Business

Top Tech Companies’ Market Values Are Being Batter By 2022

(CTN News) – You would think that tech giants would be too big to fail, wouldn’t you? According to market capitalization, the five largest companies are suffering from an increase in inflation.

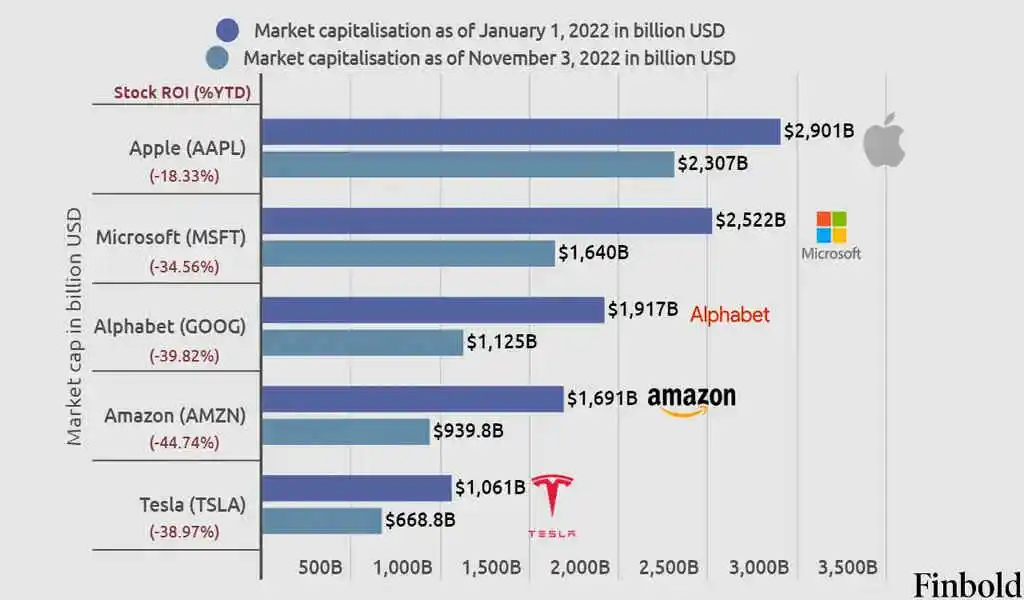

Apple, Microsoft, Alphabet (owner of Google), Amazon, and Tesla have all lost significant market value since January 2022, with Amazon losing -44.74 percent. You can view the full infographic below from the finance news site Finbold.

In 2018, Apple and Microsoft joined the trillion-dollar club. Within a short period of time, Amazon and Alphabet followed.

It is not the first time that big tech companies’ valuations have collapsed. A few years after COVID-19 hit in 2020, these same companies (minus Tesla, perhaps) were hit quite hard, so much so that Microsoft was the only company to maintain trillion-dollar status at the time.

As a result, they bounced back quite quickly (all the while being pursued by Meta/Facebook, the final member of the “Frightful Five,” though Tesla might be taking its place in the club).

As of 2021, we were comparing the individual net worth of these companies to the GDP of entire countries. On paper, Apple was worth more than 96% of the world’s GDP at the time.

This year’s drop has been particularly severe for Amazon, which has lost almost half its value. Tesla and Alphabet are not far behind, each having lost close to 40%.

Despite the loss of 18.33%, Apple’s market value has decreased to “only” $2.307 billion. These five companies alone have suffered losses of $3.41 trillion. As of now, only three companies have a trillion-dollar market cap.

The reason companies that could withstand the pandemic didn’t do better in 2022 is, according to Finbold, “existing market conditions resulting from Federal Reserve tightening policies and higher inflation resulting in high volatility for the stock market,” as well as other market fundamentals that fluctuated.

Finbold also describes this as a ‘correction in valuation,’ which occurs following a bull market like the one these companies experienced during the pandemic.

There is no doubt that their stocks enjoyed an abnormally stretched valuation during that period. It is time to take a hard look at reality.

However, as any financial advisor will tell you, wait until you see the beating your 401K and other investments take during a year like this. There will be a rebound. If a real recession occurs, that may have something to do with it.

SEE ALSO:

05 Nov 2022: Gold Rates Decline By Rs 300 Per Tola