Business

Things To Consider When Applying For A Personal Loan With Bad Credit

When it comes to paying for some of life’s biggest expenses — a home renovation, a large medical bill, an emergency, a wedding, or even a funeral — it’s easy to find yourself short on cash.

If your savings do not cover the amount needed to cover such expenses, you may need to find a way to make up the difference. This is where a personal loan can come in handy.

Personal loans are one of the fastest-growing debt categories because they provide flexibility that credit cards do not, as well as lower interest rates and the ability to have a lump sum of money deposited directly into your bank account so you can use it as required.

When taking on any type of debt, it’s generally best to apply with good or excellent credit to get the best loan terms and conditions.

However, if you find yourself applying for a personal loan with bad credit, you still have options; you just need to keep a few things in mind before you start the application process.

Can Your Personal Loan Get Approved With A Poor Credit Score?

Your credit history and credit scores are crucial because they provide lenders with information about whether you’ll be a responsible borrower who repays the loan on time and in full.

Maintaining a healthy credit score can be extremely beneficial when applying for loans for major purchases such as purchasing a home or a car.

While it is possible to be approved for a personal loan with bad credit, the final decision is made by the lender to whom you apply.

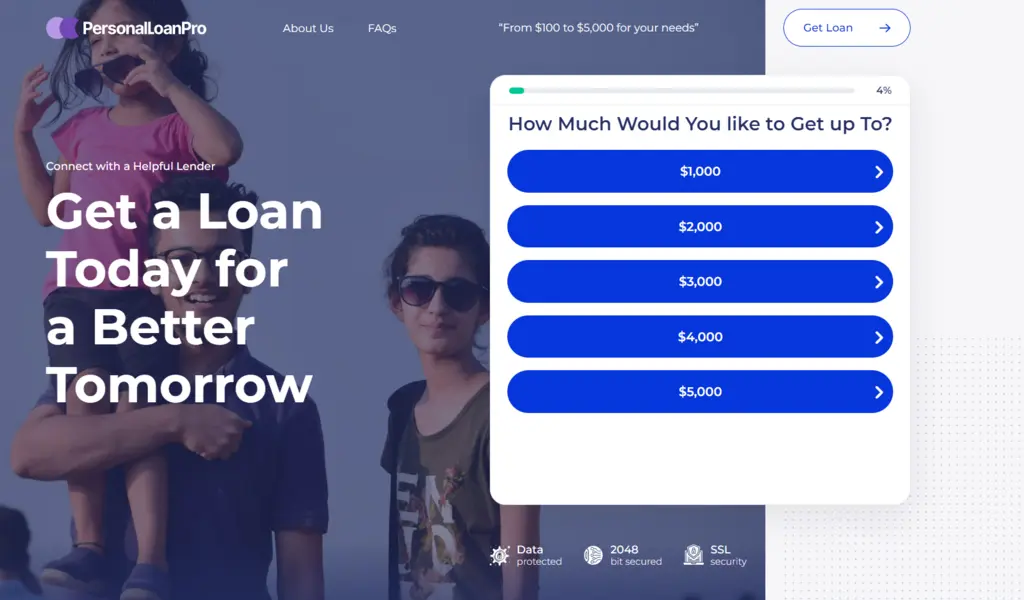

Some lenders will tell you what their minimum requirements are upfront. Some loan brokers, such as Personal Loan Pro, will work with people who have bad (or no) credit also.

Things To Consider When Applying For A Personal Loan With Bad Credit

What Interest Rates Does Your Personal Loan Get Approved For?

When applying for credit, the better your credit, the more likely you are to be granted favorable terms, such as lower interest rates.

This also applies to personal loans. If you have bad credit, you will most likely be charged a higher interest rate on your loan.

This means you’ll have to spend more money repaying the loan.

How Much Time Will You Have To Repay a Personal Loan?

The “term” of a personal loan refers to the amount of time you have to repay it. Loan terms, like interest rates and credit score requirements, can vary from lender to lender.

The good news is that this information is usually provided upfront, allowing you to determine whether the repayment schedule works for you right away.

Loan terms can range between six months and seven years. When you take out a loan with a longer repayment term, you’ll likely have lower monthly payments; however, keep in mind that a longer term means you’ll end up paying more in interest over time.

Shorter terms, on the other hand, may result in a higher monthly payment but less interest accrued over the loan’s life.

Check out the application form for personal loans here to apply for a personal loan with a bad credit score at Personal Loan Pro.

How Will Your Personal Loan Make Impact On Your Credit Score?

Applying for a personal loan, like applying for any other loan, mortgage, or credit card, can cause a minor drop in your credit score.

This is due to the fact that lenders will have to run a hard inquiry on your credit, and every time a hard inquiry is pulled, it appears on your credit report, lowering your score slightly.

Keep in mind, however, that this drop is only temporary, and maintaining good credit habits can help you raise your credit score again over time.

However, it is worthwhile to be as strategic as possible when applying for a personal loan. Applying for a personal loan as soon as applying for a new credit card may result in an even larger drop in your credit score because both applications will result in a hard inquiry.

Taking out a personal loan can actually help your credit score by establishing a track record of making timely payments.

This is especially true if you were approved by a lender who accepts applicants with a poor or no credit history.

Payment history accounts for 35% of your credit score, and is the most important factor in calculating your credit score.

Completing your monthly payments in a timely manner and in full can give a lender confidence that you will repay any money you borrow in the future.

Your credit score is likely to rise as a result of consistent on-time payments as well.

A personal loan can also assist you in improving your credit mix. Your credit mix refers to the various types of credit accounts you have, such as credit cards, student loans, mortgages, and so on, and it accounts for 10% of your credit score.

How To Avoid Falling For Gimmicky Offers And Plans?

Throughout the market, there are lenders who offer artificially low-interest rates or gimmicky schemes. When you read the fine print, these loans are often more expensive than expected.

They are also often based on floating interest rates. This makes the interest rate appear low at first, but it can rise significantly over time.

Some service providers also bury costs and fees in paperwork. For the best personal loan experience, look for a lender who is open and honest.

Share your basic information to check your pre-approved personal loan offer and get the funding you need with a genuine lender

Conclusion

Personal loans, and the prospect of incurring additional debt, can be intimidating, especially if you already have bad credit or no credit history at all.

When used responsibly, however, they can help you cover a large, necessary expense while also improving your credit score as you make on-time payments.

If you’re applying for a personal loan with bad credit from Personal Loan Pro, just keep the points above in mind so you don’t feel blindsided during the procedure.

Related CTN News:

How to Buy and What to do with Bitcoin in Kuwait

How Much is the Forex Market Worth?

Precious Metal IRA: How to Invest For Retirement With Gold And Silver

![Play Online Blackjack In Australia [2024]: Top 10 Online Australian Blackjack Sites 21 Play Online Blackjack in Australia [2024]: Top 10 Online Australian Blackjack Sites](https://www.chiangraitimes.com/wp-content/uploads/2024/03/word-image-303235-1-80x80.jpeg)