Business

How To Invest In Real Estate: Key Steps To Consider When Investing In Real Estate

How to Invest in Real Estate – Real estate investment can be a lucrative business venture for those who know how to navigate the market. However, it can also be a risky endeavor for those who don’t have a clear understanding of the industry.

If you’re considering investing in real estate, there are several factors to consider before making your first purchase

In this article, we’ll explore the basics of real estate investment and provide a comprehensive guide to help you make informed decisions when investing in property.

1. Understanding Real Estate Investment

What is Real Estate Investment?

Real estate investment involves the purchase, ownership, management, rental, and/or sale of a property for profit. Real Estate Listings property can be a residential, commercial, or industrial building, or land.

Investors make money from real estate investment through rental income, appreciation, and profits generated from selling the property.

Why Invest in Real Estate?

There are several reasons why you should consider investing in real estate.

Firstly, it provides a stable source of passive income. Rental properties can generate a steady stream of income that can help you achieve financial freedom. Secondly, real estate can be a hedge against inflation.

Property values tend to rise over time, which can help protect your investment from inflation. Finally, real estate investment provides tax benefits.

Investors can deduct property taxes, mortgage interest, and depreciation on their taxes, reducing their tax burden.

2. Factors to Consider Before Investing in Real Estate

Location

The location of the property is one of the most important factors to consider when investing in real estate.

Properties located in desirable neighborhoods with good schools, easy access to transportation, and low crime rates tend to appreciate in value over time.

On the other hand, properties in less desirable areas may have lower initial costs but may not appreciate in value as quickly.

Market Trends

Real estate markets are cyclical and can be affected by local and national economic conditions. Before investing

Property Condition

Before investing in a property, it’s essential to assess its condition. If the property is in poor condition, it may require significant renovations and repairs, which can be costly.

Inspecting the property thoroughly to identify any potential issues and estimate the cost of repairs is crucial. The property’s condition can also affect its rental income potential and resale value.

3. How to Invest in Real Estate

This will discuss some key steps to consider when investing in real estate.

1. Determine your investment goals

Before investing in real estate, it is important to determine your investment goals.

- What do you hope to achieve through this investment?

- Are you looking for long-term financial stability or short-term gains?

- Do you want to invest in residential or commercial properties?

Understanding your goals will help you make informed decisions and develop a solid investment strategy.

2. Research the market

Real estate markets can vary greatly depending on location, economic conditions, and other factors. It is important to research the market thoroughly before making any investment decisions.

Look at trends in property values, rental rates, and vacancy rates. Consider factors such as job growth, population growth, and local regulations that may impact the market.

This information will help you make informed decisions about where and when to invest.

3. Develop a budget

Real estate investing can be expensive, so it is important to develop a budget that considers all the costs associated with the investment.

This may include the property’s purchase price, closing costs, renovation costs, property management fees, and ongoing maintenance expenses.

Make sure you have a clear understanding of all of these costs before making any investment decisions.

4. Choose the right property

Choosing the right property is critical to the success of your real estate investment. Look for properties that are in desirable locations, have good potential for appreciation, and are in good condition.

Consider factors such as the age of the property, the condition of the roof and foundation, and any potential issues with the plumbing or electrical systems.

It is also important to consider the property’s rental potential if you plan to rent it out.

5. Consider financing options

There are a variety of financing options available for real estate investors, including traditional mortgages, private loans, and hard money loans.

Each option has its own advantages and disadvantages, so it is important to carefully consider which option is right for you. Factors to consider include interest rates, repayment terms, and the amount of money you are able to borrow.

6. Develop a solid management plan

If you plan to rent out your property, developing a solid management plan is important. This may include hiring a property management company to handle tenant screening, rent collection, and maintenance issues.

It is also important to have a plan in place for handling any emergency situations that may arise.

7. Be prepared for the unexpected

Real estate investing can be unpredictable, so preparing for the unexpected is important. This may include unexpected repair costs, market condition changes, or vacancies.

Having a solid financial plan in place can help you weather these challenges and ensure the long-term success of your investment.

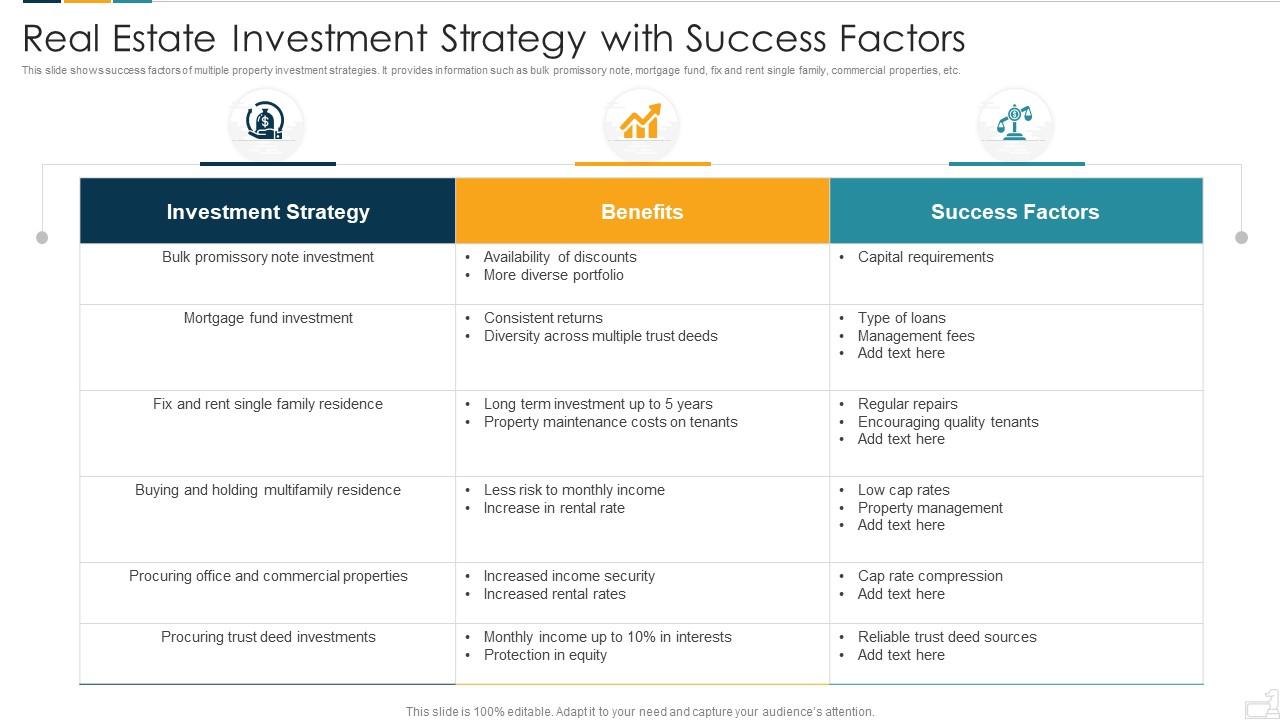

4. Strategies for Successful Real Estate Investment

Long-Term vs. Short-Term Investment

Real estate investment can be a long-term or short-term strategy, depending on the investor’s goals.

Long-term investment involves holding onto a property for an extended period, typically five years or more, to generate rental income and take advantage of appreciation.

Short-term investment involves purchasing a property and selling it quickly for a profit.

Property Management

Investing in rental properties requires ongoing maintenance and management. Investors can choose to manage the property themselves or hire a property management company to handle the day-to-day operations.

Property management companies can help investors find tenants, collect rent, handle maintenance requests, and ensure that the property complies with local regulations.

Diversification

Diversification is an essential strategy for successful real estate investment. Investors can diversify their portfolio by investing in different types of properties, such as residential, commercial, and industrial, and in different geographic locations.

Diversification can help reduce risk and increase the potential for returns.

5. Conclusion

Investing in real estate can be a lucrative business venture but requires careful planning and research.

Before investing in a property, it’s essential to consider factors such as location, market trends, property condition, and financing options.

By following these key steps and developing a solid investment strategy, you can increase your chances of success and achieve your financial goals.

Successful real estate investment requires a long-term strategy, proper property management, and diversification.

RELATED CTN NEWS:

What Is Free Cash Flow And How To Calculate Free Cash Flow?

How To Find A Job You Love? Steps To Increase Your Chances Of Landing A Fulfilling Career