News

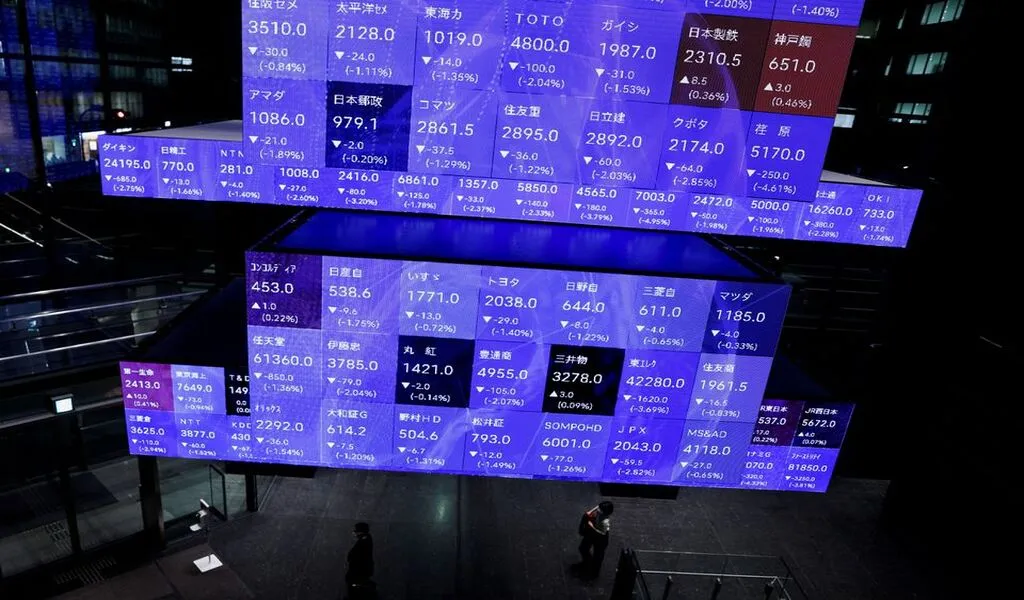

Stocks, Dollar Gain as inflation data Sends Mixed Signals

(CTN News) – After data on U.S. producer prices in November sparked hopes that inflation is slowing but also prompted concerns that the Federal Reserve may need to keep interest rates higher for longer, the dollar increased, and equities on Wall Street eked out a little gain on Friday.

The producer price index (PPI) for final demand grew 0.3% in November and 7.4% over the previous year, while the PPI for October was revised up to 0.3% from the previously reported 0.2%. stated the Labor Department.

Reuters surveyed economists, who predicted that monthly PPI would increase by 0.2% and 7.2% annually.

Even while the data indicated that inflation was slowing, it also sparked worries that the next week’s consumer price index report may show faster-than-expected inflation, delaying the Fed’s rate-cutting plans.

Next Wednesday, Fed officials are anticipated to hike rates by 50 basis points to a range of 4.25% to 4.50%, slowing the rate of rise.

The chief market strategist at Ameriprise Financial in Troy, Michigan, Anthony Saglimbene, predicted that the Federal Reserve would need to increase interest rates a little further.

The figures released today indicate that inflation is declining, but it is lingering and is stickier than most anticipate. However, the markets are unduly confident that the Fed will be prepared to lower interest rates sometime between June and December (next year).

After the preliminary reading on consumer confidence from the University of Michigan indicated an uptick to 59.1 in December from 56.8 the previous month, U.S. equities trimmed losses to trade little changed.

Later, Wall Street stocks mainly increased. The S&P 500 (.SPX) increased by 0.08%, while the Nasdaq Composite (.IXIC) increased by 0.19%. The Dow Jones Industrial Average (.DJI) decreased by 0.03%.

The broad STOXX 600 index (.STOXX) increased by 0.83% in Europe, while the global stocks index (.MIWD00000PUS) of MSCI increased by 0.40%.

Most Treasury yields increased, pointing to impending rate increases. However, the two-year note, a measure of expectations for future inflation, declined somewhat, dropping 0.3 basis points to 4.309%.

The breakeven inflation rates for the United States likewise revealed a falling trend in market pricing. TIPS, or Treasury Inflation-Protected Securities, are a reliable predictor of future prices.

Late Thursday, the two-year breakeven rate decreased from 2.407% to 2.355%, indicating that investors anticipate inflation to be around 2.35% on average over the next two years.

A recession indicator, the yield curve gauging the difference between the rates on two- and 10-year notes also shrank, falling to -76.2 basis points.

Although the dollar was generally lower overnight, some losses were recovered following the PPI data.

The yen gained 0.21% to $136.37 per dollar, while the euro declined 0.14% to $1.0541.

Following a year marred by the Ukraine crisis and skyrocketing inflation, which sparked one of the quickest monetary policy tightening cycles in recent memory, the world’s leading investment banks anticipate that global economic growth will drop even more in 2023.

In the week leading up to Wednesday, investors purchased gold and sold stocks, taking $5.7 billion out of equity funds, according to BofA Global Research, who called it a week of “modest, joyless movements.”

As officials continue to stifle growth to combat inflation, the Fed, the European Central Bank, and the Bank of England are all expected to announce interest rate increases the following week.

According to the ECB, banks in the eurozone are scheduled to return another 447.5 billion euros in multi-year loans early, bringing the total amount of outstanding loans down to roughly 800 billion euros in the next few weeks.

As concerns about a bleak economic picture in China, Europe, and the United States impacted oil consumption, oil prices increased, but both benchmarks were headed for a weekly loss.

Recently, U.S. crude increased by 1.04% to $72.20 a barrel, while Brent increased by 0.98% to $76.90.

American gold futures increased by 0.24% to $1,793.00 per ounce.

Source: Reuters

Related CTN News:

Mount Semeru Volcano Erupts in Indonesia, Over 2,000 People Flee