(CTN News) – In the fast-evolving landscape of cryptocurrency investments, the race for the first-ever spot Bitcoin exchange-traded fund (ETF) is reaching a critical juncture.

Applicants are now scrambling to meet the United States Securities and Exchange Commission’s (SEC) deadline, a pivotal step toward potentially launching spot Bitcoin ETFs in early 2024.

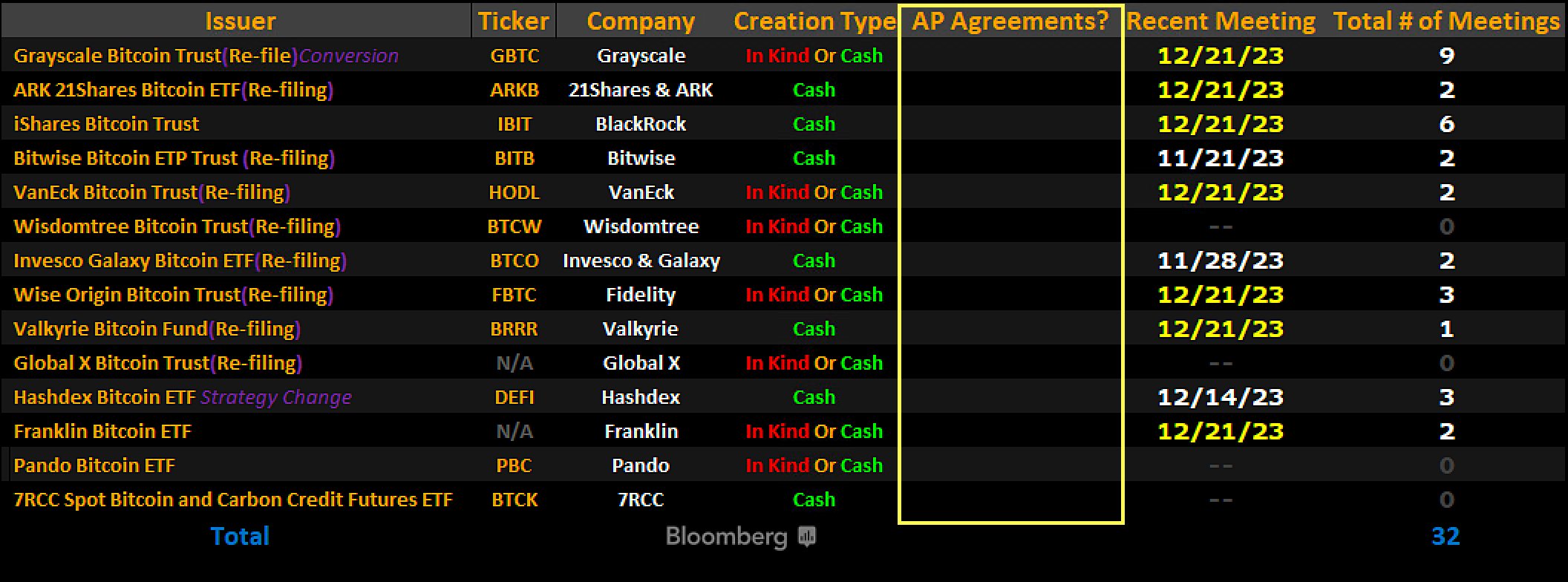

As the clock ticks down, key players such as BlackRock, Grayscale Investments, ARK Investments, and 21 Shares are navigating the complexities of regulatory requirements.

The SEC’s Dec. 29 Deadline

The SEC has set a strict deadline for spot Bitcoin ETF applicants to finalize their S-1 amendments by December 29, as reported by Reuters and confirmed by Fox Business journalist Eleanor Terrett.

Representatives from at least seven firms, including major players in the financial industry, engaged in discussions with SEC officials on December 21.

The outcome of these talks revealed a critical condition: only those applications fully completed and filed by the looming deadline will be considered in the initial wave of potential spot Bitcoin ETF approvals in early January.

Confirming the date for final amendments to all S-1s by Friday the 29th. The @SECGov has told issuers that applications that are fully finished and filed by Friday will be considered in the first wave. Anyone who is not will not be considered. In addition, the filings cannot… https://t.co/syyINu1BEI

— Eleanor Terrett (@EleanorTerrett) December 24, 2023

Racing Against the Clock

Firms rushing to secure a spot in the first wave of approvals are facing multiple challenges. One significant adjustment involves the transition from in-kind redemptions to a cash-only model.

The SEC has expressed a preference for cash redemptions, a process involving monetary payments rather than non-monetary payments like Bitcoin.

Several spot Bitcoin ETF filers have diligently updated their S-1 filings to comply with this requirement, hoping to align with the SEC’s expectations.

Authorized Participants (AP) Agreement: The Final Hurdle

In addition to the shift to cash redemptions, the SEC has urged Bitcoin ETF filers to disclose the names of authorized participants (AP) in their filings.

Bloomberg exchange-traded fund analyst Eric Balchunas emphasizes that securing the AP agreement is the last crucial step towards obtaining approval.

As of December 22, none of the spot Bitcoin ETF filers have finalized the AP agreement, creating a potential hurdle for those aiming to launch their products.

Bitcoin ETF Optimism Amidst Challenges

Despite the tight deadlines and regulatory adjustments, Bloomberg analysts express confidence that the SEC will approve the first spot Bitcoin ETFs by January 10.

This optimism is grounded in the belief that the recent updates made by multiple firms align with the SEC’s expectations, bringing the industry closer to witnessing the historic launch of spot Bitcoin ETFs.

The final days of December are witnessing a flurry of activity as applicants strive to meet the SEC’s stringent requirements for spot Bitcoin exchange-traded fund approval.

The shift to cash redemptions and the disclosure of authorized participants are pivotal steps in navigating the regulatory landscape.

As the cryptocurrency market eagerly awaits the outcome, the potential approval of spot Bitcoin exchange-traded funds could mark a significant milestone in the broader acceptance and integration of digital assets within traditional financial markets.