(CTN News) – Since inflation is taking longer to decline, the government’s economic forecaster predicts that the UK economy will expand significantly slower than anticipated during the next two years.

According to the Office for Budget Responsibility (OBR), living standards will not be projected to be restored to their levels before the epidemic until 2027–28.

This is in addition to the tax cuts and welfare increases that the chancellor announced in his Autumn Statement.

Workers’ claims that “Tory economic recklessness” was still costing them money were part of the labor movement’s rhetoric.

The non-governmental Office for Budget Responsibility (OBR) provides two sets of economic projections annually to predict the future of government finances.

These are fluid and based on the best predictions of the future.

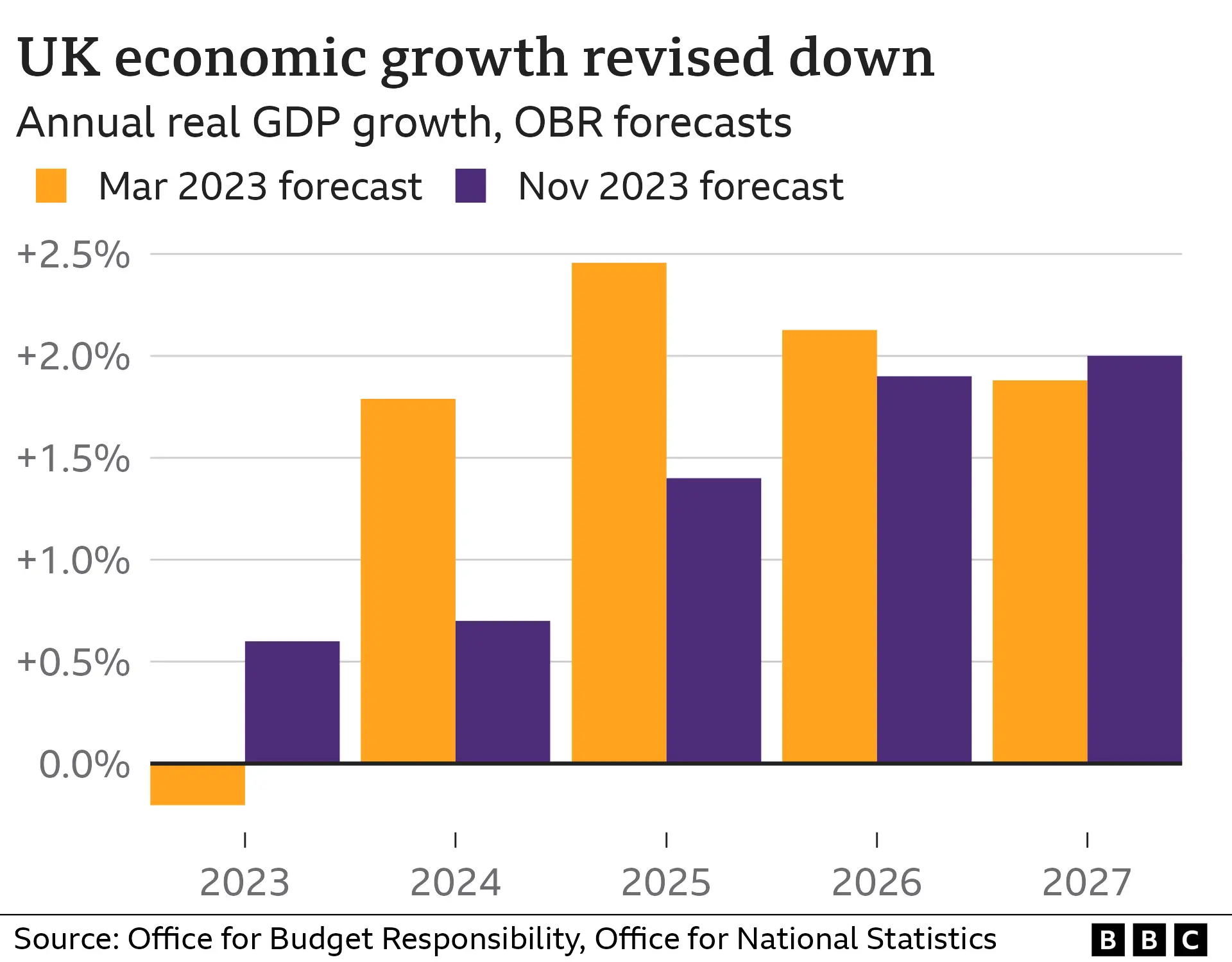

According to the watchdog, the UK economy will expand by 0.6% this year. This is a significant improvement over last autumn’s prediction that the economy would contract into recession.

After projecting 1.8% and 2.5% growth, respectively, it has now reduced its growth prediction to 0.7% in 2024 and 1.4% in 2025.

We underestimated how resilient the economy would be to the epidemic and energy crises. However, it did note that interest rates were higher than anticipated in March and that inflation had persisted longer than expected.

Inflation, which is now 4.6%, will only drop to 2.8% by the end of 2024, according to the OBR. It will meet the Bank of England’s 2% objective in 2025.

It had previously predicted that inflation would surpass the target next year.

It also predicted that real disposable income in the UK would be 3.5% lower in 2024–25 than before the epidemic and then return to normal a few years later.

This decline would be milder than anticipated, but it would still constitute “the greatest reduction in real living standards since records began in the 1950s,” according to the Office for National Statistics.

Rising interest rates, sluggish consumer demand, and high inflation have all been drags on economic growth.

The Bank of England predicted earlier this month, with a hint of gloom, that the United Kingdom would have virtually no growth in 2024 and 2025.

The Bank has raised Interest rates fourteen times since December 2021 in response to spiraling price increases; at their most recent two sessions, they were at 5.25%, a level not seen in fifteen years.

The reasoning behind this is that lending money will become more costly, reducing demand and slowing down price increases. A drag on the economy can result from firms being less inclined to invest due to increasing interest rates.

Households are feeling the pinch as both savings and mortgage rates have increased.

The OBR predicted a 4.7% decline in home values in 2024 due to this.

The UK was expanding at a faster rate than the Eurozone, but Chancellor Jeremy Hunt stressed the need to increase productivity when he delivered the Autumn Statement.

He claimed that private investment was the reason for higher productivity in the United States, Germany, and France. However, he promised that his new policies would “help close that gap” by reducing planning red tape, assisting entrepreneurs in raising capital, and lowering company taxes.

Mr. Hunt said that the government’s borrowing and debt, which have increased dramatically alongside rising interest rates, will be lower in 2024 and 2025 than the OBR had predicted.

“Some of this improvement is from higher tax receipts from a stronger economy, but we also maintain a disciplined approach to public spending,” according to him.