, and Infosys were some of these.

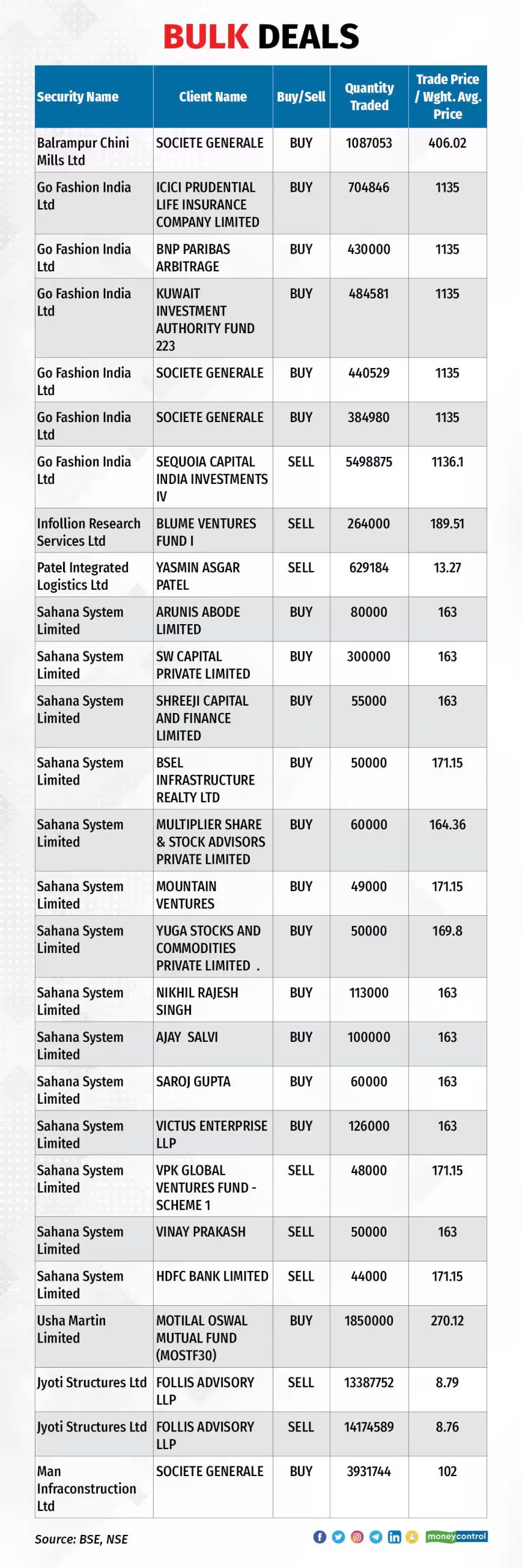

Bulk Deals

(For more bulk deals, click here)

RELATED CTN NEWS:

2023 U.S. Open: How To Watch, TV Schedule, Streaming Schedule & Tee Times

The Significance Of Juneteenth: Commemorating Freedom And Equality