Lender snapshots and rate examples reflect public lender pages and calculators reviewed in October 2025. Rates change often; confirm on each lender’s site before applying.

Refinancing can reduce interest, lower monthly payments, or speed up payoff. Cutting a loan from 7.5 percent to 5 percent can save between $3,000 and $20,000 over the life of the loan, depending on balance and term. The best results come from timing, strong credit, and comparing multiple offers.

To understand how to refinance student loans after graduation, start with prequalification and rate shopping. Choose fixed or variable, pick a term that fits your budget, apply with documents, and keep paying off old loans until the payoff is confirmed.

Disclaimer: This is educational content, not financial advice. Federal borrowers should review Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) rules before refinancing to a private loan, which removes these protections.

Current rate snapshot (October 2025): Fixed refinance APRs commonly range from about 4.5 percent to 9.3 percent with autopay discounts, based on public lender data. Offers vary by credit, income, and term. Check the latest guidance on costs and decisions from the CFPB’s student loan resources.

Key takeaways

- Best time to refinance student loans: after steady income and a credit score near 680 or higher, or with a strong cosigner.

- Student loan refinance requirements: credit score, income, debt-to-income ratio, and proof of graduation.

- Risks: Refinancing federal loans to private loans removes PSLF and IDR protections.

- Steps: prequalify, compare rates and terms, pick fixed or variable, apply, and switch autopay.

- Savings vary by rate drop and term length; prequalify to see real offers, available when available, without a hard pull.

Quick Answer: How to Refinance Student Loans After Graduation

- Prequalify with 3–4 lenders to view estimated rates without a hard pull.

- Compare fixed vs variable rates, APRs, terms, fees, and borrower perks.

- Check eligibility, including credit score, income, and debt-to-income ratio.

- Pick the best offer based on total cost, monthly payment fit, and protections.

- Upload documents, submit your application, and complete identity checks.

- Keep paying current loans until the new lender confirms the payoff date.

- Set up autopay, choose a payment date, and track savings over time.

Prequalify with several lenders to see real rates before you apply.

When Should You Refinance After Graduation?

Refinancing works best when your income is stable and your credit profile qualifies you for a lower rate than you have now. Market rates matter, but individual credit and debt-to-income ratios drive the final APR. The best time to refinance student loans often starts after your grace period and once your budget is steady.

Grace period, first job, and steady income

Most borrowers should consider refinancing after the grace period ends and a first job is in place. Some lenders allow refinancing soon after graduation, even with limited payment history. Income stability tends to qualify you for better pricing and helps you choose a term that fits your budget.

Credit score milestones that unlock lower rates

A student loan refinance credit score of around 660-680 may qualify. Scores of 700 or higher often yield stronger offers, and 740 or higher is very competitive. Build credit with on-time payments and low card balances relative to limits for several months before applying.

Reading the interest rate environment

In periods of falling rates, refinance quotes may improve. When rates rise, fixed rates grow more attractive for stability. Check quotes monthly and set a target APR that justifies a switch after accounting for fees and term length.

Eligibility and Requirements

Lenders assess credit, income, and repayment ability. The core student loan refinance requirements are consistent across the market, but exact thresholds vary by lender.

Credit score, debt-to-income, and payment history

- Credit score: Many approvals begin around 660-680. Higher scores help.

- DTI: Many lenders target a total DTI of 40-45 percent. Lower is better.

- Payment history: On-time payments strengthen your profile.

- Cosigner: A creditworthy cosigner can offset thin credit or higher DTI.

Income and employment verification

- Proof of steady income is common.

- Expect to provide recent pay stubs, W-2s, or a signed offer letter if newly employed.

- Some lenders accept part-time or contract income with consistent documentation.

- Minimum income thresholds vary; stronger earnings can improve your rate.

Cosigner rules and release options

Adding a cosigner can lower your rate if your credit is fair. Many lenders offer cosigner release after 12 to 36 on-time payments, subject to credit review. Read the release requirements before you sign.

Documents needed to refinance student loans

Checklist of documents needed to refinance student loans:

- Government ID

- Proof of income: recent pay stubs, W-2, or 1099

- Employment letter for starting a new job

- Payoff statements for each loan

- Loan statements with account numbers and servicer details

- Proof of graduation

- Bank information to set up autopay

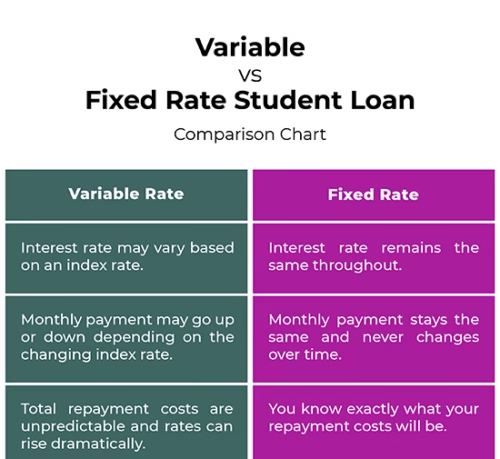

Fixed vs Variable Rates

Borrowers compare fixed vs variable student loan rates by weighing stability against potential savings. Match the rate type to your payoff plan and risk comfort.

Pros and cons at a glance

| Rate Type | Pros | Cons |

|---|---|---|

| Fixed | Predictable payment for the full term; steady budgeting; protective in rising-rate periods | Usually starts slightly higher than the best variable rate |

| Variable | Often starts lower; can save if you pay off quickly or rates stay flat | Can rise over time; payment and total cost may increase |

Who should choose which rate type?

- Fixed: Good for risk-averse borrowers, tight budgets, or longer terms.

- Variable: Fits aggressive payoff plans of 2 to 5 years if you accept the risk.

Run numbers with both types, then choose based on the total cost at your payoff speed.

Example monthly payments

Example balance: $30,000 for 10 years.

- 6.0 percent fixed: About $333 per month. The estimated total interest is about $9,960.

- 4.8 percent variable (starting): About $317 per month. The estimated total interest is about $8,040 if rates hold steady.

Variable savings depend on rate changes. Rising rates can reduce or erase the difference.

Refinance vs Consolidation (Federal)

Borrowers often compare refinance vs consolidate student loans. The programs work differently, and the choice affects protections and benefits.

Key differences and what changes

- Refinancing: A private lender pays off existing loans and issues a new private loan. This can lower your rate and change your term, but it removes federal protections.

- Federal consolidation: The Department of Education combines eligible federal loans into a Direct Consolidation Loan at a weighted average rate, rounded up slightly. Federal benefits remain.

PSLF and IDR warning for federal borrowers

Refinancing federal loans with a private lender makes them ineligible for PSLF and IDR plans. Review the PSLF rules at studentaid.gov/public-service and IDR options at studentaid.gov/idr before moving forward.

When consolidation makes sense

Federal consolidation can simplify payments or help you qualify for specific IDR plans. Review the federal consolidation process at studentaid.gov/manage-loans/consolidation.

Quick decision guide

- Need PSLF or IDR, or want access to federal forbearance options? Keep loans federal; consider consolidation.

- Want the lowest rate and can give up federal protections: compare private refinance offers and terms.

Best Lenders for Recent Graduates (2025)

Rates and requirements change. Confirm details on each lender’s site. For third-party comparisons, see the latest picks at U.S. News: Best Student Loan Refinance Lenders, Forbes Advisor’s 2025 refinance list, and The College Investor’s lender roundup.

SoFi

- Typical minimum credit score: around the mid-600s

- APR range varies by credit, term, and autopay; 0.25 percent autopay discount

- Perks: career coaching, member benefits, unemployment protection program for qualified borrowers

Earnest

- Flexible term options and precision pricing for tailored payments

- Strong fit for good credit and solid savings history

- 0.25 percent autopay discount

Laurel Road

- Solid option for medical and dental professionals

- Professional discounts may apply

- 0.25 percent autopay discount and cosigner release options

ELFI (Education Loan Finance)

- Competitive pricing for strong-credit borrowers

- Dedicated loan advisor support

- 0.25 percent autopay discount and cosigner eligibility

Splash Financial

- A marketplace that shops multiple lenders

- Can surface competitive offers across partners

- 0.25 percent autopay discount is common among partner lenders

Citizens

- Bank option with loyalty discounts for existing customers

- 0.25 percent autopay discount

- Cosigners allowed; multi-year approvals for some professional students

Note: As of October 2025, public lender pages show fixed refinance APRs often starting at about 4.5 percent to 5 percent for top profiles, with higher rates for longer terms or lower credit scores. Always confirm current ranges on the lender’s site.

How Much Can You Save? (Example Scenarios)

Illustrations below use standard amortization and rounded figures. Your results will vary by credit, term, fees, and how fast you pay.

Example 1: $30,000 from 6.8% to 4.9% for 10 years

- Original: Payment about $345, total interest about $11,448

- New: Payment of about $317, total interest of about $7,992

- Estimated savings: about $3,456 if terms are equal

Example 2: $60,000 from 7.5% for 15 years to 5.0% for 10 years

- Original: Payment about $557, total interest about $40,170

- New: Payment about $637, total interest about $16,428

- Tradeoff: Higher monthly payment, but about $23,742 less interest if the 10-year payment fits

Example 3: $45,000 from 5.8% fixed for 10 years to 4.2% variable for 10 years

- Original: Payment about $495, total interest about $9,448

- New: Starting payment about $460, total interest about $5,140 if rates stay flat

- Caution: Variable rates can rise, which can reduce or erase savings

Common Mistakes to Avoid

- Chasing the lowest rate but ignoring APR and fees: Compare total cost, not just the headline rate.

- Skipping prequalification: Soft-pull estimates from several lenders help you compare without hurting your score.

- Choosing the wrong term length: Longer terms lower the payment but often increase the total interest.

- Refinancing federal loans without understanding PSLF and IDR loss: Review rules at studentaid.gov/idr and studentaid.gov/public-service.

- Not setting up autopay and reminders: Autopay can cut 0.25 percent at many lenders and reduce missed payments.

- Mixing up consolidation and refinancing: Consolidation is federal and keeps benefits; refinancing is private and may reduce rates but removes federal protections.

FAQs

How long after graduation can you refinance student loans?

You can refinance when you have a steady income and meet a lender’s credit and DTI rules. Many borrowers wait until the grace period ends. Prequalify first to see if your current profile earns a lower rate.

What credit score do you need to refinance student loans?

Many lenders start approvals around the mid-600s. A score of 680 to 700, or higher, improves your chances of better rates. A strong cosigner can help if your score is still building.

Is it better to refinance or consolidate student loans?

Refinance with a private lender to lower your rate or change terms. Consolidate federal loans to simplify payments while keeping PSLF and IDR. If you need federal benefits, consolidation is the safer path.

Can you refinance federal student loans and still qualify for PSLF?

No. Refinancing federal loans into a private loan removes PSLF and IDR access. If you plan to pursue PSLF, keep loans federal and consider federal consolidation if needed.

What documents are needed to refinance student loans?

You will need a government ID, proof of income (recent pay stubs, W-2 or 1099), an employment letter if starting a new job, payoff and loan statements, proof of graduation, and bank details for autopay.

Does refinancing hurt your credit score?

A hard inquiry can cause a slight, temporary dip. Your score can improve over time with on-time payments and lower credit utilization. Rate shopping within a short window is often counted as one inquiry.

When is the best time to refinance student loans?

After you have a steady income, a stronger credit score, and when market rates are favorable, Re-check offers after raises or credit improvements.

How to refinance student loans after graduation if your credit is fair?

Prequalify with multiple lenders, consider a cosigner with strong credit, pay down credit cards, and fix any credit report errors. A few months of on-time payments can improve rate offers.

Conclusion

To act on how to refinance student loans after graduation, prequalify with several lenders, compare fixed vs variable rates, choose a term that balances monthly cost and total interest, then submit your application and set up autopay. Check PSLF and IDR eligibility before moving federal loans to private loans. Download a refinancing checklist, run your numbers with a calculator, or subscribe for quarterly rate updates.

Compliance: This is educational content, not financial advice. Refinancing federal loans into private loans removes PSLF and IDR options; review official guidance at studentaid.gov/idr and studentaid.gov/public-service.