BANGKOK – Thailand’s Gold Traders Association has sounded the alarm over soaring gold prices. The group says that if prices keep pushing above 70,000 baht per baht-weight, dozens of gold shops could close in 2026. The reason is simple: buyers are walking away from gold jewellery as living costs bite.

Association president Jitti Tangsitpakdee said the steady rise in domestic prices has changed how people see gold. What was once a familiar part of daily life and tradition now feels out of reach for many households. That shift puts long-standing retailers at risk, along with the jobs they support.

Record-high prices squeeze Thailand’s gold trade

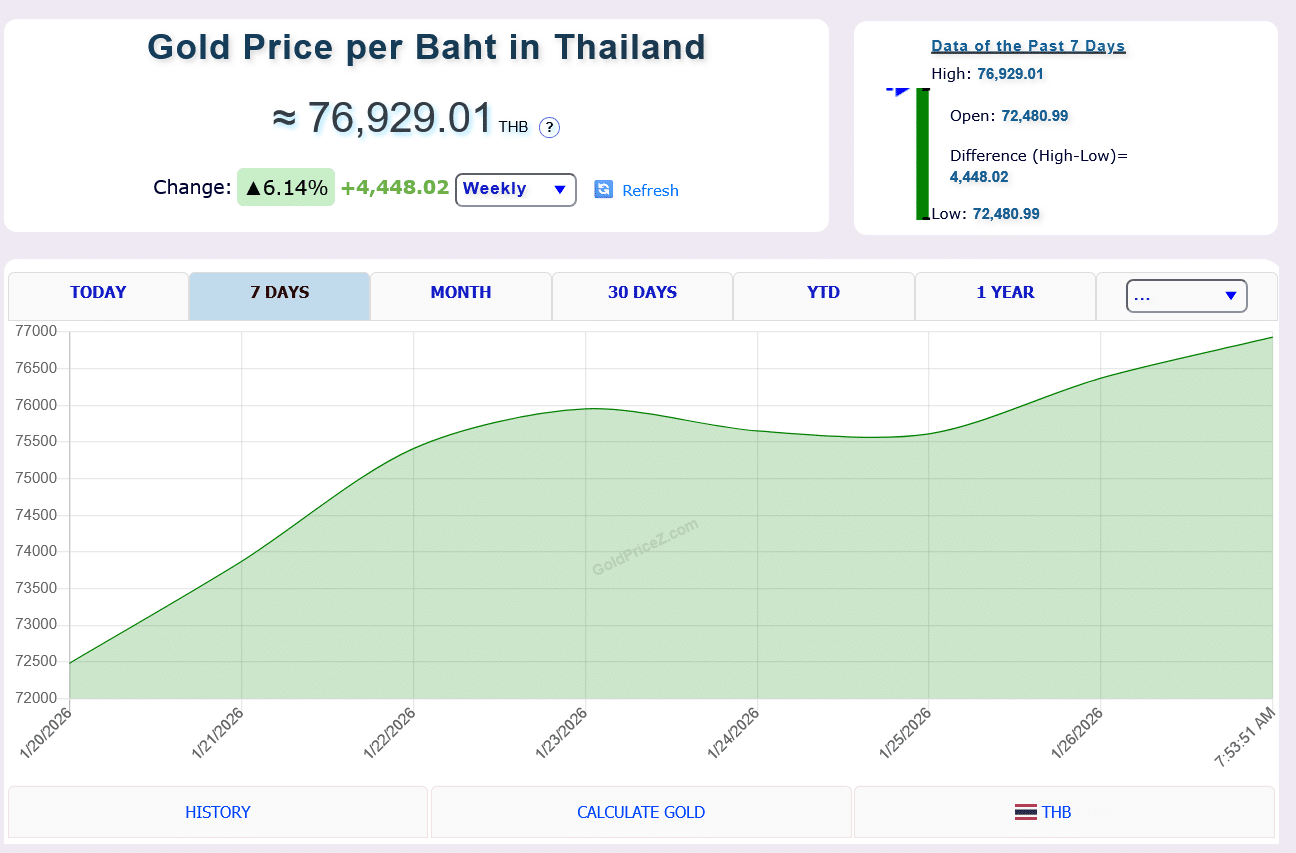

Thailand’s gold market has been especially jumpy in recent weeks. Selling prices for gold bars and ornaments have often climbed past 70,000 baht per baht-weight (about 15.244 grams for bars, slightly less for ornaments).

Updates from the Gold Traders Association show sharp moves within a single day, including drops of 500 baht or jumps of more than 1,000 baht. Those swings track closely with global prices. By late January 2026, prices were sitting around this level or above it, and ornaments often cost more because of making charges.

This rise follows years of steady gains. By mid-2025, local prices were already close to 60,000 baht, and forecasts at the time suggested 70,000 baht could arrive in early 2026. That pace has hit shopfront demand hard, especially for jewellery.

Gold ornaments play a big part in Thai culture, from weddings and festivals to family gifts. Now, many buyers are holding back. In some periods, reported jewellery sales have fallen by more than 50% compared with past years.

Traditional gold shops, often family-run in Bangkok, Chiang Mai, and other provinces, are feeling the strain. When customers treat gold mainly as an investment, sales shift towards bars and away from wearable pieces. That change leaves many jewellers with tighter margins and fewer steady orders.

The association’s warning points to a wider split in the market. Investors and traders may benefit from higher prices, but the ornament trade has shrunk fast. Some shops already be closed in 2025. Without a recovery in demand or calmer prices, 2026 could bring many more closures.

What is pushing global gold prices higher

Thailand’s price surge reflects what is happening worldwide. Gold has set fresh records, often moving above $4,000 per ounce in 2025 and keeping that strength into 2026. Several connected forces are driving the rally.

Geopolitical tension has been a major factor. Ongoing conflicts, trade disputes (including US tariff policies), and fears of wider instability have led more investors and institutions to buy gold. In uncertain times, people often move money into assets seen as safer, and gold remains one of the first choices.

Shifts in monetary policy have also played a part. Expectations of Federal Reserve rate cuts have helped weaken the US dollar, which tends to support gold prices. When real interest rates fall, non-interest assets like gold look more appealing than savings or bonds. A softer dollar can also lift buying power outside the US, which can support demand in markets such as Thailand.

A longer-term driver is heavy central bank buying. Many central banks, especially in emerging markets, have increased gold purchases to reduce reliance on US dollar reserves. Reports suggest official-sector buying has stayed strong over recent years, with hundreds of tonnes added.

Concerns about inflation, high debt levels, and a move towards reserve diversification have kept demand steady. Because this buying is often strategic, it can hold up prices even when other buyers step back.

At the same time, investment demand through ETFs, bars, and coins has increased, with some quarters seeing record inflows. Mining supply has not grown fast enough to match that appetite, which keeps pressure on prices.

What it means for Thailand’s economy and culture

In Thailand, higher gold prices collide with everyday budgets. Movements in the baht against the dollar can add to price shifts, and gold flows can influence the currency. That has led to policy responses, including limits on some forms of online speculative trading to help protect the baht.

While some investors use gold to protect savings during slower growth, ordinary buyers face higher costs. Gold jewellery, long tied to Thai customs and family milestones, now feels too expensive for many people. That change affects not only shop owners, but also goldsmiths and other skilled workers whose livelihoods depend on ornament sales.

The Gold Traders Association says the risk is clear. Without support, steadier prices, or a return in jewellery buying, the trade could shrink further. Some businesses may switch towards bullion, buy-back services, or online sales, but many older shops may not survive the shift.

Some analysts expect gold to stay high through 2026. Forecasts from parts of the market suggest averages of $4,700-$4,900 per ounce or more later in the year, which would keep baht prices elevated. Central bank buying and global tensions could continue to support the uptrend, even though pullbacks remain possible when markets overheat.

For Thailand’s gold industry, survival may depend on adapting quickly. The association’s warning highlights how exposed the trade is when jewellery demand fades. Gold may still appeal as a store of value, but the cost could be steep for local tradition and the small businesses built around it.