Business

Former FTX CEO Sam Bankman-Fried Bail Denied In The Bahamas

(CTN NEWS) – a Bahamian judge denied Sam Bankman-Fried, the creator of FTX, bail on Tuesday.

Hours after, U.S. authorities accused the 30-year-old of stealing billions of dollars and breaking campaign laws in what has been called one of the largest financial frauds in American history.

When the judge decided that the former CEO of the defunct cryptocurrency exchange’s risk of the flight was “too severe”.

Former FTX CEO Sam Bankman-Fried's bail application was denied by a magistrate judge in the Bahamas.

Bankman-Fried to be sent to the Bahamas Department of Correction till Feb. 8, judge says.

— unfolded. (@cryptounfolded) December 13, 2022

And ordered that he be sent to a Bahamas correctional facility until February 8; the man bowed his head and gave his parents a tight embrace.

The day’s events culminated in Bankman-remarkable Fried’s fall from grace in recent weeks.

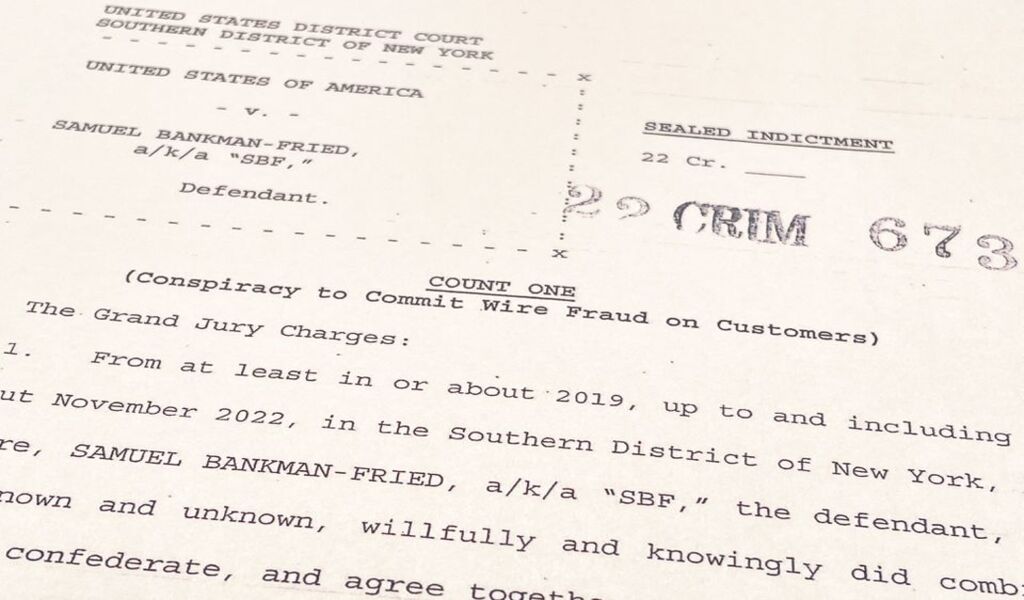

The front page of the U.S. federal indictment of FTX founder Samuel Bankman-Fried by U.S. prosecutors in the Southern District of New York on charges of a conspiracy to commit wire fraud, is seen after being released by the U.S. Justice Department in Washington, U.S. December 13, 2022. REUTERS/Jim Bourg

Before FTX abruptly failed this year, he had acquired a fortune worth over $20 billion by riding the cryptocurrency bubble to expand it into one of the biggest exchanges in the world.

U.S. authorities claimed in an indictment that Bankman-Fried had used a scheme to defraud FTX’s clients by stealing their deposits to pay for costs.

And debts and to invest money on behalf of his bitcoin hedge fund, Alameda Research LLC.

UPDATED. Prosecutors say Sam Bankman-Fried engaged in a scheme to defraud FTX's customers by misappropriating their deposits to pay for expenses and debts and to make investments on behalf of his crypto hedge fund, Alameda Research LLC. https://t.co/sgJfUubr4h

— Rappler (@rapplerdotcom) December 14, 2022

By giving incorrect and misleading information about the state of the hedge fund, he also cheated Alameda’s lenders, according to the prosecution, who also said that he tried to hide the money he had made through wire fraud.

They said that Bankman-Fried contributed “tens of millions of dollars” to political campaigns using the stolen funds.

According to U.S. Attorney Damian Williams in New York, the inquiry is “ongoing” and “moving fast.”

“While this is our first official announcement,” he added, “it won’t be our last.”

The collapse was one of the “greatest financial frauds in American history,” according to Williams.

U.S. Attorney Damian Williams speaks to the media regarding the indictment of Samuel Bankman-Fried the founder of failed crypto exchange FTX in New York City, U.S., December 13, 2022. REUTERS/David ‘Dee’ Delgado

T-SHIRTS AND SHORTS

Before his arrest, Bankman-Fried, who created FTX in 2019, was an eccentric figure who frequently appeared on panels with world leaders like former U.S. President Bill Clinton while sporting wild hair, t-shirts, and shorts.

By giving $5.2 million to President Joe Biden’s 2020 campaign, he rose to become one of the greatest Democratic donors. Forbes estimated his net worth to be $26.5 billion last year.

“In the sun, you can steal in shorts and a t-shirt. It’s possible,” Williams told journalists as an advocate.

Bankman-Fried previously expressed regret to customers and acknowledged supervisory shortcomings at FTX, but he insisted that he does not believe he is directly responsible for any criminal activity.

According to the prosecution, he may receive a term of up to 115 years in jail if found guilty on all eight counts.

Police blocked the road in front of the Magistrate Court building where Sam Bankman-Fried was to appear before the Chief Magistrate. Nassau, Bahamas, December 13, 2022. REUTERS/Dante Carrer

Williams declined to comment on whether any FTX officials would face prosecution and whether any company insiders were helping the investigation.

On Tuesday, legal action was also brought by the Commodity Futures Trading Commission (CFTC) and the U.S. Securities and Exchange Commission (SEC).

Alleging fraud involving digital commodities assets, the CFTC filed lawsuits against Bankman-Fried, Alameda, and FTX.

The SEC claimed that throughout a years-long “brazen, multi-year conspiracy” in which Bankman-Fried allegedly disguised FTX as moving client monies to Alameda Research.

FTX raised more than $1.8 billion from stock investors.

United States Attorney announces charges against FTX founder Samuel Bankman-Friedhttps://t.co/gBSA4mBmzD

— US Attorney SDNY (@SDNYnews) December 13, 2022

Bankman-Fried made his first in-person public appearance since the collapse of the cryptocurrency exchange on Tuesday at a court proceeding in The Bahamas.

Where FTX is headquartered and where he was detained at his gated enclave in the capital.

When he arrived at the tightly guarded Bahamas court, Bankman-Fried seemed unconcerned. He informed the court that he could contest his extradition to the U.S.

If Bankman-Fried contests extradition, Bahamian prosecutors had requested that bail not be granted.

According to an earlier statement from his attorney, Mark S. Cohen, “Mr. Bankman-Fried is studying the charges with his legal team and contemplating all of his legal alternatives.”

On February 8, Bankman-Fried is anticipated to make another court appearance in the Bahamas.

Sam Bankman-Fried, who founded and led FTX until a liquidity crunch forced the cryptocurrency exchange to declare bankruptcy, is escorted out of the Magistrate Court building after his arrest in Nassau, Bahamas, December 13, 2022. REUTERS/Dante Carre

‘ONE-TIME’ STRATEGY

On November 11, FTX declared bankruptcy, causing an estimated 1 million clients and other investors to suffer losses of billions of dollars.

Bitcoins and other cryptos fell due to the collapse, which echoed across the crypto world.

The day before FTX filed for bankruptcy, Bankman-Fried announced his resignation as CEO.

After surreptitiously using $10 billion in customer funds to finance his personal trading firm Alameda, FTX experienced a liquidity problem, according to Reuters. Customer cash totaling at least $1 billion had disappeared.

The fall was only one of several failures that the cryptocurrency sector experienced this year as the value of digital assets fell from its peak in 2021.

FTX Group CEO John J. Ray III attends a U.S. House Financial Services Committee hearing investigating the collapse of the now-bankrupt crypto exchange FTX after the arrest of FTX founder Sam Bankman-Fried, on Capitol Hill in Washington, U.S., December 13, 2022. REUTERS/Sarah Silbiger

A cryptocurrency exchange is a marketplace where investors may swap digital coins like bitcoin.

The company lost $8 billion in customer funds, according to FTX’s current CEO, John Ray.

Who also told lawmakers that the corporation demonstrated “total concentration of control in the hands of a tiny group of extremely incompetent, unsophisticated persons.”

The U.S. Congress is considering drafting laws to control the laxly regulated business as legal challenges multiply.

FTX is investigating whether Bankman-parents Fried was involved in the scheme after sharing its findings with the SEC and American prosecutors.

RELATED CTN NEWS:

U.S. Prosecutors Criminally Charge Former FTX CEO Sam Bankman-Fried

United Airlines Orders a Large Number Of Boeing 787s