Though online pay stubs generators are automated tools and there is no room for errors, some small mistakes can arise while generating them. There has to be kept in mind while creating a pay stub.

Pay stubs are essential documents that provide detailed information about an employee’s earnings and deductions for a specific pay period. They serve as proof of income and are often required for various purposes, such as loan applications, rental agreements, and tax filings.

While creating pay stubs may seem straightforward, common mistakes can occur during the process.

This blog will discuss four common mistakes to avoid while making pay stubs and provide tips on creating accurate and reliable documents.

What is a Pay Stub?

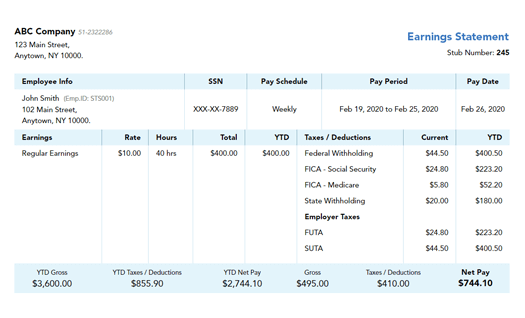

Before we delve into the common mistakes, let’s briefly understand what a pay stub is. A pay stub, or a paycheck stub, is a document that employers provide to their employees alongside their paychecks. It outlines important financial details such as the employee’s gross earnings, deductions, taxes withheld, net pay, and other relevant information. The pay stub helps employees keep track of their income, taxes, and deductions, ensuring transparency and accountability in the payment process.

Utilizing the Form W-4

The federal government requires new hires to complete a form known as the Employee’s Withholding Allowance Certificate (Form W-4). Employers can determine how much compensation should be withheld from a paycheck for tax purposes based on the information provided on the form (allowances).

Remember the following:

- The employer should keep each employee’s most recent W-4 form in the payroll file. The IRS might require a copy of the form.

- Make sure your payroll processing system has the appropriate number of allowances added.

- The W-4 forms gather the worker’s basic data (name, address, and filing status) and offer help to those with numerous jobs or spouses who are employed. Additional tools are available to figure out withholding’s in certain circumstances.

You must gather extra information for the pay stub once you have completed the W-4.

Information Needed to Create a Pay Stub

To create an accurate pay stub, certain information is essential. Here are the key details required:

Employee Information: This includes the employee’s full name, address, social security number, and identification number.

Earnings: The pay stub should display the employee’s gross wages, which include regular hours, overtime hours (if applicable), and any other additional income.

Deductions: Deductions are amounts subtracted from the employee’s gross wages. They can include taxes (federal, state, and local), Social Security and Medicare contributions, health insurance premiums, retirement plan contributions, and other relevant deductions.

Net Pay: Net pay, or take-home pay, is the amount the employee receives after subtracting all deductions from their gross earnings.

Pay Period: The pay stub should indicate the specific period for which the employee is being paid, such as weekly, bi-weekly, or monthly.

4 Common Pay Stub Mistakes

Incorrect Calculation of Earnings and Deductions:

One of the most common mistakes in pay stubs is the incorrect calculation of earnings and deductions. It can lead to discrepancies in the employee’s net pay and cause confusion or frustration. It becomes crucial to double-check all calculations and ensure accurate figures are entered for hours worked, rates of pay, and deductions to avoid it.

Incomplete or Missing Information:

Another common mistake is omitting or providing incomplete information on the pay stub. All required details, including employee information, earnings, deductions, and taxes, should be accurately and clearly stated. Missing or incomplete information can raise doubts and create complications when verifying income or filing taxes.

Failure to Account for State and Local Taxes:

Tax regulations vary from state to state, and some local jurisdictions may have additional tax requirements. Failing to correctly account for state and local taxes can result in inaccuracies on the pay stub. It is essential to stay updated with the tax laws and requirements applicable to your employees’ location and accurately reflect them on the pay stubs.

Ignoring Legal Compliance:

Pay stubs must comply with federal, state, and local labor laws. Ignoring legal compliance can lead to penalties, fines, and legal consequences. Ensure you know the specific regulations governing pay stubs in your jurisdiction and adhere to them when creating them for your employees.

Final Words

Creating accurate and reliable pay stubs is crucial for both employers and employees. By avoiding common mistakes such as incorrect calculations, incomplete information, failure to account for taxes, and ignoring legal compliance, you can ensure that your pay stubs accurately represent an employee’s earnings and deductions. Pay stubs are not only a financial record but also serve as proof of income for various purposes.

Creating precise pay stubs demonstrates professionalism and transparency, promoting trust and clarity in the employer-employee relationship.

Are you looking for a paystub generator for your business? Online Pay stub is your answer. It is a time-saving, convenient, and accurate tool available online.

⚠ Article Disclaimer

The above article is sponsored content any opinions expressed in this article are those of the author and not necessarily reflect the views of CTN News