Business

What Is Free Cash Flow And How To Calculate Free Cash Flow?

What is Free Cash Flow? – As a business owner or investor, you need to be aware of the financial health of the company you are running or investing in.

One important financial metric to know is free cash flow (FCF).

This article will define FCF, explain why it is important, and show you how to calculate it.

1. What is Free Cash Flow?

Free cash flow is a financial metric that measures how much cash a company generates from its operations after deducting the capital expenditures required to maintain or expand its asset base.

It indicates a company’s financial health and performance, as it shows how much cash is available to fund growth opportunities, pay dividends, reduce debt, or buy back shares.

2. Why is Free Cash Flow Important?

Free cash flow is important because it represents the amount of cash that a company has available to distribute to its shareholders, invest in new projects, pay off debt, or make acquisitions.

It also an indicator of a company’s financial health and ability to generate cash from its operations.

Investors often use FCF to evaluate the value of a company and its stock.

They may compare a company’s FCF to its market capitalization or use it to calculate valuation multiples like price-to-earnings (P/E) ratio or price-to-free cash flow (P/FCF) ratio.

3. How to Calculate Free Cash Flow

To calculate FCF, you need to subtract the capital expenditures from the company’s operating cash flow. Here’s a breakdown of the steps:

3.1 Operating Cash Flow

Operating cash flow (OCF) is the cash a company generates from its operations, including sales revenue, accounts receivable, accounts payable, and inventory.

It is calculated by subtracting the company’s operating expenses from its revenue. The formula for operating cash flow is:

Operating Cash Flow = Net Income + Depreciation and Amortization - Changes in Working Capital3.2 Capital Expenditures

Capital expenditures (CAPEX) are a company’s investments in long-term assets like property, plant, and equipment (PP&E).

They represent a company’s cash on new investments and upgrades to its existing assets.

To calculate CAPEX, you need to subtract the company’s ending PP&E balance from its beginning PP&E balance and add any depreciation expense. The formula for CAPEX is:

Capital Expenditures = Ending PP&E - Beginning PP&E + Depreciation Expense

3.3 Free Cash Flow Formula

Once you have calculated the OCF and CAPEX, you can use the following formula to calculate FCF:

Free Cash Flow = Operating Cash Flow - Capital Expenditures:max_bytes(150000):strip_icc():format(webp)/FreeCashFlowFormula-2fad976df0a24fa493222e21e3a86648.jpg)

4. Interpretation of Free Cash Flow (continued)

On the other hand, a negative FCF means that a company is spending more cash than it is generating from its operations.

This can be a red flag for investors, as it may indicate that the company is not generating enough cash to fund its operations or growth initiatives.

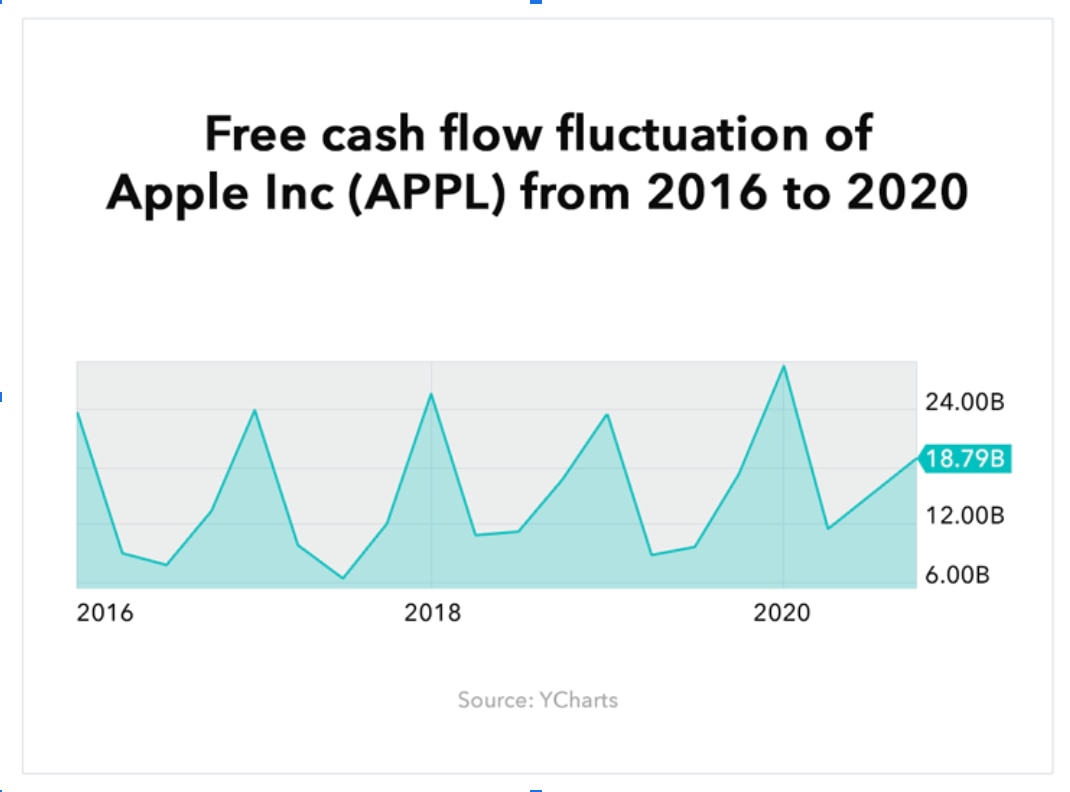

It’s important to note that FCF can vary significantly from quarter to quarter or year to year, depending on a company’s investment plans or changes in its working capital.

Therefore, looking at FCF trends over several periods is best to better understand a company’s financial health.

In addition to calculating free cash flow on a standalone basis, investors often compare a company’s free cash flow to its earnings or net income.

This is known as the free cash flow yield and can be used to evaluate how efficiently a company is generating cash relative to its earnings.

5. Limitations of Free Cash Flow

While FCF is a useful metric for evaluating a company’s financial health, it has its limitations.

For example, FCF does not take into account the time value of money, which can be significant for long-term investments or projects.

Additionally, accounting choices, such as depreciation schedules or working capital management, can affect FCF.

Therefore, investors should use FCF in conjunction with other financial metrics, such as net income, earnings per share, or return on equity, to get a more complete picture of a company’s financial performance.

6. Free Cash Flow vs. Operating Cash Flow

Operating cash flow (OCF) and free cash flow (FCF) are related but different financial metrics.

OCF represents the cash generated or used by a company’s operations, while FCF represents the cash that is available after accounting for capital expenditures.

While both metrics are important for evaluating a company’s financial health, FCF provides a more complete picture of a company’s cash position, as it considers its investment plans and potential for growth.

7. Free Cash Flow vs. Earnings

Earnings, or net income, is another financial metric that is often used to evaluate a company’s financial performance. While earnings represent a company’s profitability, FCF represents its ability to generate cash from its operations.

A company can have high earnings but low FCF if it is spending a lot of cash on capital expenditures or is not managing its working capital effectively.

Therefore, it’s important to consider both earnings and FCF when evaluating a company’s financial health.

8. Examples of Free Cash Flow Calculation

Let’s look at an example of how to calculate FCF for a fictional company called XYZ Corp.

Assume that XYZ Corp. had the following financial data for the year:

- Net income: $100,000

- Depreciation and amortization: $20,000

- Changes in working capital: -$10,000

- Beginning PP&E balance: $500,000

- Ending PP&E balance: $550,000

Using the formulas and steps outlined above, we can calculate the FCF for XYZ Corp. as follows:

Operating Cash Flow = Net Income + Depreciation and Amortization – Changes in Working Capital

= $100,000 + $20,000 – (-$10,000)

= $130,000

Capital Expenditures = Ending PP&E – Beginning PP&E + Depreciation Expense

= $550,000 – $500,000 + $20,000

= $70,000

Free Cash Flow = Operating Cash Flow – Capital Expenditures

= $130,000 – $70,000

= $60,000

Therefore, XYZ Corp. generated $60,000 in FCF for the year.

9. Free Cash Flow Analysis

- FCF Trends: Look at FCF trends over several periods to see if a company is generating consistent cash flow or if there are significant fluctuations. A consistent or growing FCF trend is generally a positive sign for investors.

- FCF Margin: Calculate FCF as a percentage of revenue to see how much cash a company is generating relative to its sales. A high FCF margin may indicate that a company is operating efficiently and has a strong cash position.

- FCF Yield: Calculate FCF as a percentage of market capitalization to see how much cash a company is generating relative to its market value. A high FCF yield may indicate that a company is undervalued or has strong growth potential.

- FCF to Debt Ratio: Calculate FCF as a percentage of total debt to see how much cash a company is generating relative to its debt load. A high FCF to debt ratio may indicate that a company has the ability to pay off its debt or invest in growth initiatives.

- FCF to Equity Ratio: Calculate FCF as a percentage of total equity to see how much cash a company is generating relative to its shareholders’ equity. A high FCF to equity ratio may indicate that a company has strong cash flow and the ability to pay dividends or invest in growth initiatives.

10. Conclusion

In conclusion, free cash flow is a valuable financial metric for evaluating a company’s financial health and ability to generate cash from its operations.

By calculating and analyzing FCF, investors can make informed investment decisions and better understand a company’s financial position.

While FCF has its limitations, it provides a more complete picture of a company’s cash position than other financial metrics such as net income or earnings per share.

Therefore, investors should consider FCF in conjunction with other financial metrics to get a more complete picture of a company’s financial health.

RELATED CTN NEWS:

How To Find A Job You Love? Steps To Increase Your Chances Of Landing A Fulfilling Career

How To Make Home Depot Credit Card Payment?: 4 Ways To Make Payment

What Is A Target Market? How To Identify And Reach Your Own Target Audience