Business

High Yield Savings Account Calculator: Your Ultimate Guide To Smart Saving!

Introduction

Saving Made Easy with a High Yield Savings Account

Saving money is an essential part of building a secure financial future.

Whether you’re saving for a down payment on a house, an emergency fund, or a dream vacation, having a high yield savings account can be a game-changer.

But what exactly is a high yield savings account, and how can you make the most of it? That’s where our high yield savings account calculator comes in handy!

What is a High Yield Savings Account?

A high yield savings account is a type of savings account that offers a higher interest rate compared to a traditional savings account.

The interest rate is usually higher because these accounts are offered by online banks that have lower overhead costs compared to brick-and-mortar banks.

This allows them to pass on the savings to their customers through higher interest rates.

A high yield savings account is a great option for individuals who want to earn more on their savings while keeping their money easily accessible.

Why Use a High Yield Savings Account Calculator?

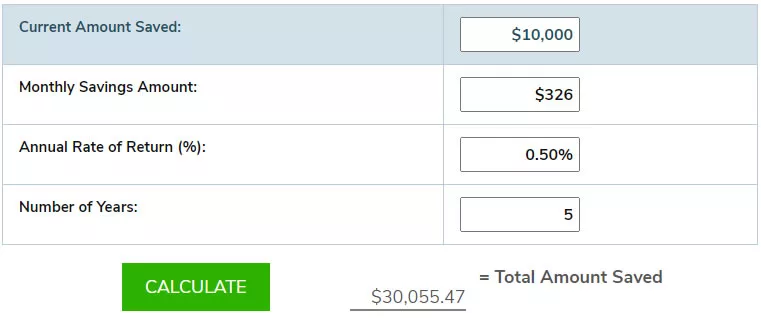

A high yield savings account calculator is a powerful tool that can help you determine how much interest you can earn over time with your savings.

By inputting key information such as your initial deposit, monthly contributions, and interest rate, the calculator can estimate how your savings will grow over time.

This can be incredibly helpful in planning your financial goals and making informed decisions about how much to save and for how long.

With a high yield savings account calculator, you can see the impact of compound interest and make strategic choices to maximize your savings.

How to Use a High Yield Savings Account Calculator

Using a high yield savings account calculator is easy. Here are the steps to get started:

Step 1: Gather Your Information

Before you start using the high yield savings account calculator, you’ll need to gather some key information. This includes:

- Your initial deposit: This is the amount of money you plan to deposit into your high yield savings account when you first open it.

- Monthly contributions: This is the amount of money you plan to deposit into your high yield savings account on a monthly basis.

- Interest rate: This is the annual interest rate offered by your high yield savings account. It’s important to use the actual interest rate, which may be compounded daily, monthly, or annually, depending on the account terms.

This information will make it easier for you to use the high yield savings account calculator and get accurate results.

Step 2: Input Your Information into the Calculator

Once you have gathered all the necessary information, it’s time to input it into the high yield savings account calculator.

Simply enter the information into the respective fields, including your initial deposit, monthly contributions, and interest rate.

The calculator will then process the data and provide you with an estimate of how much your savings will grow over time.

Step 3: Explore Different Scenarios

One of the great things about a high yield savings account calculator is that it allows you to explore different scenarios.

You can adjust the input variables, such as the initial deposit, monthly contributions, and interest rate, to see how they impact your savings growth.

This can help you make informed decisions about how much to save, how long to save, and what interest rate to aim for.

Tips for Maximizing Your Savings

Here are some tips for maximizing your savings with a high yield savings account:

- Increase Your Monthly Contributions: The more you contribute to your high yield savings account on a monthly basis, the faster your savings will grow. Consider adjusting your budget to save more each month and watch your savings grow exponentially over time.

- Take Advantage of Compound Interest: Compound interest is the interest earned on both your initial deposit and any accumulated interest. This means that the longer you keep your money in a high yield savings account, the more interest you’ll earn. Be sure to understand how frequently the interest is compounded and take advantage of this powerful feature to boost your savings.

- Shop Around for the Best Interest Rates: Different banks offer different interest rates on their high yield savings accounts. Shop around and compare rates to find the best option for your needs. Remember, even a small difference in interest rates can add up significantly over time, so it’s worth doing your research.

- Set Clear Financial Goals: Knowing what you’re saving for and how much you need to save can help you stay motivated and on track. Use the high yield savings account calculator to set clear financial goals, such as saving for a down payment on a house, an emergency fund, or a vacation. Having a specific goal in mind can help you prioritize your savings and make progress towards achieving your financial aspirations.

- Avoid Withdrawals and Fees: High yield savings accounts are designed for long-term savings, so avoiding unnecessary withdrawals and fees is important. Some high yield savings accounts may charge fees for certain transactions or if you fall below a minimum balance requirement. Be sure to read and understand the account terms and conditions, and strive to keep your savings intact to maximize your earnings.

- Automate Your Savings: Setting up automatic transfers from your checking account to your high yield savings account can make saving effortless. You can schedule regular transfers on your payday or choose to save a percentage of your income automatically. Automating your savings can help you stay consistent and disciplined with your savings plan.

- Reevaluate Your Savings Plan Regularly: It’s important to regularly review and adjust your savings plan as needed. Life circumstances and financial goals may change over time, and it’s important to make sure your savings plan aligns with your current needs. Use the high yield savings account calculator to reassess your savings progress and make any necessary adjustments to stay on track.

Conclusion

A high yield savings account can be a powerful tool for growing your savings over time, and using a high yield savings account calculator can help you plan and track your progress effectively.

By maximizing your contributions, taking advantage of compound interest, shopping around for the best rates, setting clear financial goals, avoiding unnecessary withdrawals and fees, automating your savings, and regularly reviewing and adjusting your savings plan, you can make the most of your high yield savings account and achieve your financial goals faster.

So, go ahead and use the high yield savings account calculator to kickstart your savings journey and watch your money grow.

Remember to be diligent, consistent, and make adjustments as needed to stay on track towards financial success. Happy saving!

Note: The information provided in this article is for educational purposes only and should not be considered as financial advice. It’s always best to consult with a qualified financial professional before making any financial decisions.

RELATED CTN NEWS:

Startup Business Insurance: Types & How To Choose The Right Policy

How To Analyze Stock Market Trends And Predictions?

Why Link Building Is Essential For SEO Success: How It Works & How To Implement