(CTN News) – In recent times, India has witnessed a surge in the usage of digital lending apps, providing users with quick loans without the hassles of traditional bank processes.

However, this seemingly convenient solution has a dark side, as illustrated by the tragic stories of individuals like Bhupendra Vishwakarma and Shivani Rawat.

The alarming rise in cases of predatory lending practices, cyber harassment, and suicides has drawn attention to the urgent need for regulatory intervention.

The Rise of Predatory Lending Apps:

The proliferation of digital lending apps, offering instant loans with minimal documentation, gained momentum during the COVID-19 pandemic when many faced financial hardships.

These apps typically grant loans ranging from 10,000 to 25,000 rupees with monthly interest rates soaring between 20% to 30%, coupled with processing fees as high as 15%.

The Exploitation and Harassment:

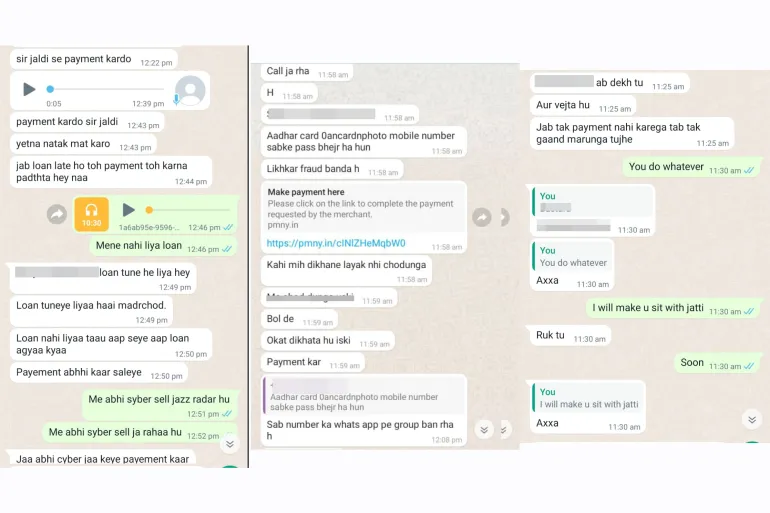

Vishwakarma and Rawat’s stories shed light on the harsh reality faced by borrowers. Recovery agents associated with these apps employ ruthless tactics, including threats, abusive language, and even cyberbullying.

In Rawat’s case, her life took a devastating turn when explicit photos were manipulated and sent to her colleagues, leading to the loss of her job.

Chinese-Owned Apps and Cybersecurity Concerns:

Reports suggest that over 700 loan apps are currently operating in India, with a significant number owned by Chinese entities. These apps not only exploit borrowers but also violate cybersecurity norms by accessing personal information beyond permissible limits.

The Reserve Bank of India (RBI) has identified the issue but struggles to enforce regulations effectively.

The Human Toll:

The Loan Consumer Association (LCA) reveals a distressing pattern, with almost 1,800 individuals seeking assistance due to illegal loan app traps. The victims often experience clinical depression, panic attacks, and distress, creating a mental health crisis.

The government’s unpreparedness to handle cybercrime exacerbates the problem, with police lacking the necessary training and tools.

Government Measures and Challenges:

While the government has taken some steps to address the issue, such as banning 94 lending apps, challenges persist.

Enforcement agencies like the Directorate of Enforcement (ED) have seized assets linked to financial fraud by Chinese loan apps, but the lack of regulatory clarity and cyber-literacy hampers effective action.

In February 2023, the Finance Ministry claimed to have forwarded a whitelist of approved digital lending apps to app stores, a move later debunked by local media.

The contradictory statements from authorities and the absence of a concrete regulatory framework underline the challenges in combating predatory lending.

The prevalence of predatory lending apps in India poses a severe threat to the financial and mental well-being of its citizens.

While some steps have been taken to curb the menace, a comprehensive and coordinated effort from regulators, law enforcement, and tech platforms is imperative.

Striking a balance between financial inclusion and consumer protection should be the guiding principle as India navigates the complex landscape of digital lending.

The stories of Vishwakarma and Rawat serve as poignant reminders that urgent action is needed to prevent further tragedies and protect vulnerable borrowers from the clutches of unscrupulous loan apps.