Business

Maxis Berhad (KLSE:MAXIS) Price In Line With Earnings

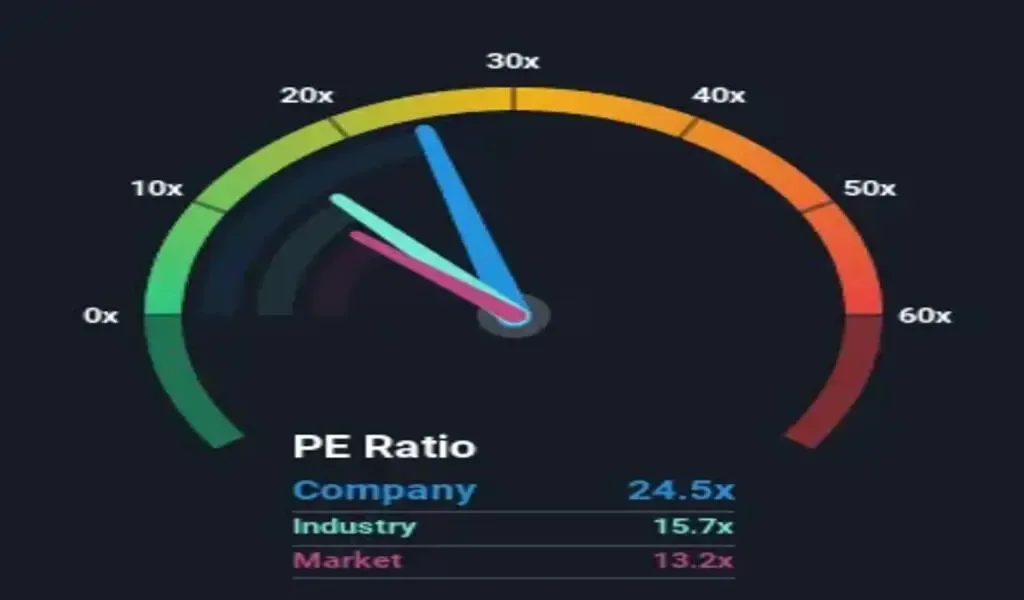

(CTN News) – With a price-to-earnings (or “P/E”) ratio of 24.5x, Maxis Berhad (KLSE:MAXIS) could look like a strong sell right now compared to the Malaysian market, where around half of the companies have a P/E ratio below 13x, and even P/E ratios below 7x are not uncommon at all.

There is a possibility that the P/E may not be a true representation of a company’s prospects because there may be a reason why the P/E is so high.

Maxis Berhad has experienced a downward trend in its earnings recently, which is not good news, while the market has been experiencing growth in those earnings lately.

There is a possibility that the high P/E ratio could be caused by investors’ expectation that this poor earnings performance will turn around at some point in the future.

The very least you want is that it’s true, because if it’s not, you’re liable to be paying a hefty price for no good reason at all.

Have you ever wondered how analysts feel about the future of Maxis Berhad in comparison to other companies in the industry? Our free report is a helpful place to get started if you are in that situation.

Does Growth Match The High P/E Ratio?

As a matter of fact, the only time you’d be comfortable seeing a P/E curve as steep as Maxis Berhad’s is when the company’s growth is on track to outperform the market by a considerable margin.

According to the company’s historical data, the bottom line of the company declined by 8.0% last year. Due to this, earnings from three years ago have also fallen 14% overall, compared with earnings from three years ago.

As a consequence, shareholders would have been less optimistic about medium-term rates of earnings growth than they were in the past.

Looking at the outlook for the next three years, according to analysts that are watching the company closely, the market is expected to grow by 13% per year for the next three years.

Interestingly, the rest of the market is only expected to grow by 11% each year, which makes it much less attractive when compared with the rest of the market.

In light of the above, it is understandable why Maxis Berhad’s price-to-earnings ratio sits ahead of the majority of other companies on the market.

According to sources, shareholders do not seem eager to sell off an asset that may offer a more prosperous future in the near future.

What Does Maxis Berhad’s P/E Tell Us About Its Future?

There’s no question that the price-to-earnings ratio shouldn’t be the determining factor in deciding whether or not to buy a stock, but it can be a really good indicator of what to expect from the company’s earnings.

SEE ALSO:

![April'S Full Moon 2024: When To Witness Pink Moon [And Zodiac Insights] 7 April's Full Moon 2024](https://www.chiangraitimes.com/wp-content/uploads/2024/04/Full-Moon-1-80x80.webp)