Calculating gratuity, or the end of service benefits for employees, can be a time-consuming and complex task. It is important to have accurate information on the applicable wage laws before determining an employee’s gratuity amount.

A gratuity calculator can be used to simplify this process. In this guide, you will learn about the basics of using a gratuity calculator, as well as best practices in order to ensure accurate and compliant calculations.

What is a Gratuity Calculator?

Gratuity is a payment made to an employee at the end of their employment. This payment is typically calculated as a percentage of the employee’s salary and varies depending on the country or state in which they work.

A gratuity calculator is an online tool that helps employers determine how much money they should pay their employees upon leaving employment or when they reach certain milestones within the company.

The calculator takes into account factors such as years of service, salary, and applicable labor laws. By using a calculator, employers can quickly and accurately calculate the gratuity amount that an employee is entitled to without manually calculating each individual’s gratuity amount.

Working of Gratuity

Employers have the option of paying gratuities from their own accounts or obtaining gratuity insurance from the best service provider. It is then crucial for the firm to pay the service provider an annual fee.

The insurance firm can pay the gratuity amount to the worker by ensuing policy guidelines and rules. Gratuities are paid totally by the employer without any contribution from employees.

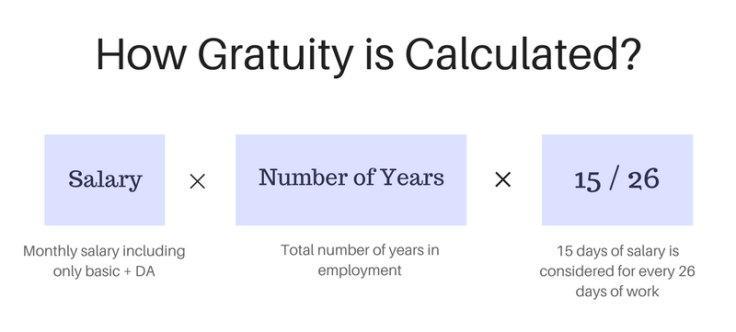

Gratuity Calculator: Formula

Rules For Gratuity:

Timeline for Gratuity payment

The following are some of the essentials of the gratuity payment process:

Initial

An authorized individual has to send an appeal to the boss about the gratuity amount.

Acknowledgement and calculation

A firm that owns a gratuity estimates its benefits immediately after receiving an application. Apart from that, it also gives the same notice to the worker seeking gratuity and the supervisory expert on the amount.

Disbursal

After sending the approval, it takes 30 days for the firm to pay the worker’s gratuity.

Gratuity Loss

There may be chances of a full deduction of gratuity if the person has worked for the company for over 5 years. This case may rise if they misbehave with the staff and bosses. All of these things can be done under the 1972 Payment Gratuity Act.

Gratuity eligibility criteria

You are qualified for gratuity only if you fulfill any one of the following mentioned eligibility criteria

- A person has left after constantly working for a company for more than 5 years.

- The amount will be paid to the nominee upon their impairment or decrease.

- A person must be eligible for gratuity if they reach the maximum age of service as fixed by the organization.

Gratuity tax rules

Employees who receive gratuities are taxed differently depending on their type of occupation.

- Workers of government agencies (whether central or state / local) are not vital to pay tax on gratuity obtained.

- Any other employee is entitled for gratuities waged by a boss are covered under the Payment of Gratuities Act.

Final words

Calculating total gratuity is a very hard job for a person. Thus, using the gratuity calculator available on the Aditya Birla Capital website is wise. This tool will ease your worries about the gratuity amount you will receive.

SEE ALSO: iPhone Battery Replacement: Ensuring Optimal Performance And Longevity