News

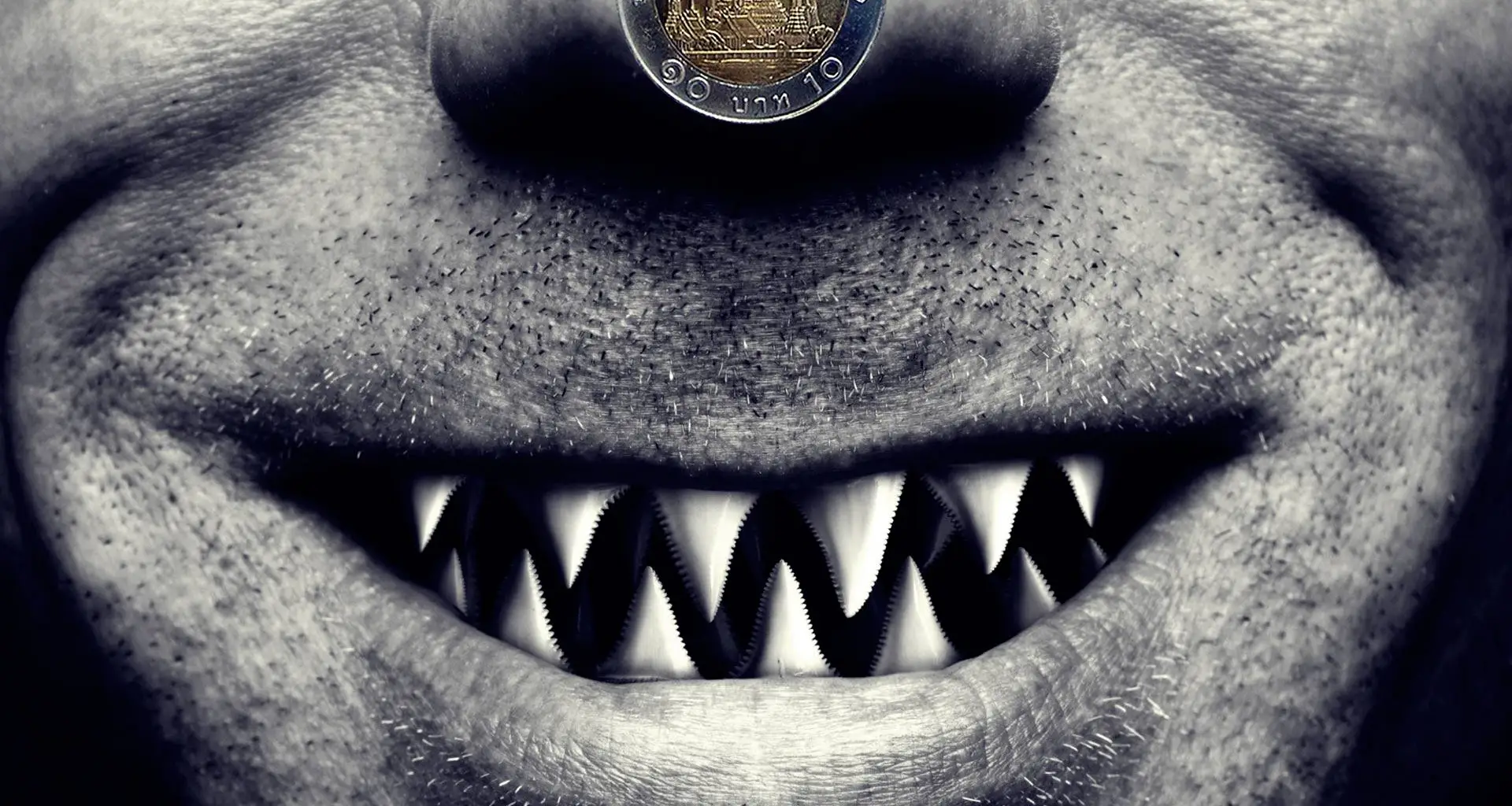

Loan Sharks in Thailand Preying on Victims of COVID-19

Thailand’s Assistant National Police Chief General Surachate Hakparn has urged borrowers of loan sharks who cannot pay exorbitant and excessive interest rates to seek assistance from the police.

In addition, the deputy police chief announced that the Revenue Department and the Anti-Money Laundering Office would audit the finances of the heads of loan shark networks and seize property suspected to be proceeds of extortion.

Napawan Rimwaan borrowed 2,000 baht ($55.00) through a phone app, believing it was an interest-free loan she would be able to repay within 90 days.

A week later, a lending agency agent began calling and threatening the Thai mother of two with a 31 percent interest charge if she did not repay the loan within days.

“I just wanted to buy my daughter a school uniform,” Napawan, 38, said through tears to the police. “My children will now have to eat rice with only sauce.”

Those were not the terms Napawan agreed to; loan sharks have thrived across Thailand and preyed on people in desperate need of cash because of the COVID-19 pandemic.

The Police, who have been cracking down on such illegal loan operations, estimates that millions of baht were taken from unsuspecting customers.

When the lending agents called Napawan more than ten times daily, she dialled the police hotline.

“Police told me to relax, saying they [the loan sharks] couldn’t hurt me,” Napawan recalled, noting that she had recently recovered from COVID-19.

As the pandemic spread across Thailand, many people fell victim to such illegal operations because they couldn’t get legitimate loans during difficult times, according to a senior police investigator.

“From street vendors to small and medium-sized businesses, the pandemic affected them all.” “Many businesses shut down,” said Col. Padol Chandon, superintendent of the Economic Crime Suppression Division of the National Police (ECD).

“When the country lifted the blockade, everyone began looking for funds to reopen their businesses, and the loan sharks are always ready to prey on desperate people.

For many people, online money lending, including smartphone app-based services, has replaced traditional bank loans because it provides quick approval without needing documents or credit checks.

It only takes a few minutes for some of the victims to borrow a few thousand baht.

“That is why the interest rate is so high,” Padol explained, adding that lenders are aware that what they are doing is illegal.

According to the ECD, from January to June, authorities arrested nearly 100 people suspected of being involved with illegal loan syndicates.

The ECD cracked down on the largest syndicate in July, arresting nearly 40 suspects who were members of three loan sharks networks in northeastern Thailand.

According to police, the syndicate was led by Sawek Manpan, 43, a former debt collector who had been arrested and imprisoned on similar charges five years prior.

A month earlier, a police task force arrested 29 suspects from five loan sharks in central Thailand, including the largest loan-sharking website.

Padol identified the network’s mastermind as Aniwat Buayai, 26, who founded his company just two years ago with 200,000 baht ($5,460).

According to ECD investigators, Aniwat began by lending money to desperate street vendors who asked for 2000 baht.

Later, he expanded his loan shark business to target owners of small and medium-sized businesses who required 100,000 to 2 million baht ($2,731 to $54,630) within days to keep their pandemic-affected businesses afloat, according to police.

According to police, Aniwat allegedly hired “young thugs” to collect debts by offering them free housing, cars, and large commissions on the money collected.

Padol stated that when police apprehended Aniwat, they discovered 500 million baht ($13.6 million) in his bank account.

“He admitted that he learned how to run the loan sharking business through social media.” “It’s copycat behaviour,” Padol explained. “It’s a high-risk, high-reward proposition.”

Aniwat and Sawek are both facing a slew of criminal charges, including illegal money-lending and providing extortionate personal loans. Furthermore, Sawek and his gang have been charged with debt collection through intimidation and violence.

After receiving numerous complaints from victims reporting physical intimidation, the Royal Thai Police established the Center for Countering Abuse by Loan Sharks in June 2020, three months into Thailand’s COVID-19 lockdown.

Police have investigated over 7,000 cases so far. For the eight months ending in June, the center’s hotline received approximately 4,000 calls per month. However, they could only respond to a quarter of them due to a lack of resources.

Despite this, police arrested 833 loan shark suspects, police seized 254 banking accounts and impounded hundreds of cars and motorcycles. They also seized 1.49 million baht ($49,780) in cash in those eight months. The center estimated that the confiscated assets were worth more than 31 million baht ($852,600).

According to authorities, several suicides have been blamed on loan shark threats in the last two years.

“I apologize. I’m exhausted. Pay the loan shark nothing. “They already made too much money from the overcharge interest rates,” said a suicide note left by a bread factory owner who committed suicide in May.

According to a Thai social activist, his team receives about ten daily loan-related complaints.

“They are increasing dramatically, and the hired thugs are using intimidation tactics and threats of violence, including an attack on life, house destruction, property seizure… and even shooting,” said Eakpob Laungprasert, founder of the Facebook page Saimai Tong Rod, or Saimai Must Survive, which assists people who have fallen on hard times after contracting COVID-19.

Eakpob recently took street vendor Jiraporn Thepabutra and her 8-year-old daughter to a police station after debt collectors barred them from entering their home and threatened them with death because she couldn’t pay a loan and interest after contracting COVID-19.

“Be aware of your surroundings. You took our money and are no longer alive. Return the money right away. “Or I’ll burn down your house,” one message warned.

Jiraporn, 44, said she had to pay around 400 baht per day on the 20,000 baht ($546) she borrowed with a monthly interest rate of 60%. When she said she couldn’t work because she was infected with COVID-19, the lender told her she needed to borrow more money to pay off the debt.

Every day, she said, debt collectors sent her threatening texts. They also followed her home, knocked on her door, and threw small rocks onto her roof.

Jiraporn and her daughter were unable to enter their home one night because debt collectors had superglued the keyholes on the padlocks and pasted a poster on the door that read, “Return my money.”

She claimed she sat on the street for nearly three hours crying before calling Eakpob for assistance.

“After my bank rejected my loan application, I decided to go to loan sharks because I needed to pay rent, tuition for my daughter, and some cash to restart my business,” Jiraporn told reporters in Bangkok.

“I’m terrified they’ll attack me.” “I’m worried about my daughter’s safety,” she said, tears streaming down her cheeks. “I can’t go on living like this. I don’t want to be in debt to anyone.”

According to Eakpob, street vendors are the most vulnerable during the pandemic because they are informal workers with no access to banking.

His group negotiates with creditors on behalf of such debtors while also collaborating with law enforcement to report potential crimes.

During these difficult times, the government, according to Eakpob, should establish emergency funds in each district.

“The funds should be easily accessible, the approval process should be quick, and the interest rates should be reasonable,” he said.