BANGKOK, Thailand – Global firms are spreading risk by moving parts of their supply chains away from China, often described as the “China + N” approach. Thailand is picking up speed as a top choice. Rising foreign direct investment (FDI), growing trade within Asia, and major public works are helping the country strengthen its role as a key logistics centre in Southeast Asia.

Trade tensions and recent supply shocks have pushed multinational companies to add new production and distribution bases outside China. Thailand has become a popular option thanks to its central position in ASEAN, a steady business setting, and a capable workforce.

Recent figures show the change in pace. During the first half of 2025, foreign investment approvals rose sharply, alongside higher application volumes and larger capital pledges. Early 2025 brought commitments worth billions, signalling confidence in Thai high-tech and logistics. The Eastern Economic Corridor (EEC) has taken a large share of inflows in some periods, attracting investors from Japan, the United States, Singapore, and China.

By mid-2024, close to half of Thailand’s FDI had moved into logistics-linked activities. That shift helped place Thailand 9th in the 2025 Agility Emerging Markets Logistics Index. Analysts link the trend to production moves in electronics, car parts, and electric vehicles (EVs), where quick transport links and reliable regional networks matter.

Intra-Asian Trade Powers the Next Wave of Growth

Thailand’s rise also reflects stronger trade within Asia, which now makes up a large share of regional activity. ASEAN trade links have deepened, supported by deals such as the Regional Comprehensive Economic Partnership (RCEP), which has helped cross-border business grow.

Thailand’s exports within ASEAN reached large totals in recent years, driven by active trade with partners such as Malaysia, Vietnam, and Indonesia. E-commerce is adding more pressure and opportunity. Thailand has the region’s second-largest online market, forecast to expand from USD 26 billion in 2024 to USD 60 billion by 2030. That growth calls for better warehousing, faster fulfilment, and dependable cross-border delivery.

A stronger focus on nearby markets can reduce exposure to swings in far-off demand. It also supports Thailand’s role as a link between southern China, India, and ASEAN’s 650 million consumers.

Big Public Works Put Infrastructure at the Centre

Large government projects sit behind much of Thailand’s push to lower logistics costs and improve connections across road, rail, sea, and air.

The Eastern Economic Corridor (EEC), The High-Tech Base

Covering Chonburi, Rayong, and Chachoengsao, the EEC is the country’s flagship programme under the Thailand 4.0 plan. It focuses on “S-Curve” sectors such as digital services, EVs, and smart logistics, and it has drawn cumulative investment pledges worth trillions.

In 2025, the EEC continues to attract strong FDI. Rayong land prices rose by over 40% year on year as more firms shift manufacturing there. Policy support, including tax incentives and easier processes, has helped attract investment in data centres, robotics, and biofuels.

Laem Chabang Port Expansion, A Larger Global Gateway

Laem Chabang, Thailand’s busiest port, is in the middle of its Phase 3 expansion. The plan is to raise capacity from 11 million to 18 million TEUs a year by the late 2020s. Work on key parts is reported at roughly 45% to 67%, and new terminals are expected to add more automation and cleaner technology.

Once complete, the upgrade should strengthen Laem Chabang’s place among leading global ports, while easing bottlenecks and supporting exports from the EEC.

The Land Bridge Project, A Bold Cross-Country Link

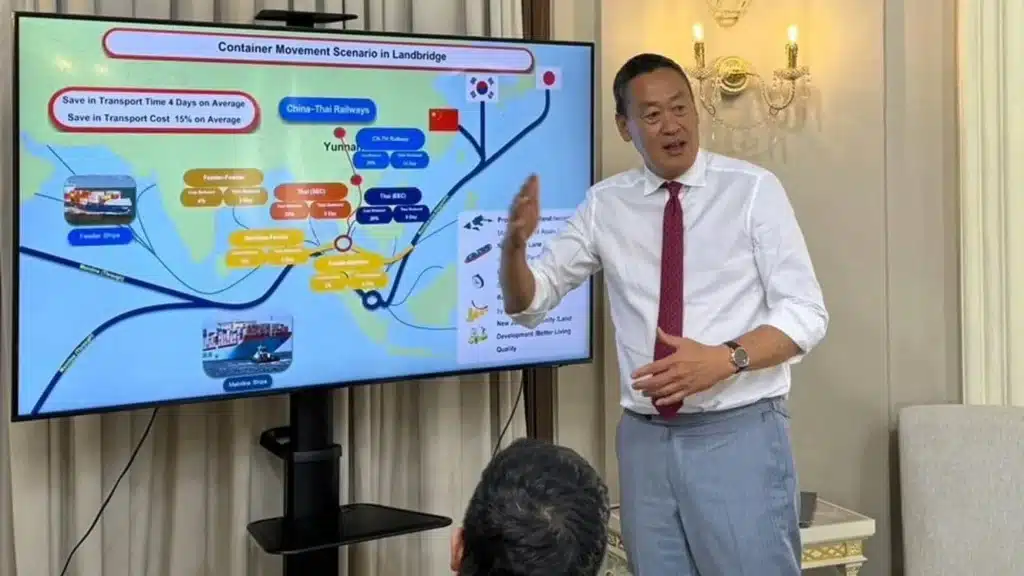

One of the biggest proposals is the trillion-baht Land Bridge. It would connect deep-sea ports in Ranong on the Andaman Sea and Chumphon on the Gulf of Thailand using rail lines, motorways, and pipelines. The aim is to offer a route that reduces reliance on the busy Malacca Strait and cuts time and costs on Middle East to Asia shipping lanes.

By late 2025, feasibility work will be complete. Public bidding is expected in 2026, and operations could start around 2030. Interest from investors in China, Dubai, and Japan points to the scale of demand, while environmental reviews are still in progress.

Along with high-speed rail plans and airport expansion projects such as U-Tapao, these efforts support a multi-route transport network that puts Thailand in a stronger position as an ASEAN logistics hub.

Thailand still faces hurdles. Large projects can slip behind schedule, skilled staff can be hard to find, and major builds often raise concerns about long-term impact on communities and nature. Even so, strong FDI and steady regional trade have kept confidence high.

Forecasts suggest Thailand’s logistics market could grow at close to 6% CAGR through 2033, supporting jobs and lifting the country’s profile in global supply chains.

As a BOI official put it, Thailand is not only spreading supply options, it is working to become one of the strongest links in the chain.