Business

Starter Portfolio: 3 Stocks You Should Buy

(CTN NEWS) – Starter Portfolio – Macroeconomic and geopolitical hindrances have encouraged increased stock market volatility this year.Because of sluggish consumer spending, dangers to the global economy, and additional interest rate hikes, Fed staff economists cautioned that the likelihood of a recession in the coming year had climbed to about 50%.

The Consumer Price Index (CPI), which increased 7.7% from a year earlier in October, showed that inflation decreased more than anticipated.

The UK Consumer Price Index hit a 41-year record in October. Presented by @CMEGroup pic.twitter.com/Vok2BsxUC7

— Bloomberg Quicktake (@Quicktake) November 16, 2022

As a result, during the Fed’s meeting earlier this month, a “substantial majority” of decision-makers concurred that it would “likely soon be appropriate” to pause the rate of rate increases. The FOMC minutes issued on Wednesday stated that a slower pace would enable the Federal Open Market Committee to review progress toward its maximum employment and price stability objectives.

Ned Davis Research claims that the probability of a “goldilocks” scenario, in which the Fed controls inflation and averts a recession, has grown in the wake of October’s positive CPI report for investing in fast growth stocks.

Paul Krugman, the Nobel Prize-winning economist, also thinks that the likelihood of a gentle landing for the economy is rising.

Beginners may want to consider boosting their Starter Portfolio’s with solid stocks like CSX Corporation (CSX), Albertsons Companies, Inc. (ACI), and KT Corporation (KT) amid rising optimism.

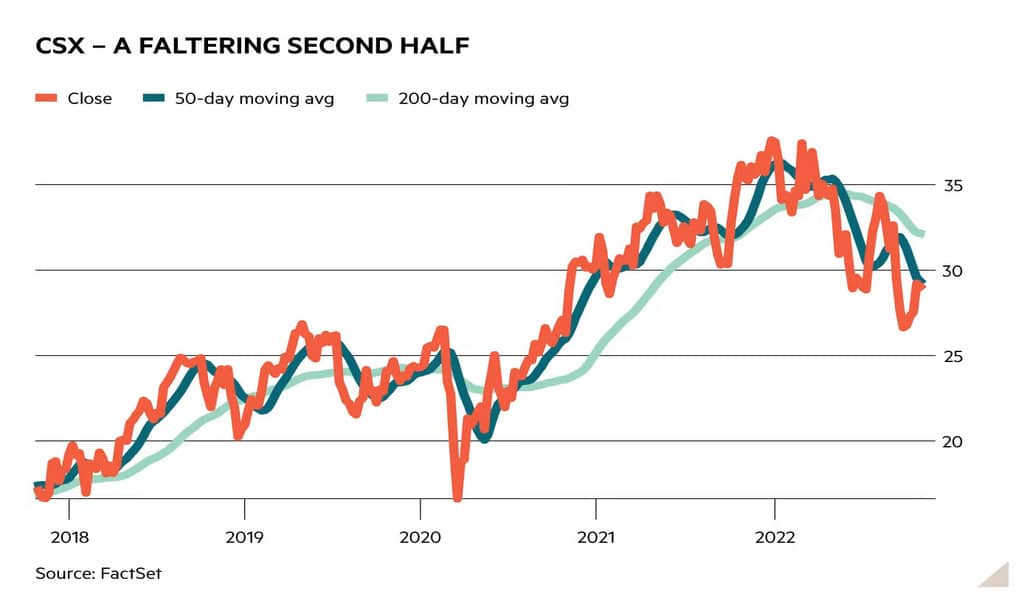

CSX Corporation (CSX)

CSX offers rail-based freight transportation services. Along with other transportation services like rail-to-truck transfers and bulk commodities operations. The company provides rail and intermodal transportation services through a network of about 30 terminals. The business runs a nearly 19,500 route-mile rail network.

The company’s Board of Directors approved a quarterly dividend of $0.10 per share on October 6. This dividend is due on December 15, 2022.

Each year, it distributes a dividend of $0.40 per share or 1.30% of the current share price. Its dividend yield over four years is 1.25%.

Over the last three years and the last five years, the company’s dividend distributions have increased at a CAGR of 7.9% and 9.2%, respectively. 17 years in a row, the corporation has increased dividends.

The third quarter of fiscal 2022, which concluded on September 30, 2022, saw an 18.3% year-over-year growth in CSX’s revenue to $3.90 billion.

Operating income for the corporation increased by 10% from the same time last year to $1.58 billion. Its EPS came in at $0.52, up 20.9% year over year, while its net earnings came in at $1.11 billion, up 20.9% from the previous year’s value. In addition, net cash created by operating activities increased to $4.26 billion over the same quarter last year, an 11.4% increase.

Analysts predict that CSX will earn $14.90 billion in revenue for the fiscal year that ends in December 2022, an increase of 19% from the previous year.

The company expects its EPS for the current year to rise 21.9% from last year to $1.90. The business has a strong track record of beating earnings projections for the previous four quarters. The share price closed the most recent trading session at $32.07, up 13.7% over the previous month.

This encouraging outlook is reflected in CSX’s POWR Ratings. Each of the 118 elements is given the appropriate weight when determining the POWR Ratings.

The stock gets a Quality, Momentum, and Sentiment rating of B. CSX is placed #7 in the 16-stock B-rated Railroads sector. Additional POWR Ratings for CSX can be found here (Growth, Value, and Stability).

Albertsons Companies, Inc. (ACI)

In the US, ACI manages grocery and medicine businesses. Groceries, general merchandise, health and beauty care products, pharmacy, petrol, and other goods and services are available at the company’s food and retail drug outlets. Additionally, it produces and processes food items for retail sale.

In a legally binding agreement signed on October 14, ACI and Kroger (KR) agreed to combine two complementing enterprises with well-known brands and substantial local roots to create a national presence. Combining two reputable supermarket banners ought to help increase customer reach.

Shareholders of ACI can anticipate receiving total compensation worth $34.10 per share. “This merger with Kroger delivers significant value to shareholders and exciting potential for colleagues to be part of a merged organization with the opportunity to better support the lives and health of millions of Americans,” said Chan Galbato, Co-Chair of ACI’s Board of Directors and CEO of Cerberus Operations. On November 14, 2022, the Board of Directors of ACI distributed a cash dividend of $0.12 per share for the third quarter of 2022.

It has an annual dividend yield of 2.28% and pays $0.48 in dividends, or $0.48 each year. Its average dividend yield over the previous four years was 1.22%. The second quarter of fiscal 2022, which concluded on September 30, 2022, had an 8.6% year-over-year growth in net sales and other revenue at ACI, reaching $17.92 billion.

Operating income increased by 9.3% over the previous year to $531 million. Adjusted EBITDA increased by 8.6% from the same quarter last year to $1.05 billion.

The company’s adjusted net income also improved by 13.2% from the prior year’s amount to $418.30 million, and it rose by 12.5% year-over-year to $0.72 per Class A common share. Analysts forecast a 4.3% year-over-year growth in ACI’s third-quarter sales to $17.45 billion for its fiscal 2023 (which ends in November 2022).

It is anticipated that the company’s sales for the current fiscal year will rise 6.5% from the previous year to $76.56 billion.

In addition, throughout the previous four quarters, the company has consistently outperformed consensus revenue projections. The stock has lost 2.7% over the last month, ending the most recent trading day at $20.44.

ACI’s positive outlook and solid fundamentals are reflected in its POWR Ratings. In our POWR Rating system, the stock’s overall A rating corresponds to a Strong Buy. It receives a B for quality and an A for value.

It is ranked #5 out of 39 stocks in the Grocery/Big Box Retailers sector with an A rating. Additional POWR Ratings from ACI for Growth, Stability, Sentiment and Momentum may be seen here.

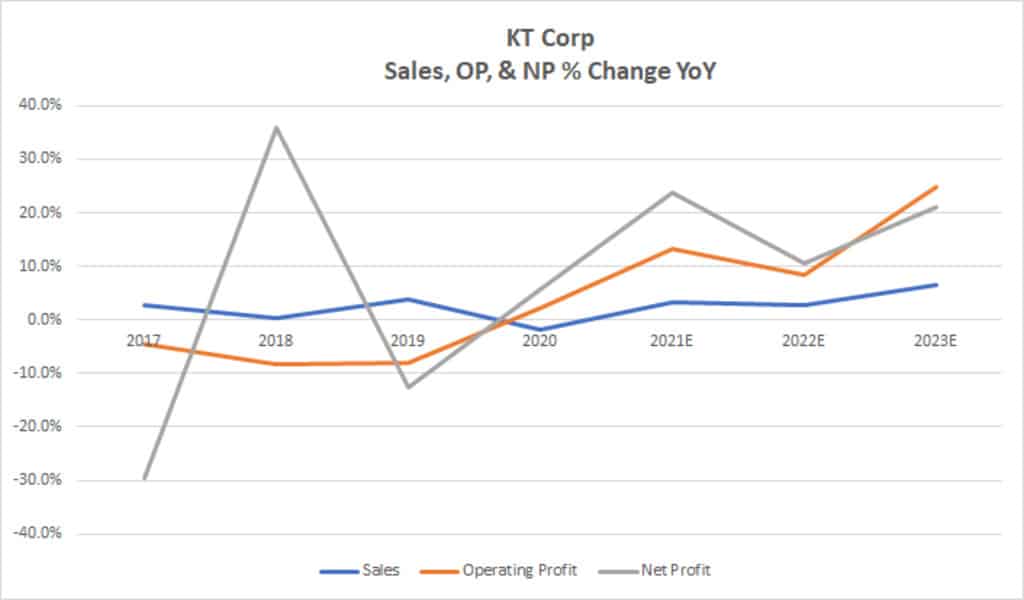

KT Corporation (KT)

Leading telecommunications service company KT is based in Korea. Information and Communications Technologies, Finance, Satellite Broadcasting, and Other are the company’s four business segments. In an announcement made on October 7, KT stated that it would strengthen its strategic alliance with Hyundai Motor Company (HYMTF).

HYMTF and KT have worked together on the Connected Car market for many years.

KT has additional ambitions to supply communication modules and connections to HYMTF’s domestic and international OEM automobiles.

In addition, to support the growth of their relationship, both companies decided on September 7 to exchange shares of each other’s businesses through a treasury stock exchange. KT decided to exchange shares worth 750 billion won ($564.05 million) with Hyundai Motor and Hyundai Mobis.

Operating revenue for KT climbed 4.2% year over year to 6.48 trillion ($4.87 billion) for the third quarter of fiscal 2022.

Its operating income was 452.90 billion yen ($340.61 million), an increase of 18.4% over the previous year. EBITDA for the business rose 6.4% from the previous year to $1.02 billion.

Assets for the company were 40.65 trillion ($30.57 billion), up from 35.83 trillion ($26.95 billion) a year earlier.

KT pays a dividend of $0.75 per share once a year or a yield of 5.45% on the current share price. Its dividend yield over four years is 4.62%.

Over the last three years and the last five years, the company’s dividend payouts have increased at a CAGR of 16.7% and 16.6%, respectively.

For the fiscal year ending in December 2023, analysts forecast a rise in KT’s revenue of 3.3% over the previous year to $19.77 billion and an increase in its earnings per share of 4.2% over the previous year of $1.96.

The stock rose 10.1% this year and 11.6% over the previous month to conclude the most recent trading session at $13.86.

KT has an overall rating of B, which corresponds to a Buy in our POWR Ratings methodology of its positive outlook. It receives an A for Value and a B for Stability grades. KT is also recognized as the sixth-best stock out of 46 in the A-rated Telecom – Foreign sector.

Additional POWR Ratings (Momentum, Sentiment, Quality, and Growth) for KT are available here.

In Friday’s premarket trade, shares of CSX remained steady. CSX’s year-to-date fall is greater than the benchmark S&P 500 index’s year-to-date gain of 14.29%.

RELATED CTN NEWS:

Oil Prices Drop as Russian Price Cap Proposal Eases Supply Concerns