Entertainment

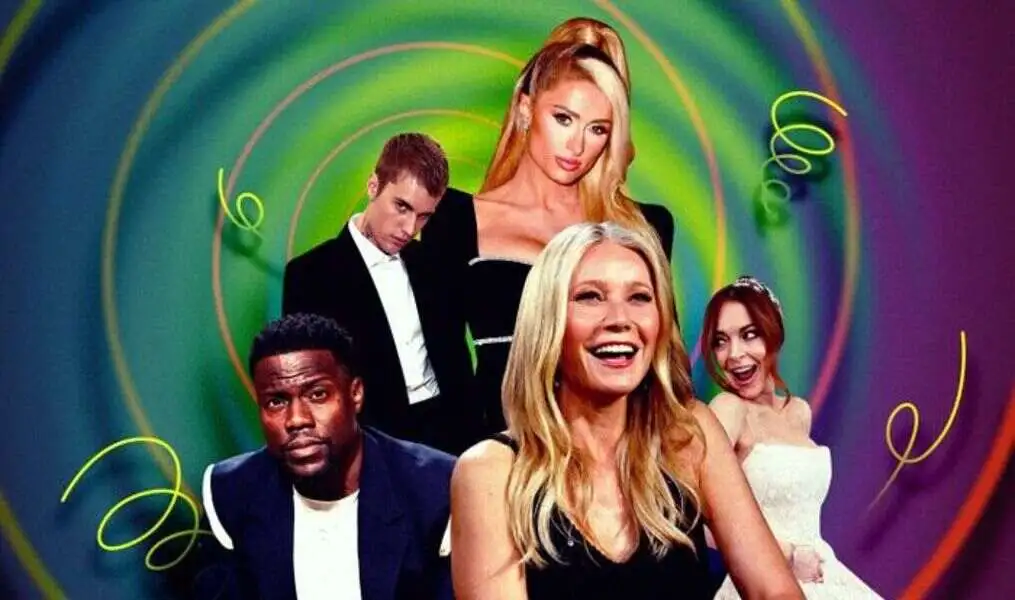

How the Glow of Celeb Fame is Helping NFTs Shine Brighter

Celebrities aren’t always at the forefront of new tech innovations, but they seem to be dashing to become part of NFTs. Their glamor and fame are helping keep NFTs in the spotlight of public consciousness, to the extent that NFTs and NFT stocks are probably strong enough to endure even without any celebrity buzz.

NFTs offer celebrity artists a new revenue channel

NFT stands for non-fungible tokens, which are tokens that are based on blockchain and used to authenticate and prove ownership over digital assets. Almost any type of digital item can be minted into an NFT, including digital art, music tracks, avatars, memes, fashion items, and more.

One of the many benefits of NFTs is that because they perfectly track every trade, artists can use them to continue receiving royalties on their work, which means they enjoy revenue from secondary sales which would otherwise go solely to the middleman. Not surprisingly, even celebrity artists like the idea of keeping more of the profits from their own creative work. Banksy has sold artwork as an NFT, and so did Damien Hirst, digital artist Beeple, and other well-known artists.

Musicians who’ve embraced NFTs include synth-pop singer Grimes, Shakira, Lewis Capaldi, Steve Aoki, Soulja Boy, and Aphex Twin. Shawn Mendes made NFT wearables of his guitar, vest, necklace, and earrings; Jay-Z, Kings of Leon, Doja Cat, and Eminem all sold albums as NFTs, and Katy Perry launched her NFT line in December 2021.

Filmmakers, for their part, discovered that NFTs can secure film scenes and stills, uncut material, and outtakes as well as memes and digital art, making it possible to sell those too. If you want to watch Mila Kunis’ new animated show, Stoner Cats, you’ll need to buy one of the 10,420 NFTs. Quentin Tarantino is battling Miramax for the right to sell uncut scenes from Pulp Fiction as NFTs, and Justin Roiland, creator of Rick and Morty, has an NFT collection for sale.

NFTs and celebrities are a match made in showbiz heaven

Another effect of NFTs is that they enable a more direct relationship between artists and their fans. Musicians found that NFTs and the metaverse offered a way to continue to perform and connect with fans during the pandemic. Travis Scott and The Weeknd already held metaverse concerts, and in case you thought this was just a lockdown phenomenon, ABBA and Ariana Grande both have metaverse concerts planned for next year.

Sports stars quickly learned that fans will fall over themselves to buy NFTs of their greatest athletic achievements. It probably started with NBA’s Top Shots, which turned moments of basketball history into NFTs. By now, we have NFTs commemorating NFL player Rob Gronkowski’s Super Bowl wins; NFT art depicting heavyweight champion Tyson Fury; a set of 4 NFT artworks of footballer Lionel Messi called, appropriately, The Messiverse; and an NFT of skateboarder icon Tony Hawk carrying out his signature move, a 540-degree Ollie, for what he declares is the last time.

The sports-NFT connection is so deep that NFL quarterback Tom Brady co-founded his own sports-focused NFT platform, called Autograph, which Usain Bolt, Naomi Osaka, and Tiger Words have all used to sell signed NFT trading cards. Simone Biles went one step further and sold animated scenes of her most famous and iconic gymnastics moves through Autograph.

Celebrity trades help publicize the NFT market

Celebrities aren’t just minting NFTs to sell to their fans. They’re also putting their money where their mouths are and investing in NFTs themselves, moving NFTs from a nerdy side-show to being part of popular culture.

For example, many people invested in Bored Ape Yacht Club (BAYC) NFTs after celebrities like Jimmy Fallon, DJ Khaled, and Post Malone publicized their purchases and made Bored Apes into a status symbol. In fact, Jimmy Fallon’s announcement about his Bored Ape was probably the first time many had heard of NFTs.

Celebrity investment puts NFTs into the headlines, normalizing the concept in a broader way. Buying and selling digital assets is still pretty new, so the more people read about NFT trades, the more likely they are to feel confident enough to buy in themselves.

It helps that an incredibly broad range of celebrities have either bought into or minted their own NFTs. Snoop Dogg was a very early investor in NFTs, creating a portfolio worth over $17 million under the pseudonym Cozomo de Medici. Top fashion brands Burberry and Dolce & Gabbana made NFT-based digital fashion collections. Entrepreneur Gary Vaynerchuck launched an NFT project called VeeFriends; tennis star Serena Williams has an impressive NFT portfolio; and Martha Stewart has already sold not one, but two series of NFTs.

NFTs aren’t relying on famous names for success

While celebrities helped raise public awareness about NFTs, people don’t (and shouldn’t) choose to invest in an NFT just because a celebrity is involved. There’ve been enough celebrity NFTs that have lost value after their initial drop to prove that being famous isn’t enough to guarantee that your NFT will soar.

At the end of a year of massive NFT activity, it’s arguable that NFTs don’t need help from the stars any more. Although NFT prices have fluctuated, just like those of every investment, there’s no sign that this is a bubble waiting to burst.

Investors who want to be part of the NFT excitement, but don’t want the risk or responsibility of hunting for an NFT that’s likely to increase in value, have been looking for NFT stocks to buy instead. Top NFT stocks can be companies that create NFT content, but there are also blockchain companies, cryptocurrencies, and NFT infrastructure stocks on any best NFT stocks list and in NFT ETFs, which are another option for would-be NFT investors to join celebrities in this disruptive sector.

Important Disclosures:

Investing involves risk. Principal loss is possible. As an ETF, the fund may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The Fund is not actively managed and would not sell a security due to current or projected under performance unless that security is removed from the Index or is required upon a reconstitution of the Index.

The Index, and consequently the Fund, is expected to concentrate its investments (i.e., hold more than 25% of its total assets) in the securities of Crypto and Blockchain Companies. As a result, the value of the Fund’s shares may rise and fall more than the value of shares of a fund that invests in securities of companies in a broader range of industries.

The mechanics of using blockchain technology to transact in digital or other types of assets, such as securities or derivatives, is relatively new and untested. There is no assurance that widespread adoption will occur. A lack of expansion in the usage of blockchain technology could adversely affect Crypto and Blockchain Companies. Transacting on a blockchain depends in part specifically on the use of cryptographic keys that are required to access a user’s account (or “wallet”). The theft, loss, or destruction of these keys could adversely affect a user’s ownership claims over an asset or a company’s business or operations if it was dependent on the blockchain.

The Fund is considered to be non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. As a result, the Fund may be more exposed to the risks associated with and developments affecting an individual issuer or a smaller number of issuers than a fund that invests more widely. This may increase the Fund’s volatility and cause the performance of a relatively smaller number of issuers to have a greater impact on the Fund’s performance.

Investments in non-U.S. securities involve certain risks that may not be present with investments in U.S. securities. For example, investments in non-U.S. securities may be subject to risk of loss due to foreign currency fluctuations or to political or economic instability. There may be less information publicly available about a non-U.S. issuer than a U.S. issuer.

The BITA Next Gen NFT Index is a rules-based index that consists of the common stock (or depositary receipts) of companies that are building a platform or developing technology to use, or have at least one use or test case for using, NFT (Non-Fungible Token), cryptocurrency trading platforms, cryptocurrency mining, cryptocurrency banking or related services, or blockchain-related technology, as well as companies that have announced publicly that they intend to enter such space or have begun working on such products (collectively, “Crypto and Blockchain Companies”). The Index consists of companies listed on North American and European exchanges and aims to capture the potential upside generated by earnings related to the adoption of crypto- and blockchain-related technologies, including NFTs and cryptocurrency.

Neither the Fund nor its relative Index will invest directly in NFTs or any funds investing in NFTs. The Index, and as a result the Fund, are currently limited to investments in companies with exposure to the NFT ecosystem. As a result, the Fund’s price movement will not track individual or collections of NFTs. Since NFTs are an emerging technology, the Index is currently expected to consist of companies whose activities in the NFT ecosystem comprise a smaller portion of their revenues, profits, or investments relative to other activities or industries in which they engage. There can be no guarantee that a company’s activities in the NFT ecosystem will become significant for the company or that its economic fortunes will be tied to such activities in the future.

NFTZ is new with a limited operating history.

Go to defianceetfs.com/nftz to read more about NFT including current performance and holdings information. Fund holdings are subject to change and should not be considered recommendations to buy or sell any securities.

The Defiance ETFs are distributed by Foreside Fund Services, LLC.

The Funds’ investment objectives, risks, charges, and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company. Please read carefully before investing. A hard copy of the prospectuses can be requested by calling 833.333.9383 or at defianceetfs.com.

Also Check:

How E-bikes Help to Boost Fitness and Why It is Necessary for You

How the Glow of Celeb Fame is Helping NFTs Shine Brighter

Why Cybersecurity Careers are the Fastest Growing in IT

Three Reasons why you should consider an Electric Van