BANGKOK — A tense shareholder vote on Friday kept Chanin Donavanik, 67, in his board seat at Dusit Thani Public Company Limited (SET: DUSIT), dealing a setback to an attempt by his two younger sisters to unseat him.

The extraordinary general meeting became a proxy contest for control of one of Thailand’s best-known hotel groups, highlighting the pressures facing family-founded companies under debt and expansion strain.

The meeting at Dusit Thani’s headquarters, which overlooks Lumpini Park, drew 466 shareholders holding 62.7% of issued shares. Thai law requires at least three-quarters of those present and voting, and a majority of the shares represented, to remove a director.

Although a slim majority of shares backed the move, largely due to the family’s large holding, the proposal failed on the headcount rule because too few individual shareholders supported it. A post-meeting filing stated the resolution did not pass, leaving Mr Chanin in place as director and Chairman of the Executive Committee.

The decision caps months of rising tension within the Piyaoui family, heirs of Thanpuying Chanut Piyaoui, who founded the group in 1948. From modest beginnings, she built a Thai hospitality brand known for warm service and modern comfort, starting with the Princess Hotel in 1949 and the landmark Dusit Thani Bangkok in 1970.

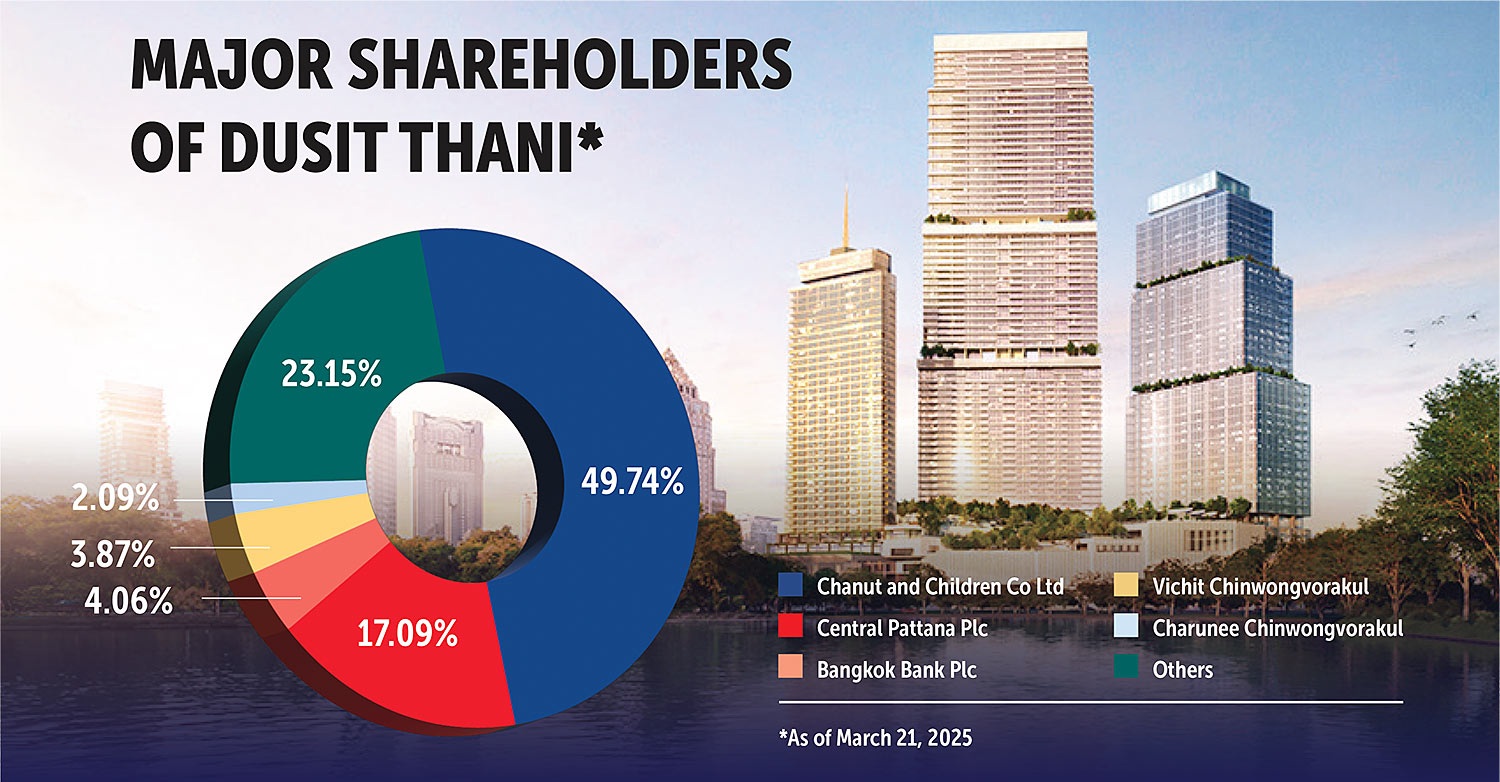

Under Dusit International, the brand now covers more than 300 properties worldwide. After her passing in 2020, her estate, including a 49.7% stake in Dusit Thani held through Chanut and Children Co. Ltd., was divided equally among her three children: Mr Chanin, Sinee Thienprasiddhi and Sunong Salirathavibhaga.

Dusit Thani Posted Losses

Chanin Donavanik has helped set strategy for over thirty years and casts himself as the keeper of his mother’s ethos, Business with Honour. He became acting chairman in July 2025 following the exit of long-time CEO Suphajee Suthumpun, who left to serve as Thailand’s commerce minister.

He now shepherds a business hit by the pandemic and by heavy investment, led by the 46 billion baht (1.3 billion dollars) Dusit Central Park project on the former Dusit Thani Bangkok site. The mixed-use complex, due to fully open on 3 September, features luxury residences (92% sold), a new hotel, retail, and an office tower. It is billed as a showcase for the brand, but it carries large interest costs.

The project sits at the heart of the dispute. Dusit Thani has posted cumulative losses of more than 1 billion baht (28 million dollars) in recent years, driven by COVID shutdowns and pre-opening expenses tied to Dusit Central Park. Mr Chanin Donavanik calls the plan forward-looking and says the company avoided a dilutive capital increase.

We kept the business intact through COVID without asking investors for more cash, he said at a 27 August press briefing beside senior managers. His sisters disagree. They took control of Chanut and Children Co. in February 2025 by voting him off its board, despite his role as co-administrator of the estate, and say the expansion is overreach.

The rift also stems from strategy and governance. The sisters criticize moves into food production and on-demand services, saying these distract from the hotel’s core. They also object to promotions that place Mr Chanin’s descendants in key posts, which they argue weakens family unity.

Sisters Reverse Course

In May 2025, their refusal to approve the company’s audited first-quarter results, even with clean opinions from the auditor, triggered a trading halt on the Stock Exchange of Thailand and unnerved investors. Analysts link the fallout to a post-COVID understanding to split family assets.

Under that plan, Mr Chanin would take Chanut and Children (Dusit Thani), Ms Sinee would take Piyasiri Co. Ltd. (Sukhumvit Hospital), and Ms Sunong would take Thanajirang Co. Ltd. (property leasing). Mr Chanin Donavanik says his sisters reversed course after strong sales at Dusit Residences lifted the hotel group’s prospects.

Corporate intrigue sits in the background. Mr Chanin alleges his sisters act on behalf of Central Group, the retail and property conglomerate with a 17.09% stake in Dusit Thani and more than 20 billion baht invested in Dusit Central Park alongside CPN Retail Growth Property Fund.

He points to proposed board nominees linked to Central, and to plans to expand the board from 12 to 18 seats, which he says would water down family influence and change signing powers. They are trying to rewrite governance to hand control to outsiders, he said, adding he is ready to go to court. I will never leave Dusit Thani.

Finding Common Ground

Central Pattana Plc (CPN), Central Group’s listed arm, rejects any takeover intent. It calls board nominations standard shareholder activity and says it seeks only to support the joint venture’s success.

Industry watchers see familiar patterns from Thailand’s hotel sector, where family firms such as Minor International and Centara have faced succession and control disputes. This fight is about who leads Dusit out of a difficult period, said a Bangkok analyst who asked not to be named.

The failed attempt to remove Mr Chanin keeps him entrenched, but the family is still split. Chanut and Children, now filled with directors aligned with the sisters, retains the power to block key resolutions. Minority investors, who influenced Friday’s outcome, could decide future votes.

Long conflict could weigh on buyer sentiment at Dusit Central Park and delay returns to shareholders. With the complex set to open next week, attention turns to whether the heirs of Thanpuying Chanut can find common ground, or whether an honour-led legacy will fracture under competing aims.

For Mr Chanin, the win carries a cost. My mother saw me as the pillar, he said after the meeting. With losses still on the books and Central’s role under scrutiny, the next phase calls for more than holding on. In a city where family heritage meets corporate muscle, the hotel that once stood for Thai confidence now reflects the risks of a divided house.