(CTN News) – Despite last week’s very positive job figures, Federal Reserve Chair Jerome Powell chose not to materially tighten his tone on inflation in a closely-watched speech, which caused the dollar to drop on Wednesday.

In a question-and-answer session on Tuesday before the Economic Club of Washington, Powell said that if the economy stayed strong, interest rates could need to climb higher than anticipated, but he reaffirmed his belief that a “disinflation” is underway.

The dollar lost momentum during Powell’s speech and continued to lose ground into early Wednesday European trade.

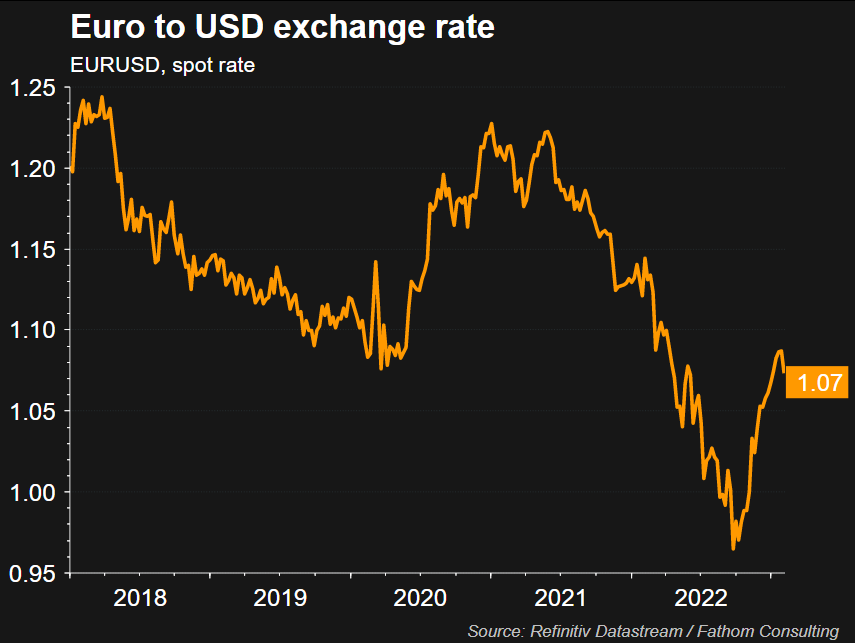

The euro recently increased by 0.21% to $1.075 after dropping its lowest level since January 9, the previous session at $1.067. The 20-year low of $0.953 reached in September was still considerably above it.

Despite last week’s very positive job figures, Federal Reserve Chair Jerome Powell chose not to materially tighten his tone on inflation in a closely-watched speech, which caused the dollar to drop on Wednesday.

In a question-and-answer session on Tuesday before the Economic Club of Washington, Powell said that if the economy stayed strong, interest rates could need to climb higher than anticipated, but he reaffirmed his belief that a “disinflation” is underway.

The dollar lost momentum during Powell’s speech and continued to lose ground into early Wednesday European trade.

The euro recently increased by 0.21% to $1.075 after dropping its lowest level since January 9, the previous session at $1.067. The 20-year low of $0.953 reached in September was still considerably above it.

Investors were also considering remarks made by two German ECB officials, who stated that there was still room for interest rates in the eurozone to increase.

Joachim Nagel, the head of the German central bank, said on Tuesday, “from where I stand today, we need more, considerable rate rises.”

“It is not yet obvious that monetary policy is genuinely functioning so well that we can expect inflation to return to our inflation objective of 2% in the medium run,” his colleague Isabel Schnabel remarked.

The U.S. dollar index decreased 0.19% to 103.1 against a basket of currencies on Wednesday after declining 0.3% the previous day.

Sterling recovered from a one-month low of $1.196 on Tuesday, rising 0.3% to $1.209.

Following Friday’s ground-breaking employment data, which revealed that nonfarm payrolls had increased by 517,000 jobs last month, the dollar had a brief rise.

Due to this, investors increased their forecasts of how far the Fed would need to hike interest rates before they drove the U.S. dollar index to a one-month high of 103.96 on Tuesday.

On Wednesday, futures pricing indicated that markets anticipate the Fed funds rate to rise from its current range of 4.5% to 4.75% to a high of slightly around 5.1% by June.

Meanwhile, traders predict that the ECB will raise rates from 2.5% to around 3.5% in late summer, according to pricing in the futures markets.

A dollar was worth 130.88 yen elsewhere, up 0.15% on the previous session’s 1.2% gain.

According to statistics, real salaries in Japan increased for the first time in nine months on Tuesday thanks to significant temporary bonuses.

A significant salary increase during the spring labor negotiations is seen to be a must for the Bank of Japan to begin tightening its ultra-loose monetary policy.

The Aussie rose 0.42% to $0.699 after rising more than 1% on Tuesday, while the kiwi fell 0.26% to $0.634.

As anticipated, the Reserve Bank of Australia increased its cash rate by 25 basis points on Tuesday. However, it emphasized that more hikes would be necessary.

Related CTN News:

Digital Pound is Likely to be Launched Later this Decade, According to the Bank of England